Why Broad Gate S.A.’s (WSE:BDG) Return On Capital Employed Might Be A Concern

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll look at Broad Gate S.A. (WSE:BDG) and reflect on its potential as an investment. Specifically, we're going to calculate its Return On Capital Employed (ROCE), in the hopes of getting some insight into the business.

First up, we'll look at what ROCE is and how we calculate it. Second, we'll look at its ROCE compared to similar companies. Last but not least, we'll look at what impact its current liabilities have on its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Generally speaking a higher ROCE is better. Ultimately, it is a useful but imperfect metric. Author Edwin Whiting says to be careful when comparing the ROCE of different businesses, since 'No two businesses are exactly alike.'

So, How Do We Calculate ROCE?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for Broad Gate:

0.038 = zł1.7m ÷ (zł88m - zł42m) (Based on the trailing twelve months to March 2019.)

So, Broad Gate has an ROCE of 3.8%.

View our latest analysis for Broad Gate

Is Broad Gate's ROCE Good?

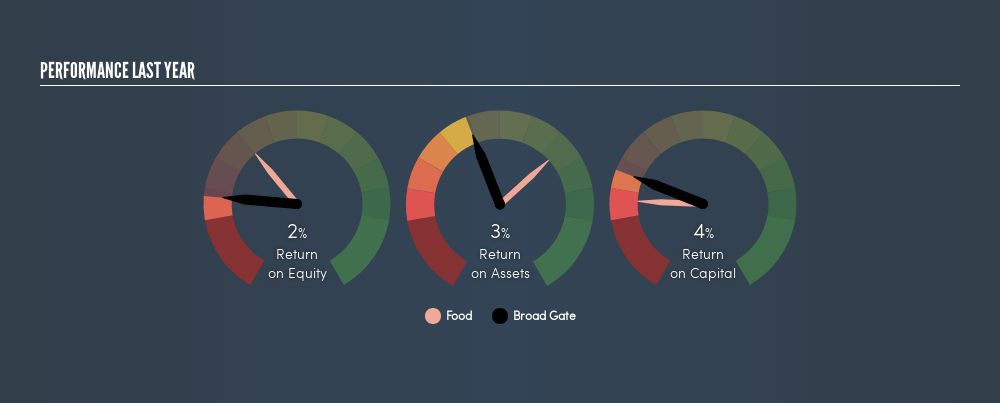

ROCE can be useful when making comparisons, such as between similar companies. In this analysis, Broad Gate's ROCE appears meaningfully below the 12% average reported by the Food industry. This performance could be negative if sustained, as it suggests the business may underperform its industry. Putting aside Broad Gate's performance relative to its industry, its ROCE in absolute terms is poor - considering the risk of owning stocks compared to government bonds. It is likely that there are more attractive prospects out there.

In our analysis, Broad Gate's ROCE appears to be 3.8%, compared to 3 years ago, when its ROCE was 1.5%. This makes us think the business might be improving.

When considering this metric, keep in mind that it is backwards looking, and not necessarily predictive. Companies in cyclical industries can be difficult to understand using ROCE, as returns typically look high during boom times, and low during busts. This is because ROCE only looks at one year, instead of considering returns across a whole cycle. How cyclical is Broad Gate? You can see for yourself by looking at this free graph of past earnings, revenue and cash flow.

Do Broad Gate's Current Liabilities Skew Its ROCE?

Liabilities, such as supplier bills and bank overdrafts, are referred to as current liabilities if they need to be paid within 12 months. Due to the way ROCE is calculated, a high level of current liabilities makes a company look as though it has less capital employed, and thus can (sometimes unfairly) boost the ROCE. To counter this, investors can check if a company has high current liabilities relative to total assets.

Broad Gate has total liabilities of zł42m and total assets of zł88m. As a result, its current liabilities are equal to approximately 48% of its total assets. With a medium level of current liabilities boosting the ROCE a little, Broad Gate's low ROCE is unappealing.

What We Can Learn From Broad Gate's ROCE

This company may not be the most attractive investment prospect. You might be able to find a better investment than Broad Gate. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

The Superintelligence Pivot: Meta’s $135 Billion Bet on the Energy-Compute Nexus

The Privacy Fortress: Apple’s Lean AI Path and the $100 Billion Buyback Engine

The $200 Billion Gamble: Can AWS Outrun the AI Capex Monster?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.