Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Floridienne S.A. (EBR:FLOB) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View 2 warning signs we detected for Floridienne

What Is Floridienne's Net Debt?

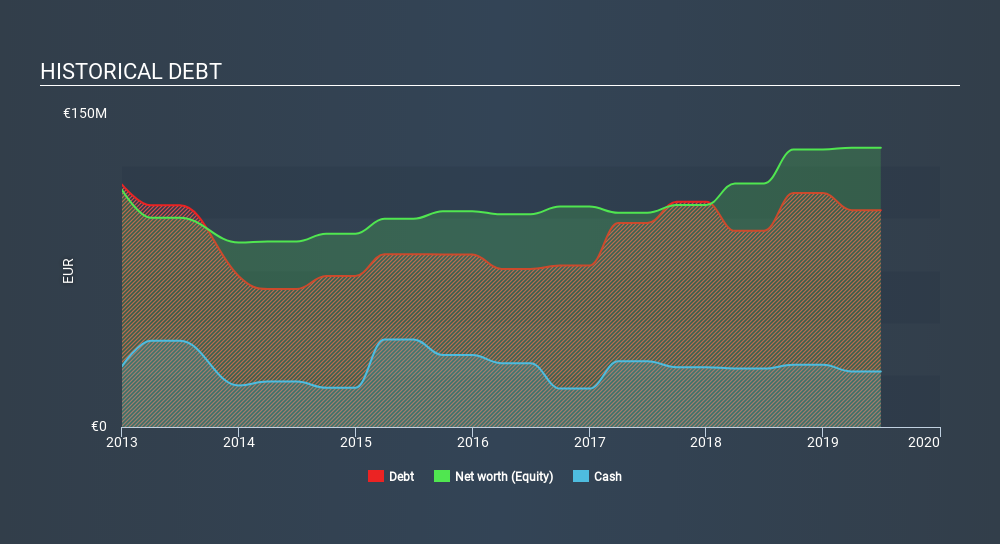

The image below, which you can click on for greater detail, shows that at June 2019 Floridienne had debt of €103.9m, up from €94.0m in one year. However, it does have €26.6m in cash offsetting this, leading to net debt of about €77.3m.

How Healthy Is Floridienne's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Floridienne had liabilities of €99.1m due within 12 months and liabilities of €93.3m due beyond that. On the other hand, it had cash of €26.6m and €66.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €99.6m.

Floridienne has a market capitalization of €190.5m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Floridienne's debt is 3.0 times its EBITDA, and its EBIT cover its interest expense 4.7 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. It is well worth noting that Floridienne's EBIT shot up like bamboo after rain, gaining 35% in the last twelve months. That'll make it easier to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Floridienne can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Floridienne reported free cash flow worth 16% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

On our analysis Floridienne's EBIT growth rate should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. For example, its conversion of EBIT to free cash flow makes us a little nervous about its debt. Looking at all this data makes us feel a little cautious about Floridienne's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Floridienne which any shareholder or potential investor should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTBR:FLOB

Floridienne

Through its subsidiaries, operates in the life sciences, food, and chemistry sectors in Belgium and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives