- India

- /

- Metals and Mining

- /

- NSEI:MMP

We're Not Counting On MMP Industries (NSE:MMP) To Sustain Its Statutory Profitability

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding MMP Industries (NSE:MMP).

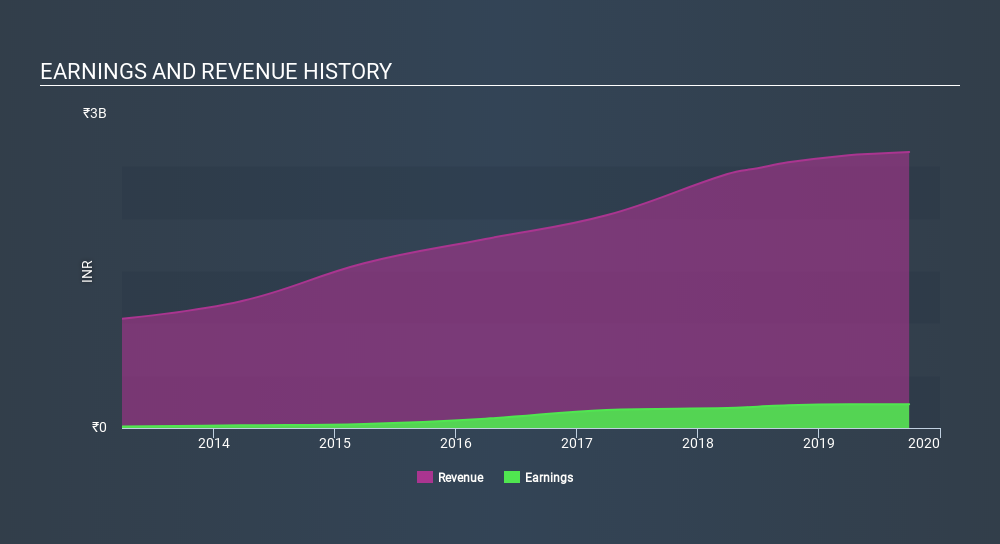

While MMP Industries was able to generate revenue of ₹2.64b in the last twelve months, we think its profit result of ₹227.5m was more important. One positive is that it has grown both its profit and its revenue, over the last few years.

Check out our latest analysis for MMP Industries

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. So today we'll examine what MMP Industries's cashflow and its expanding share count tell us about the nature of its profits. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of MMP Industries.

Zooming In On MMP Industries's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Over the twelve months to September 2019, MMP Industries recorded an accrual ratio of 0.26. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. Over the last year it actually had negative free cash flow of ₹165m, in contrast to the aforementioned profit of ₹227.5m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of ₹165m, this year, indicates high risk.

Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, MMP Industries issued 12% more new shares over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of MMP Industries's EPS by clicking here.

How Is Dilution Impacting MMP Industries's Earnings Per Share? (EPS)

As you can see above, MMP Industries has been growing its net income over the last few years, with an annualized gain of 74% over three years. But EPS was only up 33% per year, in the exact same period. And in the last year the company managed to bump profit up by 4.7%. But that's starkly different from the 6.3% drop in earnings per share. So you can see that the dilution has had a bit of an impact on shareholders.Therefore, the dilution is having a noteworthy influence on shareholder returnsAnd so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if MMP Industries's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On MMP Industries's Profit Performance

In conclusion, MMP Industries has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). For the reasons mentioned above, we think that a perfunctory glance at MMP Industries's statutory profits might make it look better than it really is on an underlying level. While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. If you're interestedwe have a graphic representation of MMP Industries's balance sheet.

Our examination of MMP Industries has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:MMP

MMP Industries

Manufactures, sells, distributes, and trades aluminium products in India.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives