- Hong Kong

- /

- Construction

- /

- SEHK:1727

What Is Hebei Construction Group's (HKG:1727) P/E Ratio After Its Share Price Rocketed?

Hebei Construction Group (HKG:1727) shares have continued recent momentum with a 30% gain in the last month alone. And the full year gain of 19% isn't too shabby, either!

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So some would prefer to hold off buying when there is a lot of optimism towards a stock. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

See our latest analysis for Hebei Construction Group

How Does Hebei Construction Group's P/E Ratio Compare To Its Peers?

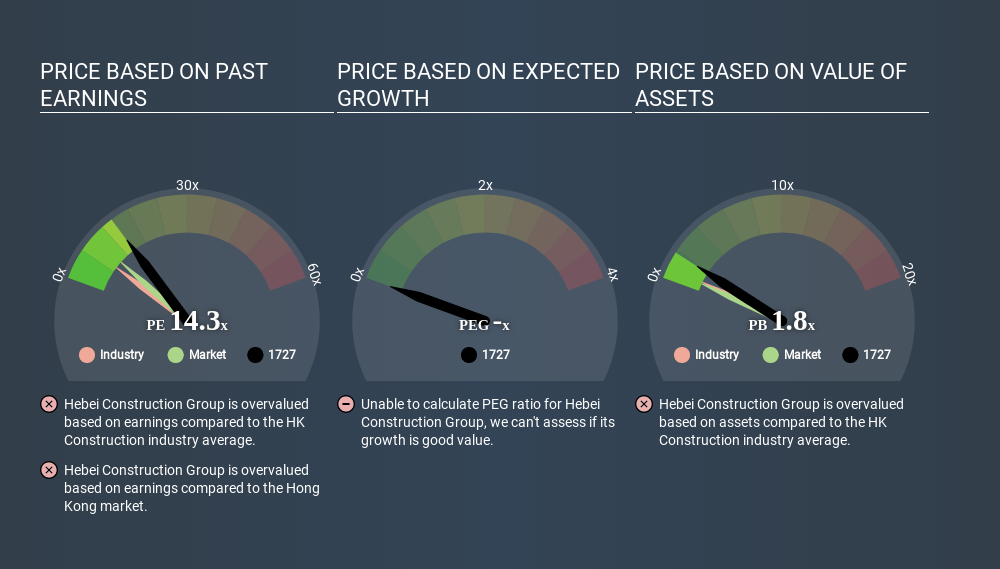

Hebei Construction Group's P/E of 14.32 indicates some degree of optimism towards the stock. The image below shows that Hebei Construction Group has a higher P/E than the average (7.3) P/E for companies in the construction industry.

Its relatively high P/E ratio indicates that Hebei Construction Group shareholders think it will perform better than other companies in its industry classification. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

When earnings fall, the 'E' decreases, over time. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. A higher P/E should indicate the stock is expensive relative to others -- and that may encourage shareholders to sell.

Hebei Construction Group shrunk earnings per share by 45% over the last year. And it has shrunk its earnings per share by 2.4% per year over the last five years. This growth rate might warrant a below average P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. So it won't reflect the advantage of cash, or disadvantage of debt. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

Is Debt Impacting Hebei Construction Group's P/E?

With net cash of CN¥2.0b, Hebei Construction Group has a very strong balance sheet, which may be important for its business. Having said that, at 20% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Verdict On Hebei Construction Group's P/E Ratio

Hebei Construction Group has a P/E of 14.3. That's higher than the average in its market, which is 9.3. The recent drop in earnings per share might keep value investors away, but the relatively strong balance sheet will allow the company time to invest in growth. Clearly, the high P/E indicates shareholders think it will! What is very clear is that the market has become more optimistic about Hebei Construction Group over the last month, with the P/E ratio rising from 11.0 back then to 14.3 today. For those who prefer to invest with the flow of momentum, that might mean it's time to put the stock on a watchlist, or research it. But the contrarian may see it as a missed opportunity.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SEHK:1727

Hebei Construction Group

Provides integrated solutions primarily for the construction contracting of buildings and infrastructure projects in the People's Republic of China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives