- Denmark

- /

- Renewable Energy

- /

- CPSE:ORSTED

Why Fundamental Investors Might Love Ørsted A/S (CPH:ORSTED)

As an investor, I look for investments which does not compromise one fundamental factor for another. By this I mean, I look at stocks holistically, from their financial health to their future outlook. In the case of Ørsted A/S (CPH:ORSTED), it is a company with great financial health as well as a a strong history of performance. Below, I've touched on some key aspects you should know on a high level. For those interested in understanding where the figures come from and want to see the analysis, read the full report on Ørsted here.

Outstanding track record with flawless balance sheet

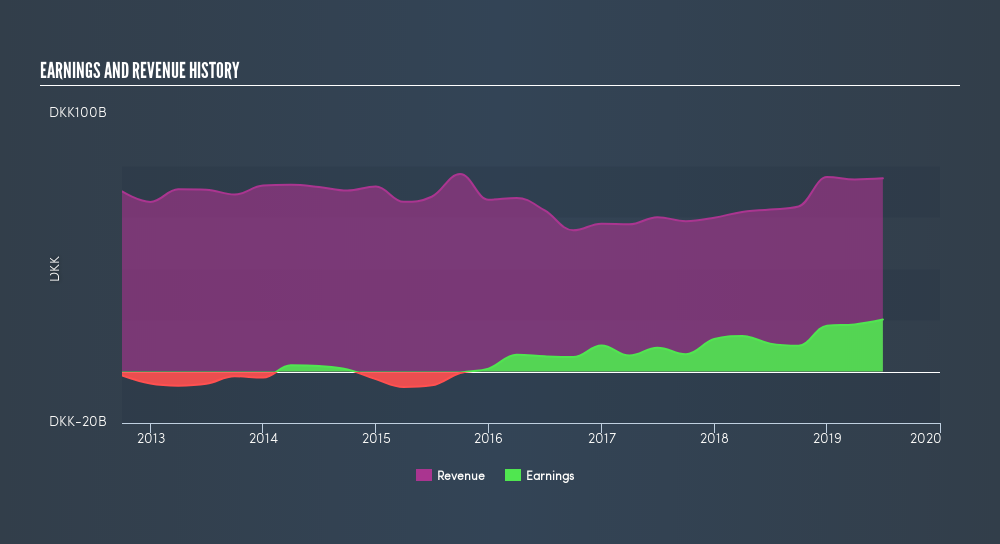

In the previous year, ORSTED has ramped up its bottom line by 86%, with its latest earnings level surpassing its average level over the last five years. This illustrates a strong track record, leading to a satisfying return on equity of 24%. which is what investors like to see! ORSTED's ability to maintain an adequate level of cash to meet upcoming liabilities is a good sign for its financial health. This suggests prudent control over cash and cost by management, which is a key determinant of the company’s health. ORSTED seems to have put its debt to good use, generating operating cash levels of 0.46x total debt in the most recent year. This is also a good indication as to whether debt is properly covered by the company’s cash flows.

Next Steps:

For Ørsted, I've compiled three important aspects you should look at:

- Future Outlook: What are well-informed industry analysts predicting for ORSTED’s future growth? Take a look at our free research report of analyst consensus for ORSTED’s outlook.

- Valuation: What is ORSTED worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether ORSTED is currently mispriced by the market.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of ORSTED? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About CPSE:ORSTED

Ørsted

Owns, develops, constructs, and operates offshore and onshore wind farms, solar farms, and energy storage and combined heat and power (CHP) plants.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Inotiv NAMs Test Center

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.