Darren Pateman became the CEO of Finbar Group Limited (ASX:FRI) in 2010. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for Finbar Group

How Does Darren Pateman's Compensation Compare With Similar Sized Companies?

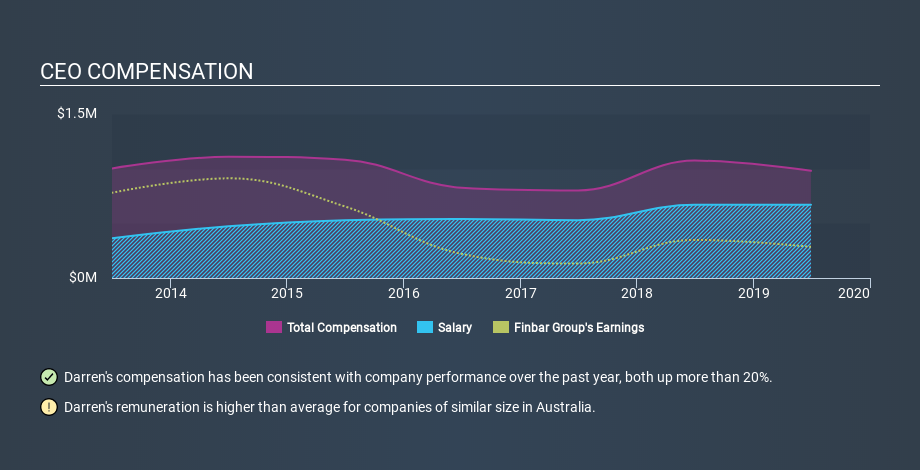

According to our data, Finbar Group Limited has a market capitalization of AU$260m, and paid its CEO total annual compensation worth AU$980k over the year to June 2019. While we always look at total compensation first, we note that the salary component is less, at AU$670k. We looked at a group of companies with market capitalizations from AU$151m to AU$605m, and the median CEO total compensation was AU$681k.

As you can see, Darren Pateman is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Finbar Group Limited is paying too much. We can better assess whether the pay is overly generous by looking into the underlying business performance.

The graphic below shows how CEO compensation at Finbar Group has changed from year to year.

Is Finbar Group Limited Growing?

Over the last three years Finbar Group Limited has grown its earnings per share (EPS) by an average of 42% per year (using a line of best fit). In the last year, its revenue is up 2.6%.

This shows that the company has improved itself over the last few years. Good news for shareholders. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. We don't have analyst forecasts, but you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Finbar Group Limited Been A Good Investment?

Finbar Group Limited has served shareholders reasonably well, with a total return of 28% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

We examined the amount Finbar Group Limited pays its CEO, and compared it to the amount paid by similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

Importantly, though, the company has impressed with its earnings per share growth, over three years. We also note that, over the same time frame, shareholder returns haven't been bad. While it may be worth researching further, we don't see a problem with the CEO pay, given the good EPS growth. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Finbar Group.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:FRI

Finbar Group

Engages in the property development and investment in Australia.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives