- United States

- /

- Medical Equipment

- /

- NasdaqCM:UFPT

Unpleasant Surprises Could Be In Store For UFP Technologies, Inc.'s (NASDAQ:UFPT) Shares

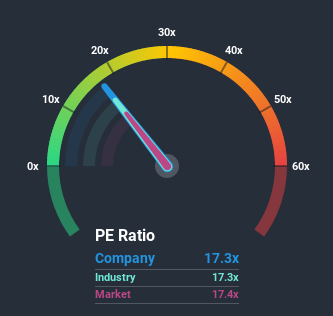

There wouldn't be many who think UFP Technologies, Inc.'s (NASDAQ:UFPT) price-to-earnings (or "P/E") ratio of 17.3x is worth a mention when the median P/E in the United States is similar at about 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, UFP Technologies has been doing quite well of late. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for UFP Technologies

How Is UFP Technologies' Growth Trending?

In order to justify its P/E ratio, UFP Technologies would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 21%. Pleasingly, EPS has also lifted 113% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the sole analyst covering the company are not good at all, suggesting earnings should decline by 34% over the next year. With the rest of the market predicted to shrink by 4.6%, it's a sub-optimal result.

In light of this, it's somewhat peculiar that UFP Technologies' P/E sits in line with the majority of other companies. When earnings shrink rapidly the P/E often shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that UFP Technologies currently trades on a higher than expected P/E since its earnings forecast is even worse than the struggling market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. In addition, we would be concerned whether the company can even maintain this level of performance under these tough market conditions. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 1 warning sign for UFP Technologies you should be aware of.

Of course, you might also be able to find a better stock than UFP Technologies. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

If you decide to trade UFP Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:UFPT

UFP Technologies

Designs and manufactures solutions for medical devices, sterile packaging, and other engineered custom products in the United States.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives