David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, SBS Transit Ltd (SGX:S61) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for SBS Transit

What Is SBS Transit's Debt?

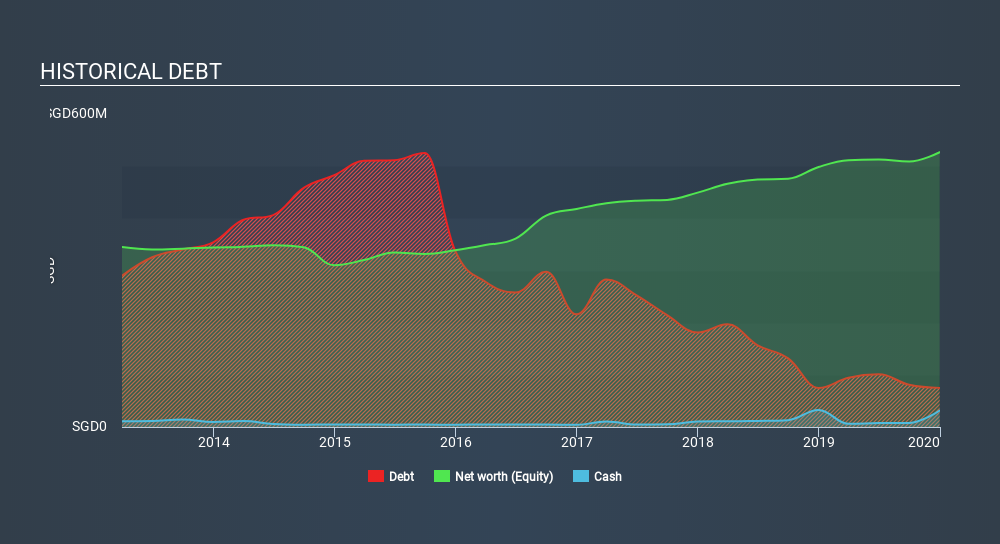

The chart below, which you can click on for greater detail, shows that SBS Transit had S$75.0m in debt in December 2019; about the same as the year before. However, it does have S$31.5m in cash offsetting this, leading to net debt of about S$43.5m.

A Look At SBS Transit's Liabilities

Zooming in on the latest balance sheet data, we can see that SBS Transit had liabilities of S$419.6m due within 12 months and liabilities of S$190.9m due beyond that. On the other hand, it had cash of S$31.5m and S$235.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by S$343.9m.

This deficit isn't so bad because SBS Transit is worth S$863.9m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

SBS Transit's net debt is only 0.21 times its EBITDA. And its EBIT easily covers its interest expense, being 25.2 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The good news is that SBS Transit has increased its EBIT by 6.4% over twelve months, which should ease any concerns about debt repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since SBS Transit will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, SBS Transit recorded free cash flow worth a fulsome 94% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

The good news is that SBS Transit's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Looking at the bigger picture, we think SBS Transit's use of debt seems quite reasonable and we're not concerned about it. While debt does bring risk, when used wisely it can also bring a higher return on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for SBS Transit you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:S61

SBS Transit

Provides bus and rail public transportation services, and consultancy services relating to land transport in Singapore.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives