Jayant Mhaiskar has been the CEO of MEP Infrastructure Developers Limited (NSE:MEP) since 2014, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for MEP Infrastructure Developers

How Does Total Compensation For Jayant Mhaiskar Compare With Other Companies In The Industry?

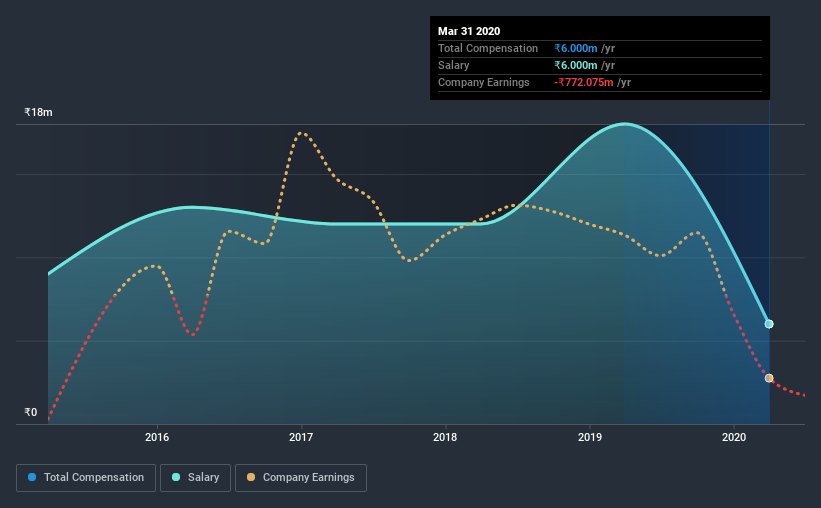

Our data indicates that MEP Infrastructure Developers Limited has a market capitalization of ₹2.6b, and total annual CEO compensation was reported as ₹6.0m for the year to March 2020. We note that's a decrease of 67% compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹6.0m.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹5.4m. From this we gather that Jayant Mhaiskar is paid around the median for CEOs in the industry. Furthermore, Jayant Mhaiskar directly owns ₹201m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹6.0m | ₹18m | 100% |

| Other | - | - | - |

| Total Compensation | ₹6.0m | ₹18m | 100% |

On an industry level, around 93% of total compensation represents salary and 7.5% is other remuneration. Speaking on a company level, MEP Infrastructure Developers prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

MEP Infrastructure Developers Limited's Growth

Over the last three years, MEP Infrastructure Developers Limited has shrunk its earnings per share by 75% per year. It saw its revenue drop 36% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has MEP Infrastructure Developers Limited Been A Good Investment?

Since shareholders would have lost about 87% over three years, some MEP Infrastructure Developers Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

MEP Infrastructure Developers pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As we touched on above, MEP Infrastructure Developers Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. Considering overall performance, shareholders will likely hold off support for a raise until results improve.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 4 warning signs for MEP Infrastructure Developers you should be aware of, and 2 of them are potentially serious.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading MEP Infrastructure Developers or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:MEP

MEP Infrastructure Developers

Engages in the construction, operation, and maintenance of road infrastructure in India.

Very low risk with weak fundamentals.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Sustained Silver at ~US$100/oz Drives Explosive Leverage and Re-Rating for PAAS

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.