- United States

- /

- Food and Staples Retail

- /

- NYSE:WMT

Walmart (NYSE:WMT) Partners With NationsBenefits To Enhance Health And Wellness Shopping Experience

Reviewed by Simply Wall St

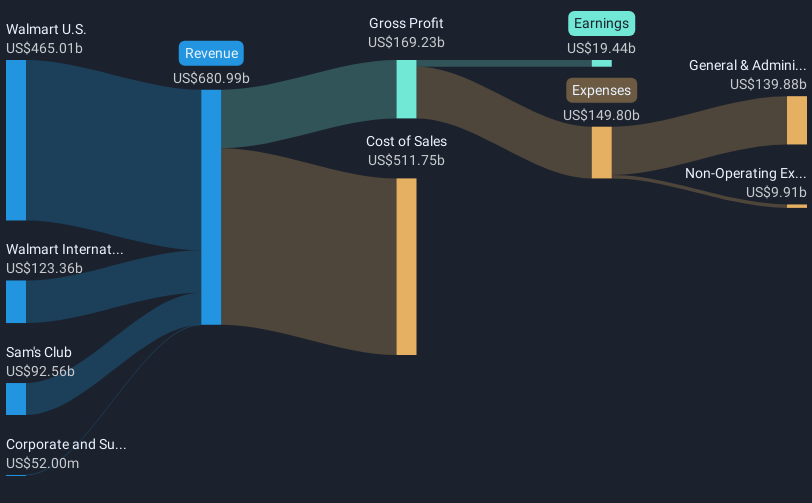

Walmart (NYSE:WMT) recently announced a collaboration with NationsBenefits, aiming to enhance healthcare access through initiatives like the Basket Analyzer Service and Everyday Health Signals program. This move highlights the company's focus on integrating healthcare with retail experiences. Alongside other product launches, such as the "Hot Girl Summer" swimwear collection and the expansion of health-oriented offerings, Walmart saw a 2% price increase over the month. While these developments may have bolstered its market position, broader market trends, such as the tech sector rally and tariff adjustments, played a significant role in supporting overall stock gains.

We've discovered 2 risks for Walmart that you should be aware of before investing here.

The collaboration between Walmart and NationsBenefits introduces promising opportunities for Walmart to further intertwine healthcare with its retail operations. As Walmart continues to expand its product offerings and integrated services, this initiative could potentially boost revenue streams and support the narrative of enhanced supply chain efficiency and e-commerce growth. The integration of programs like the Basket Analyzer Service aligns well with Walmart’s focus on higher-margin ventures, which could positively impact earnings projections.

Over a five-year period, Walmart has delivered a total return of 153.73%, reflecting strong long-term performance. While Walmart's stock exceeded the broader US market's return of 11.5% over the past year, this suggests a robust positioning against market fluctuations despite currency and inflationary pressures potentially moderating future gains. In the shorter term, Walmart's recent share price uptick of 2% is vindicated by analysts' consensus price target of US$107.01, approximately 7.9% higher than the current price of US$98.55, indicating confidence in achieving forecasted revenue and margin improvements.

Forecasts indicate a 4.1% annual revenue growth for the next three years, with earnings anticipated to rise significantly, driven by ventures like the PhonePe IPO. The healthcare collaboration is a step towards enhancing Walmart’s comprehensive service model, aligning with analysts' projections of a strong growth trajectory in earnings. The investor community should remain mindful of the impact that operational investments and market conditions hold on profitability and valuation assessments.

Learn about Walmart's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walmart might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMT

Walmart

Engages in the operation of retail and wholesale stores and clubs, eCommerce websites, and mobile applications worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives