Visa (NYSE:V) Expands Global Network with Sunny's New Prepaid Card Collaboration

Reviewed by Simply Wall St

Visa (NYSE:V) recently announced a partnership with Sunny, launching the Sunny Visa Prepaid Card to enable users to spend their health benefits across an expansive network. This collaboration is indicative of Visa’s ongoing efforts to innovate and enhance consumer payment experiences. The company's stock moved up 5.3% over the last quarter, paralleling broader market increases. With the overall market exhibiting similar upward trends amidst geopolitical tensions and pending Fed decisions, Visa’s initiatives like the Sunny collaboration and other strategic partnerships likely added positive momentum, aligning with these broader market dynamics.

Buy, Hold or Sell Visa? View our complete analysis and fair value estimate and you decide.

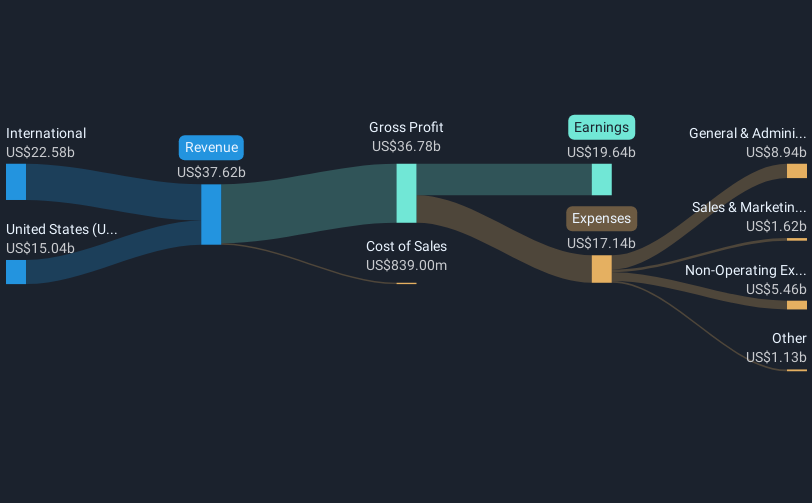

Visa's partnership with Sunny introduces the Sunny Visa Prepaid Card, potentially enhancing Visa's influence in the health benefits sector and driving consumer engagement. By integrating Visa's trusted payment technology with Sunny's expansive network, this collaboration may strengthen Visa's position in diversifying revenue streams. Over the longer three-year period, Visa's shareholders saw a total return of 88.34%, reflecting solid growth relative to a broader market environment marked by uncertainties. Compared to the US market's 9.8% return over the past year, Visa exceeded these gains, showcasing its resilience and solid performance.

The recent stock price uptick of 5.3% aligns with the analysts' consensus price target of US$382.44, indicating market confidence in Visa's growth potential. In light of the new partnership and forecasted revenue growth, Visa's shares, currently priced at US$347.70, suggest limited room for immediate upside when juxtaposed with the target. Analysts anticipate revenue to grow by 10.9% annually over the next three years, driven by innovations like tokenization and stablecoin settlements. Despite economic and geopolitical challenges potentially impacting international operations and cross-border transactions, Visa's proactive moves in technology and market expansions are integral to expected performance improvements.

Click here to discover the nuances of Visa with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives