- United States

- /

- Medical Equipment

- /

- NYSEAM:STXS

Undervalued Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As the U.S. market navigates geopolitical tensions and fluctuating oil prices, investors are keeping a close eye on how these factors impact broader economic conditions. Amid this backdrop, penny stocks continue to capture attention for their potential to offer value in a volatile landscape. Despite being an older term, penny stocks represent smaller or newer companies that can provide growth opportunities at lower price points when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.57 | $122.86M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $2.27 | $71.56M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.34 | $484.63M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.11 | $36.7M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.07 | $179.95M | ✅ 4 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $98.26M | ✅ 3 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.42 | $55.9M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.84176 | $6.11M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.78 | $84.72M | ✅ 3 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.74 | $497.69M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 717 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

CuriosityStream (CURI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CuriosityStream Inc. is a media and entertainment company that offers factual content through various channels, with a market cap of $277.18 million.

Operations: The company generates revenue primarily from its media and entertainment segment, totaling $54.22 million.

Market Cap: $277.18M

CuriosityStream Inc. has been making strategic moves to enhance its global reach and revenue potential, recently securing international content licensing agreements with major broadcasters like France TV and Canal+. The company's expansion into Spanish-speaking territories through partnerships with Samsung TV Plus and others underscores its growth strategy in the fast-evolving media landscape. Despite being unprofitable, CuriosityStream has a strong cash position, sufficient for over three years of operations without additional funding. The company is debt-free and has achieved positive net income for the first quarter of 2025, marking a significant milestone in its financial trajectory.

- Get an in-depth perspective on CuriosityStream's performance by reading our balance sheet health report here.

- Examine CuriosityStream's earnings growth report to understand how analysts expect it to perform.

Caesarstone (CSTE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Caesarstone Ltd. designs, develops, manufactures, and sells engineered stone and porcelain products under various brands across multiple regions including the United States, Canada, Latin America, Australia, Asia, Europe, the Middle East and Africa, and Israel with a market cap of $71.53 million.

Operations: The company's revenue is primarily derived from its Building Products segment, which generated $424.49 million.

Market Cap: $71.53M

Caesarstone Ltd., with a market cap of US$71.53 million, faces challenges as it reported a net loss of US$12.88 million for Q1 2025, widening from the previous year's loss. Despite being unprofitable and experiencing declining earnings over five years, the company maintains financial stability with short-term assets exceeding liabilities and cash surpassing total debt. The management team is relatively new, averaging 1.8 years in tenure, which could impact strategic continuity. Trading at a good value compared to peers and industry standards, Caesarstone's stock may attract investors seeking potential turnaround opportunities amidst its current volatility stability.

- Jump into the full analysis health report here for a deeper understanding of Caesarstone.

- Review our growth performance report to gain insights into Caesarstone's future.

Stereotaxis (STXS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Stereotaxis, Inc. designs, manufactures, and markets robotic systems, instruments, and information systems for interventional laboratories globally, with a market cap of approximately $194.31 million.

Operations: The company's revenue is primarily derived from its Surgical & Medical Equipment segment, which generated $27.51 million.

Market Cap: $194.31M

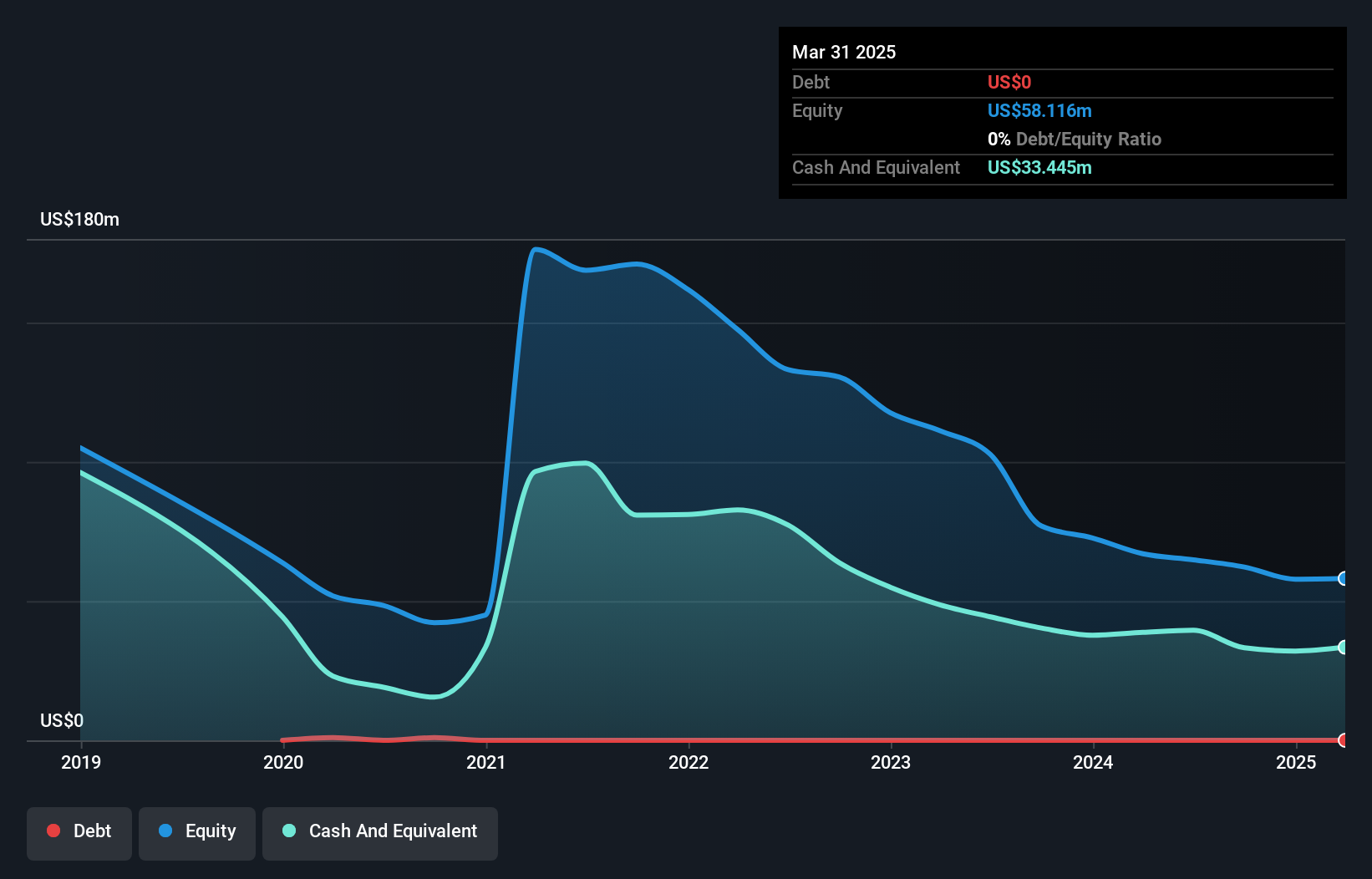

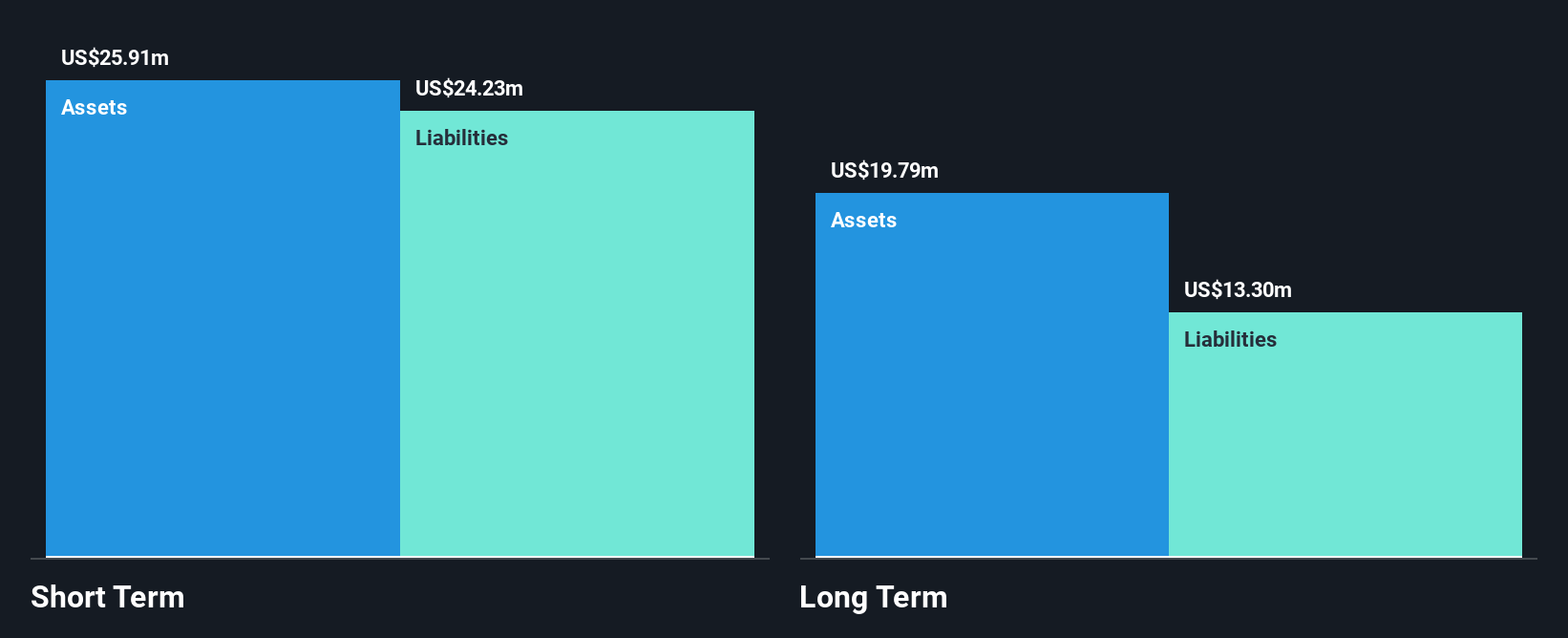

Stereotaxis, Inc. is navigating the complexities of its financial landscape with a market cap of US$194.31 million and revenue from the Surgical & Medical Equipment segment at US$27.51 million. Despite being unprofitable with a significant net loss in Q1 2025, Stereotaxis remains debt-free and has short-term assets exceeding liabilities, providing some financial resilience. Analysts anticipate substantial stock price growth, although profitability isn't expected soon. The company forecasts double-digit revenue growth for 2025 driven by its GenesisX system and other product lines, despite no anticipated system revenue from China this year and modest contributions from Europe.

- Unlock comprehensive insights into our analysis of Stereotaxis stock in this financial health report.

- Evaluate Stereotaxis' prospects by accessing our earnings growth report.

Taking Advantage

- Take a closer look at our US Penny Stocks list of 717 companies by clicking here.

- Ready To Venture Into Other Investment Styles? These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:STXS

Stereotaxis

Designs, manufactures, and markets robotic systems, instruments, and information systems for the interventional laboratory in the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives