- United States

- /

- Food

- /

- NasdaqGM:RMCF

We Think Rocky Mountain Chocolate Factory (NASDAQ:RMCF) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Rocky Mountain Chocolate Factory

What Is Rocky Mountain Chocolate Factory's Debt?

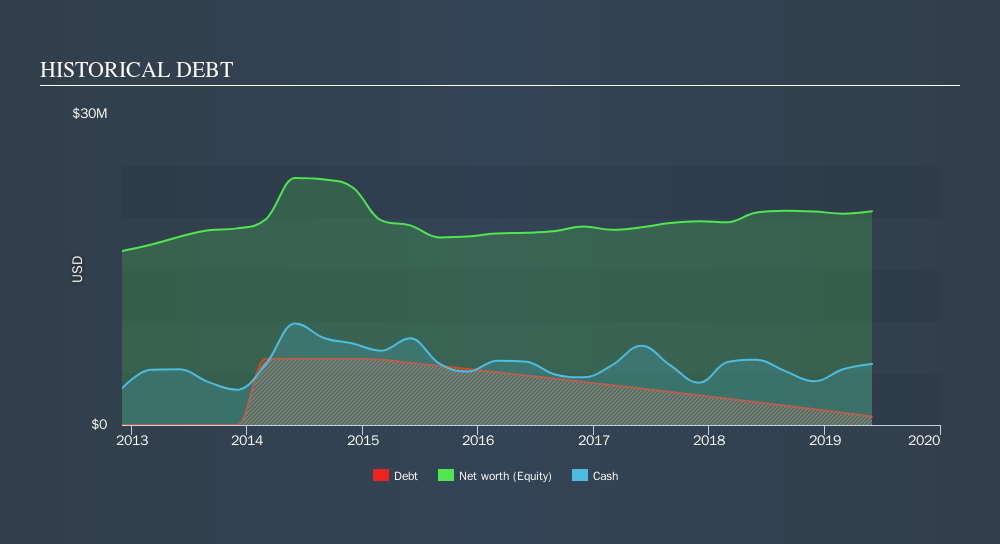

As you can see below, Rocky Mountain Chocolate Factory had US$829.9k of debt at May 2019, down from US$2.20m a year prior. But on the other hand it also has US$5.90m in cash, leading to a US$5.07m net cash position.

A Look At Rocky Mountain Chocolate Factory's Liabilities

According to the last reported balance sheet, Rocky Mountain Chocolate Factory had liabilities of US$5.48m due within 12 months, and liabilities of US$3.45m due beyond 12 months. Offsetting these obligations, it had cash of US$5.90m as well as receivables valued at US$4.02m due within 12 months. So it can boast US$985.8k more liquid assets than total liabilities.

This state of affairs indicates that Rocky Mountain Chocolate Factory's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the US$56.6m company is struggling for cash, we still think it's worth monitoring its balance sheet. Simply put, the fact that Rocky Mountain Chocolate Factory has more cash than debt is arguably a good indication that it can manage its debt safely.

It is just as well that Rocky Mountain Chocolate Factory's load is not too heavy, because its EBIT was down 30% over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Rocky Mountain Chocolate Factory will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Rocky Mountain Chocolate Factory has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Rocky Mountain Chocolate Factory recorded free cash flow worth a fulsome 87% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

While it is always sensible to investigate a company's debt, in this case Rocky Mountain Chocolate Factory has US$5.07m in net cash and a decent-looking balance sheet. The cherry on top was that in converted 87% of that EBIT to free cash flow, bringing in US$3.7m. So we don't have any problem with Rocky Mountain Chocolate Factory's use of debt. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Rocky Mountain Chocolate Factory's dividend history, without delay!

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:RMCF

Rocky Mountain Chocolate Factory

Produces and sells confectionery products.

Slight and slightly overvalued.

Market Insights

Community Narratives