- United States

- /

- Specialty Stores

- /

- NYSE:FND

Volatility 101: Should Floor & Decor Holdings (NYSE:FND) Shares Have Dropped 39%?

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. That downside risk was realized by Floor & Decor Holdings, Inc. (NYSE:FND) shareholders over the last year, as the share price declined 39%. That falls noticeably short of the market return of around -14%. We wouldn't rush to judgement on Floor & Decor Holdings because we don't have a long term history to look at. Unfortunately the last month hasn't been any better, with the share price down 48%.

See our latest analysis for Floor & Decor Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Floor & Decor Holdings share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

Floor & Decor Holdings managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

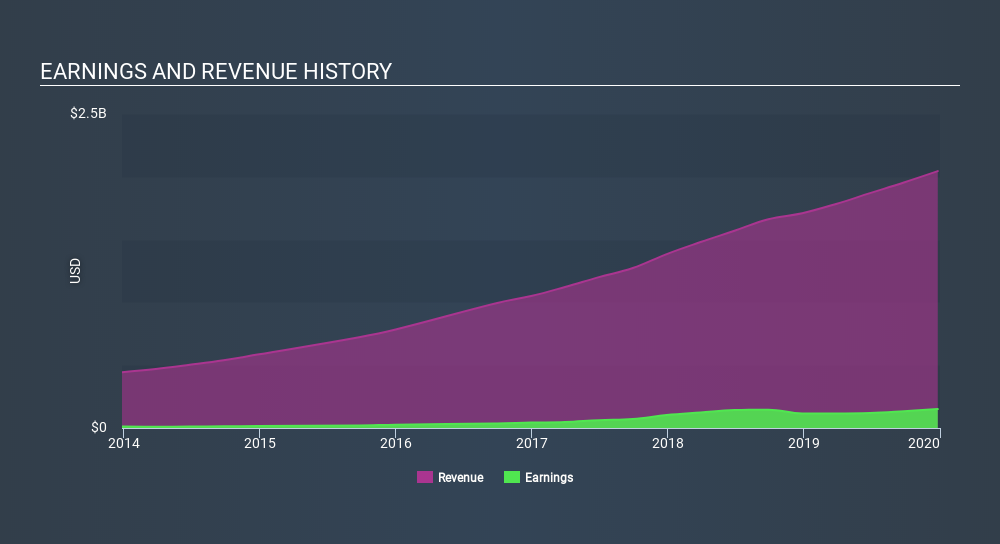

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Floor & Decor Holdings

A Different Perspective

We doubt Floor & Decor Holdings shareholders are happy with the loss of 39% over twelve months. That falls short of the market, which lost 14%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. It's worth noting that the last three months did the real damage, with a 45% decline. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Floor & Decor Holdings you should know about.

But note: Floor & Decor Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:FND

Floor & Decor Holdings

Operates as a multi-channel specialty retailer of hard surface flooring and related accessories, and commercial surfaces seller in the United States.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives