Visa (NYSE:V) Expands Payment Security With Worldpay and Launches Innovative Tap to Pay Gift Card

Reviewed by Simply Wall St

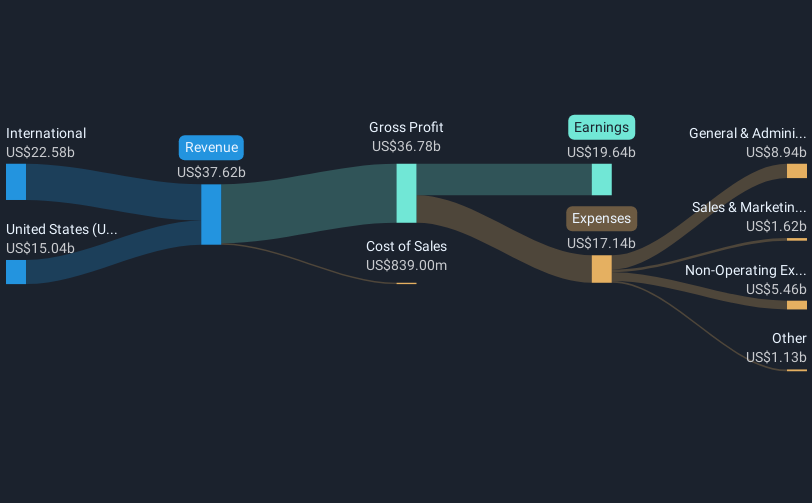

Visa (NYSE:V) recently announced a partnership with Worldpay to enhance online transaction security through 3D Secure, and Blackhawk Network launched a secure Tap to Pay Visa Gift Card, bolstering Visa's innovation in secure payment solutions. These developments may have augmented investor confidence, evidenced by Visa's 11% share price increase last quarter, potentially bolstered by favorable market conditions and broader U.S. index gains. Additionally, Visa's financial performance, including increased sales and a $30 billion share buyback program, contributed to this positive sentiment, aligning with a general market uptrend reflecting benign inflation and progress in China-US trade talks.

Buy, Hold or Sell Visa? View our complete analysis and fair value estimate and you decide.

Visa's recent partnership with Worldpay and the launch of the Tap to Pay Visa Gift Card reflects its ongoing efforts to bolster online transaction security and foster innovation in payment solutions. These initiatives could positively influence Visa's long-term growth narrative by enhancing user engagement, expanding transaction volumes, and ultimately supporting revenue growth. Additionally, Visa's focus on security measures could further entrench its market position, crucial for its strategic geographical expansions.

Over the last five years, Visa's total return, including share price and dividends, achieved a substantial 99.15% increase, showcasing strong performance. Comparatively, over the past year, Visa's return outpaced the US Diversified Financial industry, recording gains above the industry's 23.3% return. This indicates robust market positioning and a favorable reception among investors.

Visa’s current and forecasted financial performance reveals a promising trajectory, with revenue and earnings anticipated to grow as the company capitalizes on stablecoin innovations and value-added services. However, the analyst consensus price target of US$374.25 suggests only a modest increase from the current share price of US$347.7, indicating that Visa's market valuation aligns closely with analysts' expectations of future performance. Consequently, investors should consider both the potential for future growth and existing valuation when assessing Visa's investment prospects.

Evaluate Visa's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives