This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll apply a basic P/E ratio analysis to ING Bank Slaski S.A.'s (WSE:ING), to help you decide if the stock is worth further research. What is ING Bank Slaski's P/E ratio? Well, based on the last twelve months it is 15.56. In other words, at today's prices, investors are paying PLN15.56 for every PLN1 in prior year profit.

Check out our latest analysis for ING Bank Slaski

How Do I Calculate ING Bank Slaski's Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for ING Bank Slaski:

P/E of 15.56 = PLN198.40 ÷ PLN12.75 (Based on the year to December 2019.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio means that investors are paying a higher price for each PLN1 of company earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price'.

How Does ING Bank Slaski's P/E Ratio Compare To Its Peers?

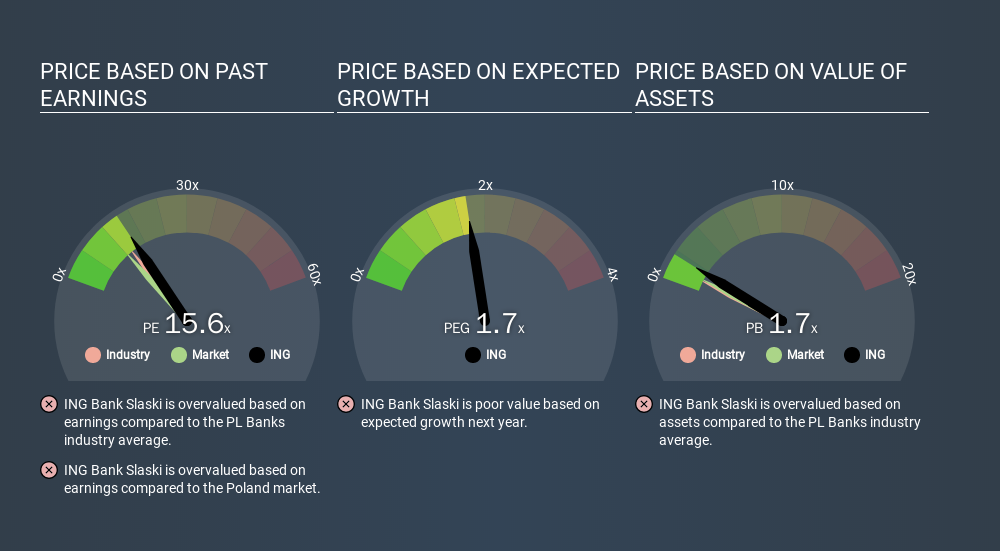

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. The image below shows that ING Bank Slaski has a higher P/E than the average (13.0) P/E for companies in the banks industry.

ING Bank Slaski's P/E tells us that market participants think the company will perform better than its industry peers, going forward. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should delve deeper. I like to check if company insiders have been buying or selling.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. And in that case, the P/E ratio itself will drop rather quickly. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

ING Bank Slaski saw earnings per share improve by -8.7% last year. And earnings per share have improved by 9.8% annually, over the last five years.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

It's important to note that the P/E ratio considers the market capitalization, not the enterprise value. In other words, it does not consider any debt or cash that the company may have on the balance sheet. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

So What Does ING Bank Slaski's Balance Sheet Tell Us?

Net debt totals 24% of ING Bank Slaski's market cap. That's enough debt to impact the P/E ratio a little; so keep it in mind if you're comparing it to companies without debt.

The Verdict On ING Bank Slaski's P/E Ratio

ING Bank Slaski's P/E is 15.6 which is above average (11.7) in its market. With modest debt relative to its size, and modest earnings growth, the market is likely expecting sustained long-term growth, if not a near-term improvement.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

Of course you might be able to find a better stock than ING Bank Slaski. So you may wish to see this free collection of other companies that have grown earnings strongly.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:ING

ING Bank Slaski

Together with our subsidiaries, provides various banking products and services for retail clients and businesses in Poland.

Established dividend payer and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion