- United States

- /

- Specialty Stores

- /

- NasdaqGS:FLWS

Why 1-800-FLOWERS.COM, Inc.'s (NASDAQ:FLWS) CEO Pay Matters To You

Chris McCann became the CEO of 1-800-FLOWERS.COM, Inc. (NASDAQ:FLWS) in 2016. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

Check out our latest analysis for 1-800-FLOWERS.COM

How Does Chris McCann's Compensation Compare With Similar Sized Companies?

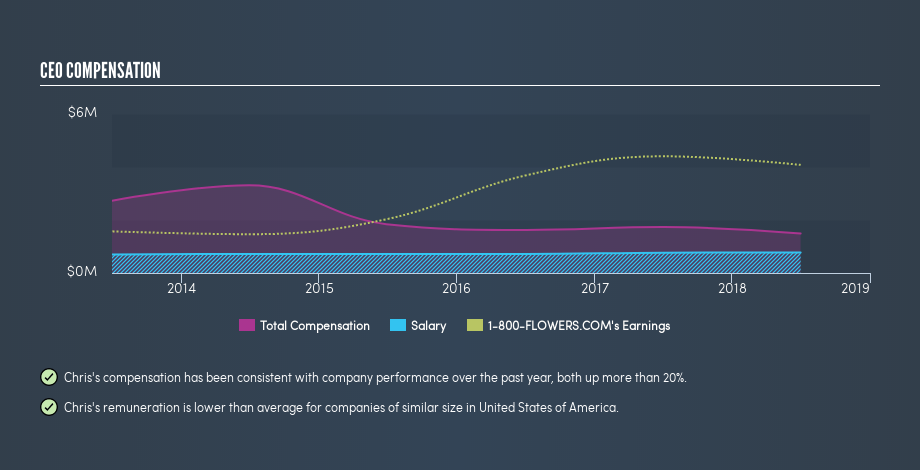

At the time of writing our data says that 1-800-FLOWERS.COM, Inc. has a market cap of US$1.2b, and is paying total annual CEO compensation of US$1.5m. (This is based on the year to July 2018). We think total compensation is more important but we note that the CEO salary is lower, at US$775k. When we examined a selection of companies with market caps ranging from US$1.0b to US$3.2b, we found the median CEO total compensation was US$4.0m.

A first glance this seems like a real positive for shareholders, since Chris McCann is paid less than the average total compensation paid by similar sized companies. However, before we heap on the praise, we should delve deeper to understand business performance.

You can see, below, how CEO compensation at 1-800-FLOWERS.COM has changed over time.

Is 1-800-FLOWERS.COM, Inc. Growing?

On average over the last three years, 1-800-FLOWERS.COM, Inc. has grown earnings per share (EPS) by 8.0% each year (using a line of best fit). It achieved revenue growth of 5.0% over the last year.

I would argue that the improvement in revenue isn't particularly impressive, but it is good to see modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information.

Has 1-800-FLOWERS.COM, Inc. Been A Good Investment?

Boasting a total shareholder return of 112% over three years, 1-800-FLOWERS.COM, Inc. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

It looks like 1-800-FLOWERS.COM, Inc. pays its CEO less than similar sized companies.

It's well worth noting that while Chris McCann is paid below what is normal at companies of similar size, the returns have been very pleasing, over the last three years. So, while it might be nice to have better EPS growth, on our analysis the CEO compensation is quite modest. So you may want to check if insiders are buying 1-800-FLOWERS.COM shares with their own money (free access).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:FLWS

1-800-FLOWERS.COM

Provides gifts for various occasions in the United States and internationally.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion