- United States

- /

- Mortgage REITs

- /

- NYSE:MITT

What Kind Of Shareholders Own AG Mortgage Investment Trust, Inc. (NYSE:MITT)?

If you want to know who really controls AG Mortgage Investment Trust, Inc. (NYSE:MITT), then you'll have to look at the makeup of its share registry. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. Companies that have been privatized tend to have low insider ownership.

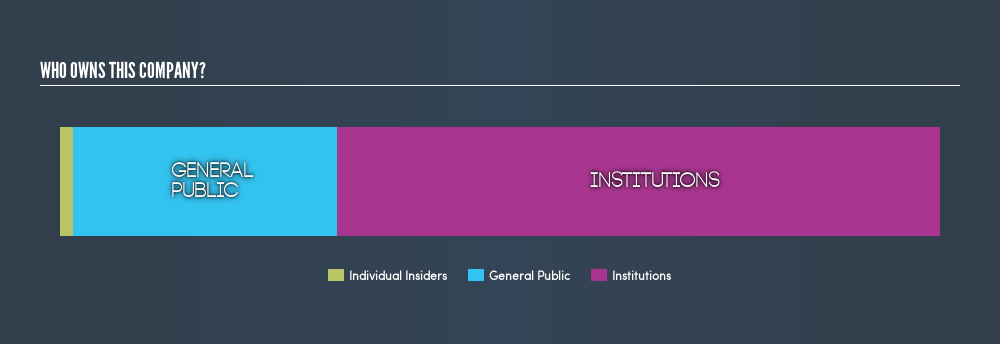

With a market capitalization of US$537m, AG Mortgage Investment Trust is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutions are noticeable on the share registry. We can zoom in on the different ownership groups, to learn more about MITT.

Check out our latest analysis for AG Mortgage Investment Trust

What Does The Institutional Ownership Tell Us About AG Mortgage Investment Trust?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

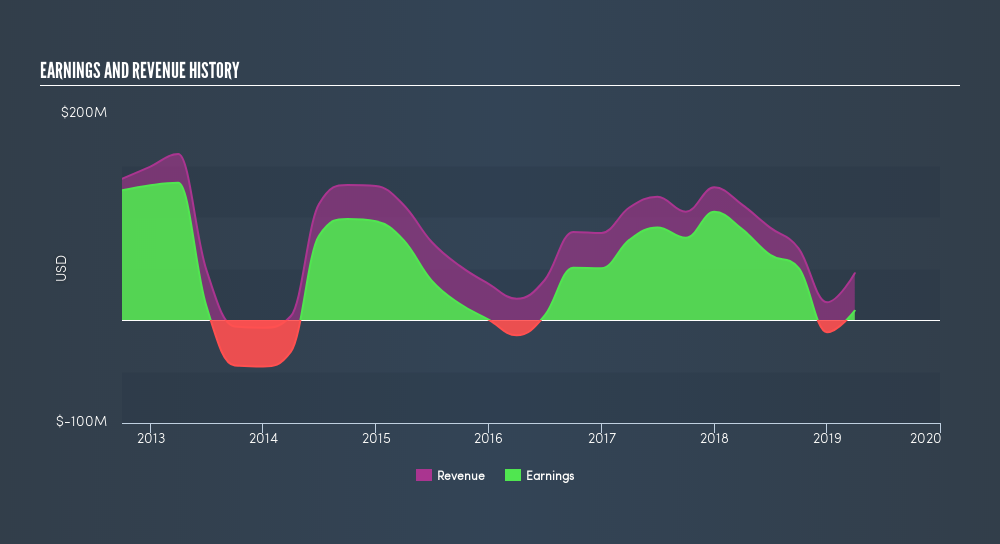

As you can see, institutional investors own 68% of AG Mortgage Investment Trust. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see AG Mortgage Investment Trust's historic earnings and revenue, below, but keep in mind there's always more to the story.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. AG Mortgage Investment Trust is not owned by hedge funds. There is some analyst coverage of the stock, but it could still become more well known, with time.

Insider Ownership Of AG Mortgage Investment Trust

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own some shares in AG Mortgage Investment Trust, Inc.. As individuals, the insiders collectively own US$8.4m worth of the US$537m company. Some would say this shows alignment of interests between shareholders and the board. But it might be worth checking if those insiders have been selling.

General Public Ownership

The general public, with a 30% stake in the company, will not easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:MITT

AG Mortgage Investment Trust

Operates as a residential mortgage real estate investment trust in the United States.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives