The big shareholder groups in Tiptree Inc. (NASDAQ:TIPT) have power over the company. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

Tiptree is a smaller company with a market capitalization of US$245m, so it may still be flying under the radar of many institutional investors. In the chart below, we can see that institutions are noticeable on the share registry. Let's take a closer look to see what the different types of shareholder can tell us about Tiptree.

Check out our latest analysis for Tiptree

What Does The Institutional Ownership Tell Us About Tiptree?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

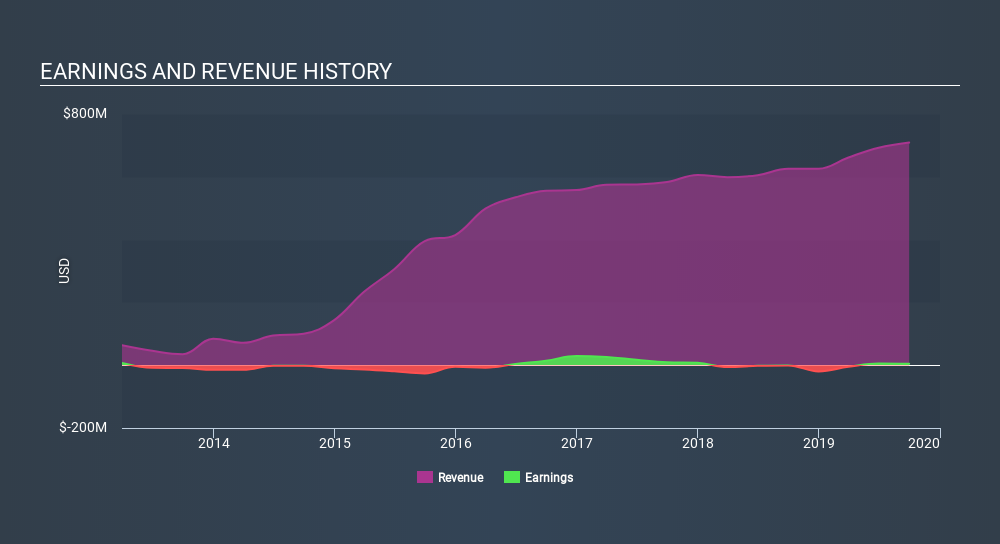

As you can see, institutional investors own 45% of Tiptree. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Tiptree, (below). Of course, keep in mind that there are other factors to consider, too.

Hedge funds don't have many shares in Tiptree. From our data, we infer that the largest shareholder is Michael Barnes (who also holds the title of Top Key Executive) with 23% of shares outstanding. Its usually considered a good sign when insiders own a significant number of shares in the company, and in this case, we're glad to see a company insider play the role of a key stakeholder. With 9.2% and 8.5% of the shares outstanding respectively, Citco Bank Canada Ref Fintan Master Fund Ltd. and Arif Inayatullah are the second and third largest shareholders.

A deeper analysis brings to light the fact that 54% of the company is controlled by the top 5 shareholders suggesting that these owners wield significant influence on the business.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Tiptree

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of Tiptree Inc.. Insiders have a US$86m stake in this US$245m business. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public holds a 19% stake in TIPT. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Take risks, for example - Tiptree has 3 warning signs we think you should be aware of.

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:TIPT

Tiptree

Through its subsidiaries, provides specialty insurance products and related services in the United States and Europe.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives