Improvement in profitability and outperformance against the industry can be important characteristics in a stock for some investors. Below, I will assess Oeneo SA's (ENXTPA:SBT) track record on a high level, to give you some insight into how the company has been performing against its historical trend and its industry peers.

See our latest analysis for Oeneo

Was SBT weak performance lately part of a long-term decline?

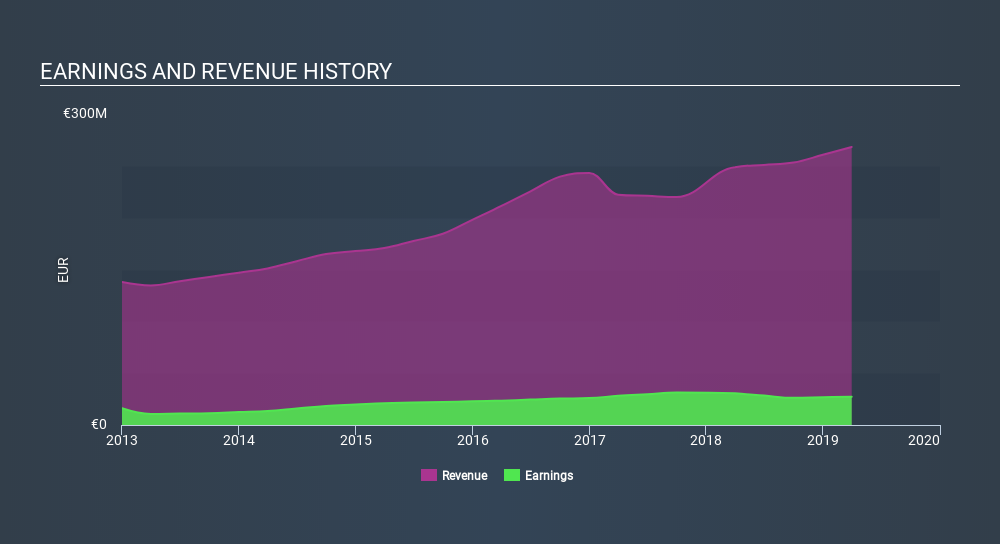

SBT's trailing twelve-month earnings (from 31 March 2019) of €27m has declined by -10% compared to the previous year.

Furthermore, this one-year growth rate has been lower than its average earnings growth rate over the past 5 years of 11%, indicating the rate at which SBT is growing has slowed down. Why could this be happening? Well, let’s take a look at what’s occurring with margins and whether the entire industry is experiencing the hit as well.

In terms of returns from investment, Oeneo has fallen short of achieving a 20% return on equity (ROE), recording 11% instead. However, its return on assets (ROA) of 6.5% exceeds the FR Packaging industry of 5.7%, indicating Oeneo has used its assets more efficiently. And finally, its return on capital (ROC), which also accounts for Oeneo’s debt level, has increased over the past 3 years from 12% to 13%.

What does this mean?

While past data is useful, it doesn’t tell the whole story. Companies that are profitable, but have unpredictable earnings, can have many factors influencing its business. I suggest you continue to research Oeneo to get a better picture of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for SBT’s future growth? Take a look at our free research report of analyst consensus for SBT’s outlook.

- Financial Health: Are SBT’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

NB: Figures in this article are calculated using data from the trailing twelve months from 31 March 2019. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:SBT

Oeneo

Operates in the wine industry worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.