Philippe Brassac has been the CEO of Crédit Agricole S.A. (EPA:ACA) since 2015, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Crédit Agricole pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Crédit Agricole

How Does Total Compensation For Philippe Brassac Compare With Other Companies In The Industry?

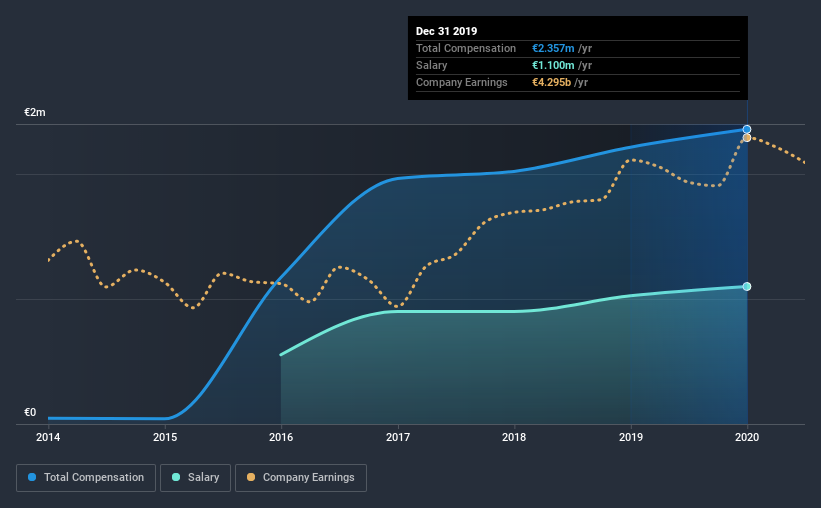

According to our data, Crédit Agricole S.A. has a market capitalization of €24b, and paid its CEO total annual compensation worth €2.4m over the year to December 2019. That's just a smallish increase of 6.4% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €1.1m.

In comparison with other companies in the industry with market capitalizations over €6.8b , the reported median total CEO compensation was €2.1m. This suggests that Crédit Agricole remunerates its CEO largely in line with the industry average.

On an industry level, around 66% of total compensation represents salary and 34% is other remuneration. Crédit Agricole sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Crédit Agricole S.A.'s Growth

Crédit Agricole S.A.'s earnings per share (EPS) grew 15% per year over the last three years. It saw its revenue drop 2.3% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Crédit Agricole S.A. Been A Good Investment?

Since shareholders would have lost about 37% over three years, some Crédit Agricole S.A. investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we noted earlier, Crédit Agricole pays its CEO in line with similar-sized companies belonging to the same industry. On the other hand, the company has logged negative shareholder returns over the previous three years. But on the bright side, earnings growth is positive over the same period. Overall, we wouldn't say Philippe is paid an unjustified compensation, but shareholders might not favor a raise before shareholder returns show a positive trend.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Crédit Agricole that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Crédit Agricole, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ACA

Crédit Agricole

Provides retail and corporate banking, insurance, and investment banking products and services in France, Italy, rest of the European Union, rest of Europe, North America, Central and South America, Africa, the Middle East, the Asia Pacific, and Japan.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

The Concentration Trap: Why the S&P 500 Is No Longer a 'Safe' Diversifier

Transformational Merger

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.