- India

- /

- Retail Distributors

- /

- NSEI:JMA

Volatility 101: Should Jullundur Motor Agency (Delhi) (NSE:JMA) Shares Have Dropped 46%?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Jullundur Motor Agency (Delhi) Limited (NSE:JMA) shareholders have had that experience, with the share price dropping 46% in three years, versus a market return of about 18%. The more recent news is of little comfort, with the share price down 43% in a year. The falls have accelerated recently, with the share price down 32% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

View our latest analysis for Jullundur Motor Agency (Delhi)

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

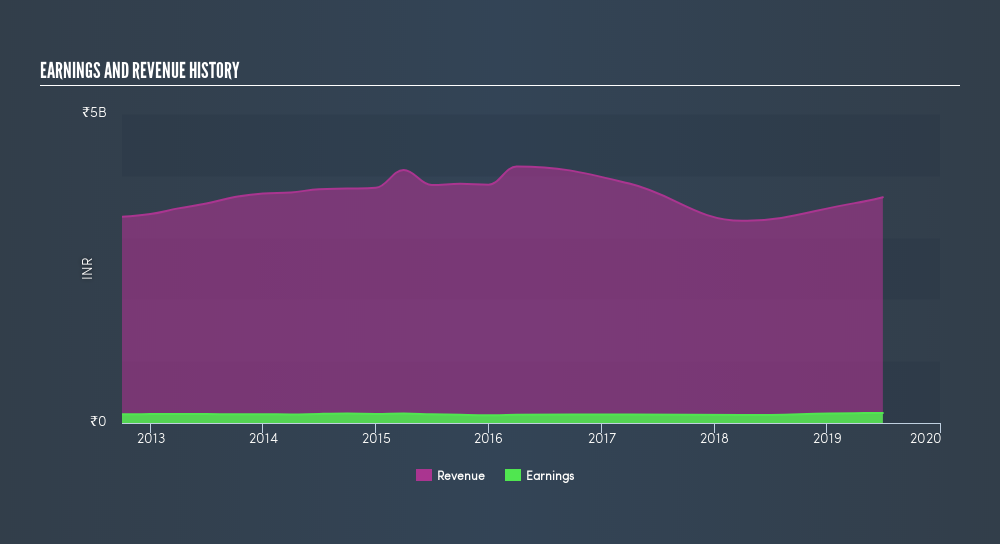

During the unfortunate three years of share price decline, Jullundur Motor Agency (Delhi) actually saw its earnings per share (EPS) improve by 0.4% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past. It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. Looking to other metrics might better explain the share price change.

With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. There doesn't seem to be any clear correlation between the fundamental business metrics and the share price. That could mean that the stock was previously overrated, or it could spell opportunity now.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Jullundur Motor Agency (Delhi)'s TSR for the last 3 years was -42%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Jullundur Motor Agency (Delhi) shareholders are down 41% for the year (even including dividends), falling short of the market return. Meanwhile, the broader market slid about 13%, likely weighing on the stock. Shareholders have lost 16% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. Before spending more time on Jullundur Motor Agency (Delhi) it might be wise to click here to see if insiders have been buying or selling shares.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:JMA

Jullundur Motor Agency (Delhi)

Trades and distributes automobile parts, accessories, and petroleum products primarily in India.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives