- Netherlands

- /

- Metals and Mining

- /

- ENXTAM:MT

What Are Analysts Expecting From ArcelorMittal (AMS:MT) In The Years Ahead?

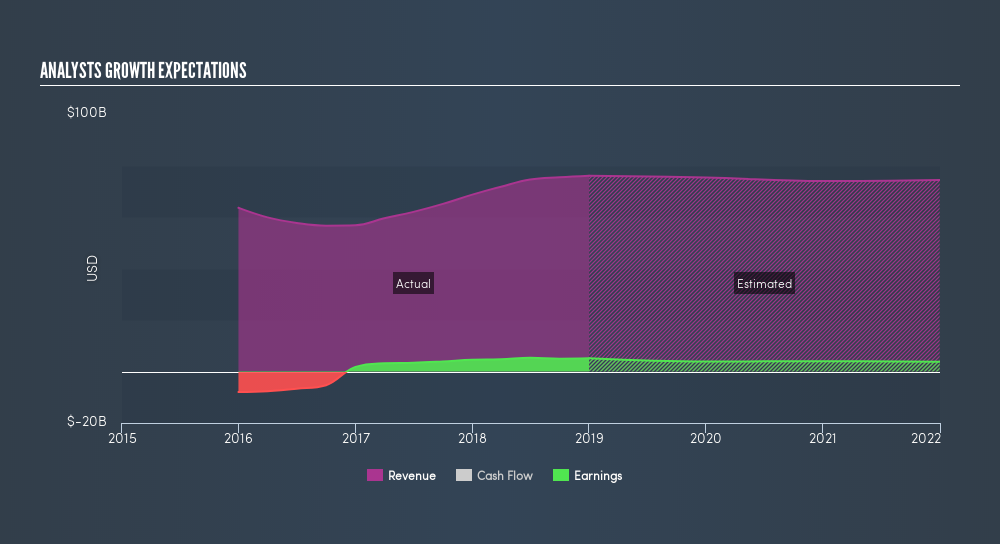

ArcelorMittal's (AMS:MT) latest earnings announcement in December 2018 suggested that the company benefited from a strong tailwind, leading to a double-digit earnings growth of 13%. Below is a brief commentary on my key takeaways on how market analysts view ArcelorMittal's earnings growth outlook over the next few years and whether the future looks even brighter than the past. I will be using net income excluding extraordinary items in order to exclude one-off volatility which I am not interested in.

Check out our latest analysis for ArcelorMittal

Analysts' outlook for the upcoming year seems pessimistic, with earnings decreasing by a double-digit -25%. Over the medium term, earnings are predicted to continue to be below today's level, with a decline of -23% in 2021, eventually reaching US$4.0b in 2022.

Although it’s helpful to be aware of the rate of growth each year relative to today’s level, it may be more valuable analyzing the rate at which the earnings are growing on average every year. The advantage of this method is that it removes the impact of near term flucuations and accounts for the overarching direction of ArcelorMittal's earnings trajectory over time, fluctuate up and down. To calculate this rate, I put a line of best fit through analyst consensus of forecasted earnings. The slope of this line is the rate of earnings growth, which in this case is -11%. This means that, we can anticipate ArcelorMittal will chip away at a rate of -11% every year for the next few years.

Next Steps:

For ArcelorMittal, there are three essential factors you should further examine:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Valuation: What is MT worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether MT is currently mispriced by the market.

- Other High-Growth Alternatives: Are there other high-growth stocks you could be holding instead of MT? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTAM:MT

ArcelorMittal

Operates as integrated steel and mining companies in the Americas, Europe, Asia, and Africa.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Perion (PERI) Q4 Earnings: Real AI Turnaround… or Just Another Adtech Hype Cycle? 🤔📊

TSMC will drive future growth with CoWoS packaging and N2 rollout

Beyond 2026, Beyond a Double

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.