Uflex Limited (NSE:UFLEX), might not be a large cap stock, but it led the NSEI gainers with a relatively large price hike in the past couple of weeks. Less-covered, small caps tend to present more of an opportunity for mispricing due to the lack of information available to the public, which can be a good thing. So, could the stock still be trading at a low price relative to its actual value? Today I will analyse the most recent data on Uflex’s outlook and valuation to see if the opportunity still exists.

See our latest analysis for Uflex

What's the opportunity in Uflex?

Good news, investors! Uflex is still a bargain right now according to my price multiple model, which compares the company's price-to-earnings ratio to the industry average. In this instance, I’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. I find that Uflex’s ratio of 5.08x is below its peer average of 10.64x, which indicates the stock is trading at a lower price compared to the Packaging industry. What’s more interesting is that, Uflex’s share price is quite volatile, which gives us more chances to buy since the share price could sink lower (or rise higher) in the future. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

What does the future of Uflex look like?

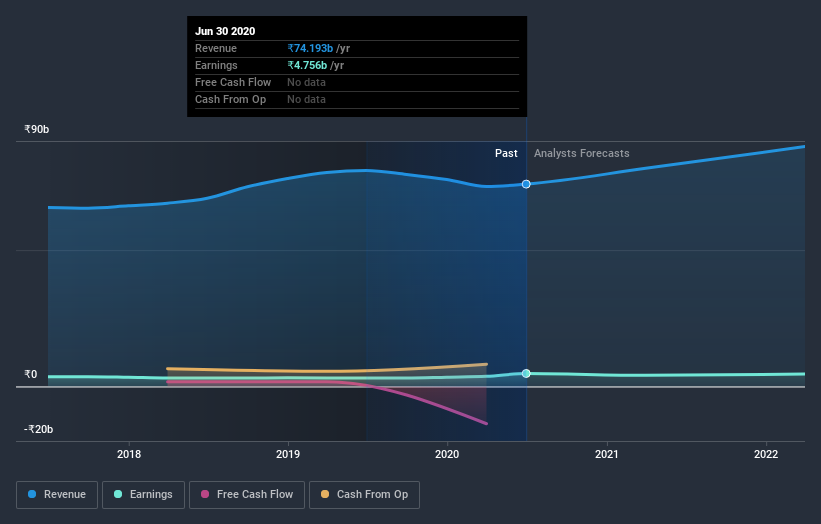

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. However, with a negative profit growth of -12% expected next year, near-term growth certainly doesn’t appear to be a driver for a buy decision for Uflex. This certainty tips the risk-return scale towards higher risk.

What this means for you:

Are you a shareholder? Although UFLEX is currently trading below the industry PE ratio, the negative profit outlook does bring on some uncertainty, which equates to higher risk. I recommend you think about whether you want to increase your portfolio exposure to UFLEX, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping tabs on UFLEX for some time, but hesitant on making the leap, I recommend you dig deeper into the stock. Given its current price multiple, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, Uflex has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you are no longer interested in Uflex, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you decide to trade Uflex, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:UFLEX

Uflex

Manufactures and sells flexible packaging materials and solutions in Indiaand internationally.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The "Geopolitical Discount" vs. The Monopolistic Floor: The Two Narratives of TSM

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.