Visa (NYSE:V) Appoints Tareq Muhmood As CEMEA Regional President Covering 86 Markets

Reviewed by Simply Wall St

Visa (NYSE:V) appointed Tareq Muhmood as the regional president for CEMEA, an area with significant strategic importance. This appointment, along with other executive changes, such as Andrew Torre's move to President of Value-Added Services, positioned the company for continued leadership across vital regions. Despite these developments, Visa's stock price was flat over the last quarter, aligning with a broader market trend. While initiatives like enhanced client collaborations and a robust share repurchase program could have added weight to future performance, the overall price change was not significantly different from the general market, which was also steady.

Buy, Hold or Sell Visa? View our complete analysis and fair value estimate and you decide.

The recent appointment of Tareq Muhmood as Visa's regional president for CEMEA is set to strengthen Visa's strategic position, particularly in this area of significant importance. This aligns with Visa's ongoing efforts to enhance client collaborations, expected to contribute positively to the company's expanding international payment volumes and overall revenue. Over the past five years, Visa achieved a substantial total shareholder return of 85.35%, contrasting with its recent flat performance that mirrored broader market trends.

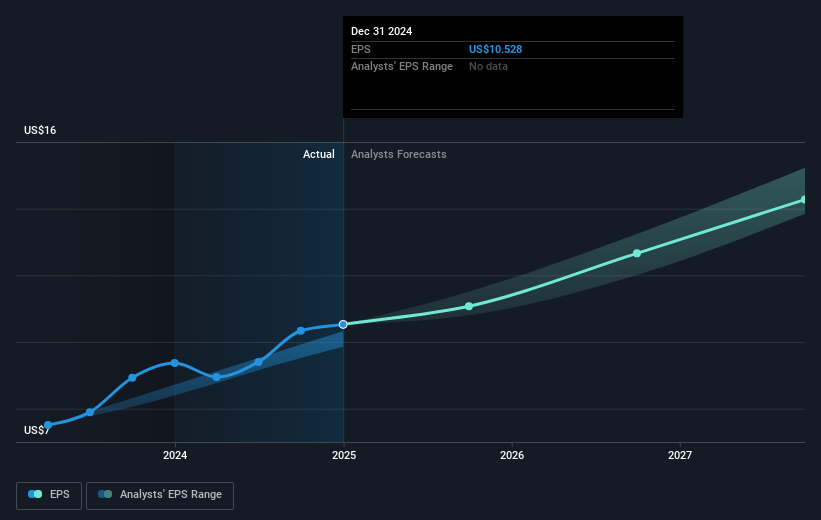

In the past year, Visa’s earnings growth underperformed the diversified financial industry after growing by 8.5% compared to the industry's 9.3%. Nonetheless, Visa's stock exceeded the US market, which returned 10% over the same period. These longer-term performance indicators suggest resilience in Visa's business model amidst short-term fluctuations. The current initiatives, including the focus on stablecoin innovations and value-added services, could influence future revenue and earnings growth projections.

Visa's stock price of US$347.70 remains close to the analyst consensus target of US$374.25, reflecting a discount of about 7.1%. This suggests an alignment in market expectations with analysts' forecasts. As Visa continues to push into new geographical markets and innovative payment solutions, these efforts may provide additional revenue streams. The anticipated improvements in transaction security and user engagement through tokenization and the expansion of stablecoin settlements are important factors in the company's growth narrative. Overall, the executive changes and strategic expansions are set to support Visa’s evolving business strategy and financial outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:V

Visa

Operates as a payment technology company in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives