- Canada

- /

- Metals and Mining

- /

- TSX:ERD

What Kind Of Shareholder Owns Most Erdene Resource Development Corporation (TSE:ERD) Stock?

Every investor in Erdene Resource Development Corporation (TSE:ERD) should be aware of the most powerful shareholder groups. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

Erdene Resource Development is a smaller company with a market capitalization of CA$54m, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions are not really that prevalent on the share registry. We can zoom in on the different ownership groups, to learn more about Erdene Resource Development.

See our latest analysis for Erdene Resource Development

What Does The Institutional Ownership Tell Us About Erdene Resource Development?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

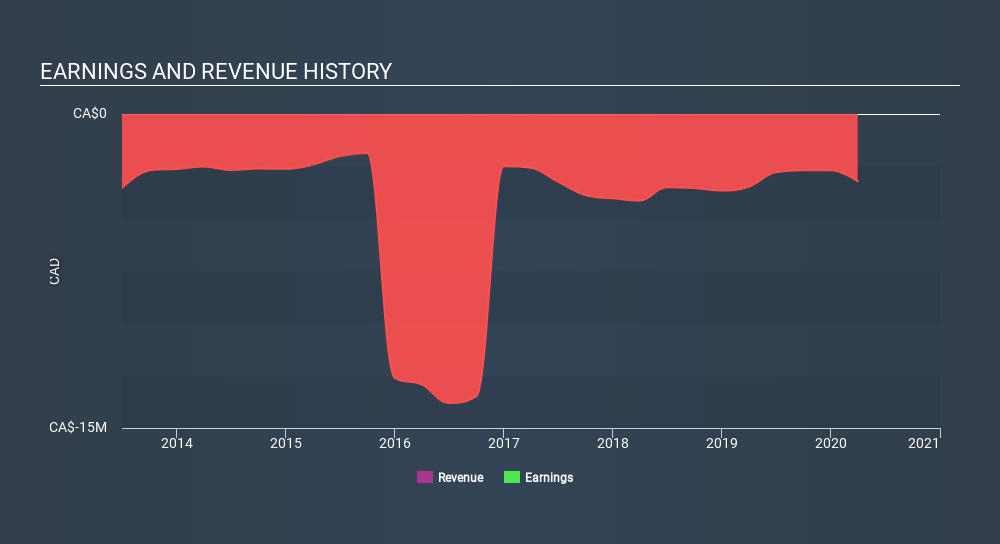

Less than 5% of Erdene Resource Development is held by institutional investors. This suggests that some funds have the company in their sights, but many have not yet bought shares in it. If the business gets stronger from here, we could see a situation where more institutions are keen to buy. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

We note that hedge funds don't have a meaningful investment in Erdene Resource Development. Our data shows that Konwave AG is the largest shareholder with 3.8% of shares outstanding. Next, we have John Byrne and Peter Akerley as the second and third largest shareholders, holding 3.3% and 1.4%, of the shares outstanding, respectively. Peter Akerley also happens to hold the title of Member of the Board of Directors.

A deeper look at our ownership data shows that the top 15 shareholders collectively hold less than 50% of the register, suggesting a large group of small holders where no one share holder has a majority.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Erdene Resource Development

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own some shares in Erdene Resource Development Corporation. As individuals, the insiders collectively own CA$3.7m worth of the CA$54m company. Some would say this shows alignment of interests between shareholders and the board, though I generally prefer to see bigger insider holdings. But it might be worth checking if those insiders have been selling.

General Public Ownership

The general public -- mostly retail investors -- own 89% of Erdene Resource Development. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Take risks, for example - Erdene Resource Development has 4 warning signs (and 1 which is significant) we think you should know about.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSX:ERD

Erdene Resource Development

Focuses on the exploration and development of precious and base metal deposits in Mongolia.

Excellent balance sheet with very low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026