- India

- /

- Life Sciences

- /

- NSEI:DCAL

What We Learned About Dishman Carbogen Amcis' (NSE:DCAL) CEO Compensation

The CEO of Dishman Carbogen Amcis Limited (NSE:DCAL) is Arpit Vyas, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Dishman Carbogen Amcis pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Dishman Carbogen Amcis

How Does Total Compensation For Arpit Vyas Compare With Other Companies In The Industry?

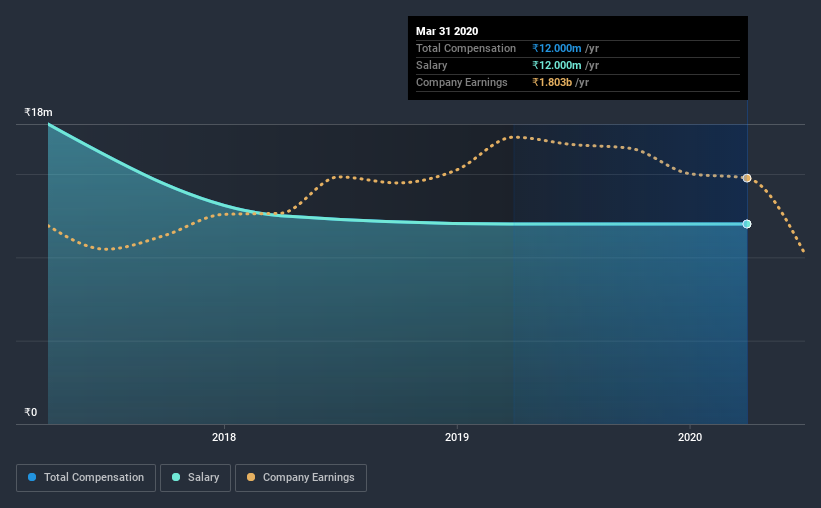

According to our data, Dishman Carbogen Amcis Limited has a market capitalization of ₹24b, and paid its CEO total annual compensation worth ₹12m over the year to March 2020. That is, the compensation was roughly the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹12m.

In comparison with other companies in the industry with market capitalizations ranging from ₹15b to ₹59b, the reported median CEO total compensation was ₹22m. In other words, Dishman Carbogen Amcis pays its CEO lower than the industry median.

On an industry level, it's fascinating to see that all of total compensation represents salary and non-salary benefits do not factor into the equation at all. On a company level, Dishman Carbogen Amcis prefers to reward its CEO through a salary, opting not to pay Arpit Vyas through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Dishman Carbogen Amcis Limited's Growth

Over the last three years, Dishman Carbogen Amcis Limited has not seen its earnings per share change much, though they have deteriorated slightly. It saw its revenue drop 4.9% over the last year.

The lack of EPS growth is certainly unimpressive. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Dishman Carbogen Amcis Limited Been A Good Investment?

Since shareholders would have lost about 55% over three years, some Dishman Carbogen Amcis Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Dishman Carbogen Amcis pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As we noted earlier, Dishman Carbogen Amcis pays its CEO lower than the norm for similar-sized companies belonging to the same industry. Over the last three years, shareholder returns have been downright disappointing, and EPSgrowth has been equally disappointing. It's tough to say that Arpit is earning a very high compensation, but shareholders will likely want to see healthier investor returns before agreeing that a raise is in order.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for Dishman Carbogen Amcis that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Dishman Carbogen Amcis, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:DCAL

Dishman Carbogen Amcis

Provides contract research and manufacturing services for the pharmaceutical and healthcare industries worldwide.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

TSMC will drive future growth with CoWoS packaging and N2 rollout

Beyond 2026, Beyond a Double

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.

Nedbank please contact me,l need guidance step by step, please