- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

What Is Canadian Natural Resources's (TSE:CNQ) P/E Ratio After Its Share Price Tanked?

To the annoyance of some shareholders, Canadian Natural Resources (TSE:CNQ) shares are down a considerable 44% in the last month. That drop has capped off a tough year for shareholders, with the share price down 41% in that time.

Assuming nothing else has changed, a lower share price makes a stock more attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. So, on certain occasions, long term focussed investors try to take advantage of pessimistic expectations to buy shares at a better price. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

Check out our latest analysis for Canadian Natural Resources

Does Canadian Natural Resources Have A Relatively High Or Low P/E For Its Industry?

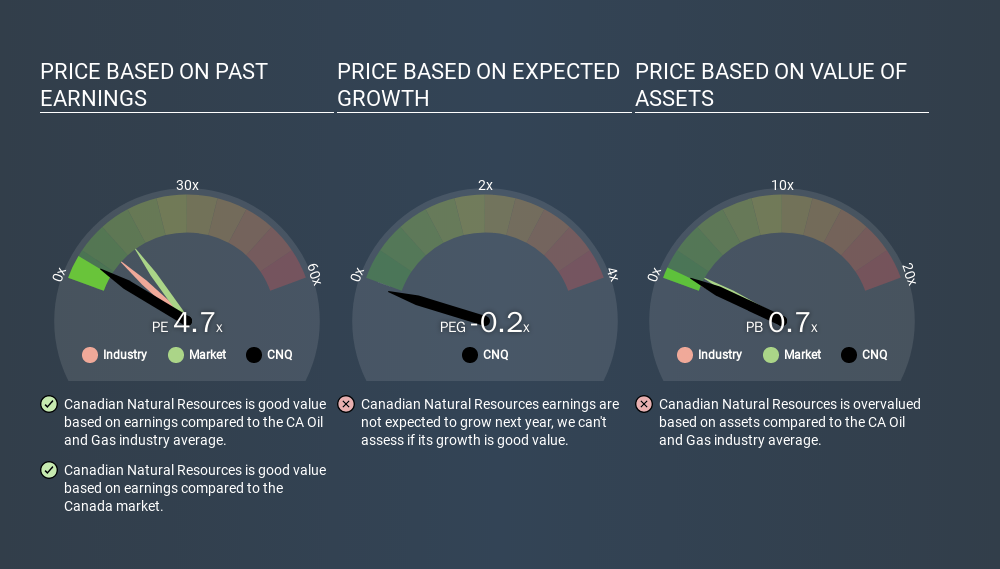

Canadian Natural Resources's P/E of 4.71 indicates relatively low sentiment towards the stock. The image below shows that Canadian Natural Resources has a lower P/E than the average (8.2) P/E for companies in the oil and gas industry.

This suggests that market participants think Canadian Natural Resources will underperform other companies in its industry. Many investors like to buy stocks when the market is pessimistic about their prospects. If you consider the stock interesting, further research is recommended. For example, I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. When earnings grow, the 'E' increases, over time. That means even if the current P/E is high, it will reduce over time if the share price stays flat. And as that P/E ratio drops, the company will look cheap, unless its share price increases.

Canadian Natural Resources's earnings made like a rocket, taking off 114% last year.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. In other words, it does not consider any debt or cash that the company may have on the balance sheet. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

So What Does Canadian Natural Resources's Balance Sheet Tell Us?

Canadian Natural Resources's net debt is 80% of its market cap. This is enough debt that you'd have to make some adjustments before using the P/E ratio to compare it to a company with net cash.

The Bottom Line On Canadian Natural Resources's P/E Ratio

Canadian Natural Resources trades on a P/E ratio of 4.7, which is below the CA market average of 13.6. While the EPS growth last year was strong, the significant debt levels reduce the number of options available to management. If it continues to grow, then the current low P/E may prove to be unjustified. Given Canadian Natural Resources's P/E ratio has declined from 8.5 to 4.7 in the last month, we know for sure that the market is more worried about the business today, than it was back then. For those who prefer to invest with the flow of momentum, that might be a bad sign, but for deep value investors this stock might justify some research.

When the market is wrong about a stock, it gives savvy investors an opportunity. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

Of course you might be able to find a better stock than Canadian Natural Resources. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion