- Hong Kong

- /

- Hospitality

- /

- SEHK:296

We're Not Counting On Emperor Entertainment Hotel (HKG:296) To Sustain Its Statutory Profitability

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Emperor Entertainment Hotel (HKG:296).

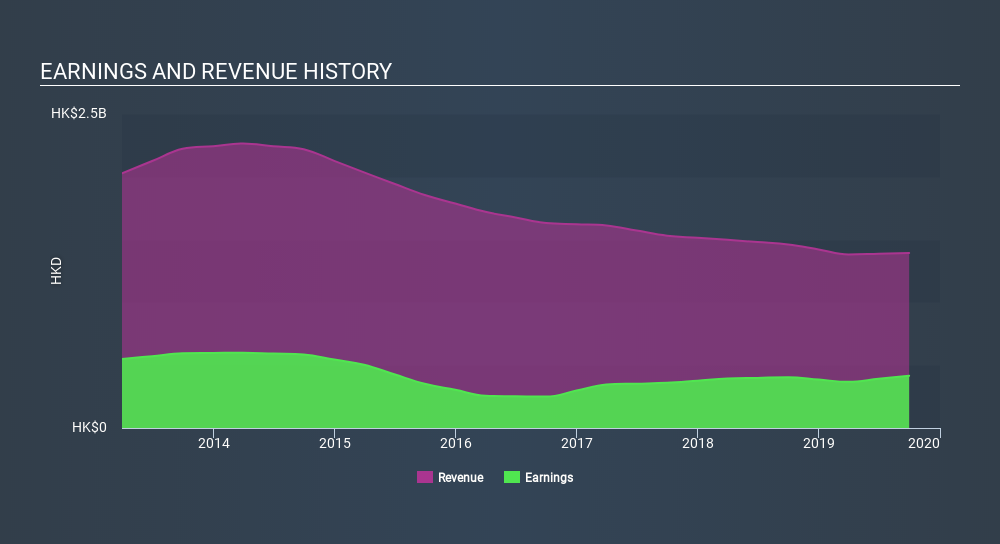

While Emperor Entertainment Hotel was able to generate revenue of HK$1.39b in the last twelve months, we think its profit result of HK$415.8m was more important. As depicted below, while its revenue may have fallen over the last few years, its profit actually improved.

View our latest analysis for Emperor Entertainment Hotel

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. As a reuslt, we think it's important to consider how unusual items and the recent tax benefit have influenced Emperor Entertainment Hotel's statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Emperor Entertainment Hotel.

The Impact Of Unusual Items On Profit

For anyone who wants to understand Emperor Entertainment Hotel's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from HK$22m worth of unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. If Emperor Entertainment Hotel doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Emperor Entertainment Hotel received a tax benefit which contributed HK$67m to the bottom line. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. Of course, prima facie it's great to receive a tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On Emperor Entertainment Hotel's Profit Performance

In its last report Emperor Entertainment Hotel received a tax benefit which might make its profit look better than it really is on a underlying level. And on top of that, it also saw an unusual item boost its profit, suggesting that next year might see a lower profit number, if these events are not repeated. Considering all this we'd argue Emperor Entertainment Hotel's profits probably give an overly generous impression of its sustainable level of profitability. While it's very important to consider the profit and loss statement, you can also learn a lot about a company by looking at its balance sheet. If you're interestedwe have a graphic representation of Emperor Entertainment Hotel's balance sheet.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:296

Emperor Entertainment Hotel

An investment holding company, provides hospitality and entertainment services in Macau and Hong Kong.

Flawless balance sheet and good value.

Market Insights

Community Narratives