- India

- /

- Hospitality

- /

- NSEI:WONDERLA

Wonderla Holidays Limited (NSE:WONDERLA) Is Going Strong But Fundamentals Appear To Be Mixed : Is There A Clear Direction For The Stock?

Wonderla Holidays' (NSE:WONDERLA) stock is up by a considerable 13% over the past three months. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Particularly, we will be paying attention to Wonderla Holidays' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Wonderla Holidays

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Wonderla Holidays is:

1.0% = ₹82m ÷ ₹8.6b (Based on the trailing twelve months to June 2020).

The 'return' is the yearly profit. So, this means that for every ₹1 of its shareholder's investments, the company generates a profit of ₹0.01.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Wonderla Holidays' Earnings Growth And 1.0% ROE

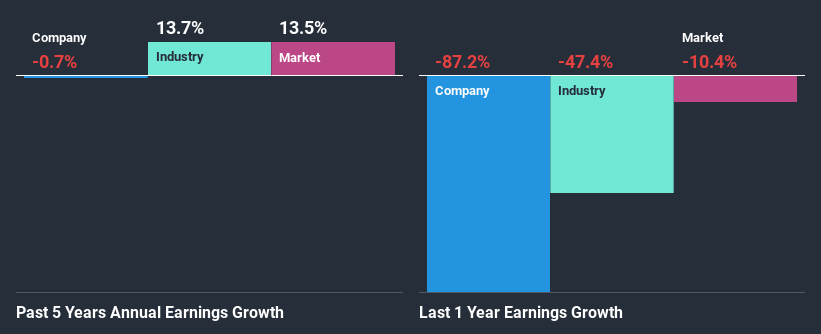

As you can see, Wonderla Holidays' ROE looks pretty weak. Even compared to the average industry ROE of 4.5%, the company's ROE is quite dismal. Hence, the flat earnings seen by Wonderla Holidays over the past five years could probably be the result of it having a lower ROE.

Next, on comparing with the industry net income growth, we found that the industry grew its earnings by14% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Wonderla Holidays is trading on a high P/E or a low P/E, relative to its industry.

Is Wonderla Holidays Efficiently Re-investing Its Profits?

Wonderla Holidays' low three-year median payout ratio of 18% (implying that the company keeps82% of its income) should mean that the company is retaining most of its earnings to fuel its growth and this should be reflected in its growth number, but that's not the case.

Moreover, Wonderla Holidays has been paying dividends for six years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

Overall, we have mixed feelings about Wonderla Holidays. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Wonderla Holidays' past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you’re looking to trade Wonderla Holidays, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wonderla Holidays might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:WONDERLA

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion