- France

- /

- Diversified Financial

- /

- ENXTPA:EDEN

What Do Analysts Think About Edenred SA's (EPA:EDEN) Future?

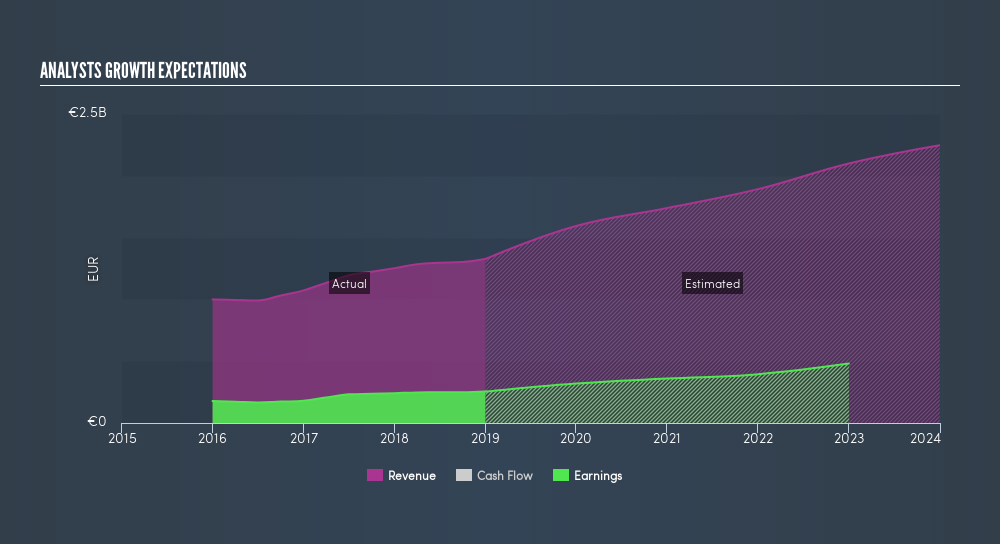

In December 2018, Edenred SA (EPA:EDEN) released its earnings update. Generally, analysts seem fairly confident, as a 26% increase in profits is expected in the upcoming year, against the past 5-year average growth rate of 11%. With trailing-twelve-month net income at current levels of €254m, we should see this rise to €319m in 2020. I will provide a brief commentary around the figures and analyst expectations in the near term. Readers that are interested in understanding the company beyond these figures should research its fundamentals here.

View our latest analysis for Edenred

How will Edenred perform in the near future?

The longer term expectations from the 13 analysts of EDEN is tilted towards the positive sentiment. Given that it becomes hard to forecast far into the future, broker analysts tend to project ahead roughly three years. To reduce the year-on-year volatility of analyst earnings forecast, I've inserted a line of best fit through the expected earnings figures to determine the annual growth rate from the slope of the line.

By 2022, EDEN's earnings should reach €395m, from current levels of €254m, resulting in an annual growth rate of 14%. This leads to an EPS of €1.68 in the final year of projections relative to the current EPS of €1.07. With a current profit margin of 19%, this movement will result in a margin of 21% by 2022.

Next Steps:

Future outlook is only one aspect when you're building an investment case for a stock. For Edenred, there are three important aspects you should further research:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Valuation: What is Edenred worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether Edenred is currently mispriced by the market.

- Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Edenred? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:EDEN

Edenred

Operates as digital platform for services and payments for companies, employees, and merchants worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion