- India

- /

- Metals and Mining

- /

- NSEI:TATAMETALI

What Did Tata Metaliks Limited's (NSE:TATAMETALI) CEO Take Home Last Year?

Sandeep Kumar has been the CEO of Tata Metaliks Limited (NSE:TATAMETALI) since 2017. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for Tata Metaliks

How Does Sandeep Kumar's Compensation Compare With Similar Sized Companies?

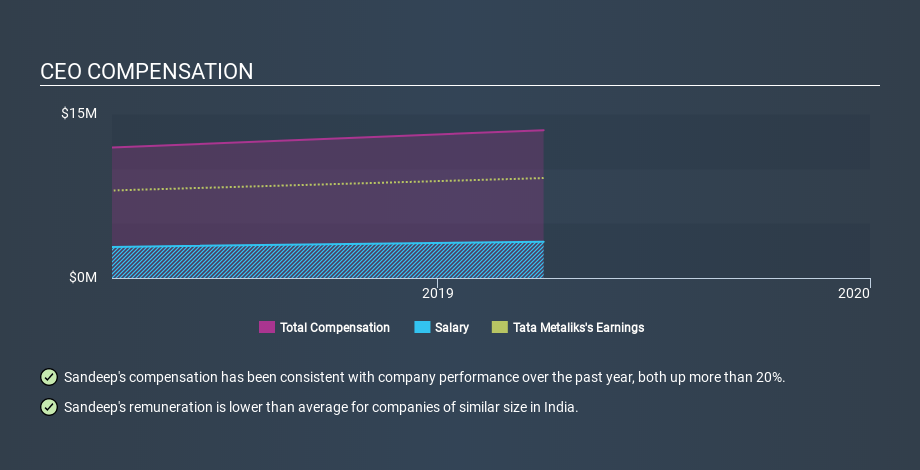

At the time of writing, our data says that Tata Metaliks Limited has a market cap of ₹14b, and reported total annual CEO compensation of ₹14m for the year to March 2019. We think total compensation is more important but we note that the CEO salary is lower, at ₹3.3m. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. When we examined a selection of companies with market caps ranging from ₹7.6b to ₹30b, we found the median CEO total compensation was ₹25m.

Now let's take a look at the pay mix on an industry and company level to gain a better understanding of where Tata Metaliks stands. Talking in terms of the sector, salary represented approximately 99% of total compensation out of all the companies we analysed, while other remuneration made up 0.8% of the pie. It's interesting to note that Tata Metaliks allocates a smaller portion of compensation to salary in comparison to the broader industry.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. While this is a good thing, you'll need to understand the business better before you can form an opinion. The graphic below shows how CEO compensation at Tata Metaliks has changed from year to year.

Is Tata Metaliks Limited Growing?

Over the last three years Tata Metaliks Limited has seen earnings per share (EPS) move in a positive direction by an average of 7.7% per year (using a line of best fit). It saw its revenue drop 4.4% over the last year.

I generally like to see a little revenue growth, but it is good to see EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Tata Metaliks Limited Been A Good Investment?

With a three year total loss of 32%, Tata Metaliks Limited would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

Tata Metaliks Limited is currently paying its CEO below what is normal for companies of its size.

Sandeep Kumar receives relatively low remuneration compared to similar sized companies. But the company isn't exactly firing on all cylinders, and returns over three years are not good. I am not concerned by the CEO compensation, but it would be good to see improved performance before pay increases. Shifting gears from CEO pay for a second, we've spotted 2 warning signs for Tata Metaliks you should be aware of, and 1 of them shouldn't be ignored.

Important note: Tata Metaliks may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:TATAMETALI

Tata Metaliks

Tata Metaliks Limited engages in the manufacture and sale of pig iron and ductile iron pipes in India and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026