- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:QQ.

UK Stocks That May Be Undervalued In June 2025

Reviewed by Simply Wall St

As the UK market grapples with global economic challenges, particularly the ripple effects from China's sluggish recovery, investors are keeping a close eye on the FTSE indices. In this environment of uncertainty, identifying undervalued stocks can be crucial for those looking to capitalize on potential growth opportunities amidst broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vistry Group (LSE:VTY) | £6.678 | £11.93 | 44% |

| Van Elle Holdings (AIM:VANL) | £0.385 | £0.69 | 44.2% |

| Informa (LSE:INF) | £7.762 | £14.50 | 46.5% |

| Ibstock (LSE:IBST) | £1.578 | £3.13 | 49.5% |

| Huddled Group (AIM:HUD) | £0.033 | £0.06 | 44.9% |

| Gooch & Housego (AIM:GHH) | £5.70 | £11.00 | 48.2% |

| Entain (LSE:ENT) | £7.514 | £13.73 | 45.3% |

| Duke Capital (AIM:DUKE) | £0.2975 | £0.54 | 44.6% |

| Deliveroo (LSE:ROO) | £1.759 | £3.13 | 43.8% |

| Crest Nicholson Holdings (LSE:CRST) | £1.886 | £3.73 | 49.4% |

We're going to check out a few of the best picks from our screener tool.

Crest Nicholson Holdings (LSE:CRST)

Overview: Crest Nicholson Holdings plc is a company that builds residential homes in the United Kingdom, with a market cap of £483.46 million.

Operations: The company's revenue primarily comes from its Home Builders - Residential / Commercial segment, which generated £610.20 million.

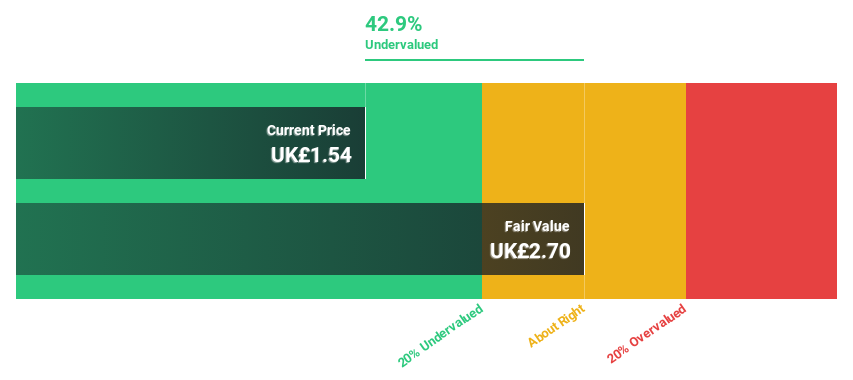

Estimated Discount To Fair Value: 49.4%

Crest Nicholson Holdings is trading at £1.89, significantly below its estimated fair value of £3.73, indicating it may be undervalued based on cash flows. Despite a revenue decline to £249.5 million for the half year ending April 2025, net income improved to £6.7 million from a loss last year. Earnings are forecasted to grow annually by 76%, with expected profitability and revenue growth outpacing the UK market over the next three years.

- Insights from our recent growth report point to a promising forecast for Crest Nicholson Holdings' business outlook.

- Get an in-depth perspective on Crest Nicholson Holdings' balance sheet by reading our health report here.

QinetiQ Group (LSE:QQ.)

Overview: QinetiQ Group plc is a science and engineering company that operates in the defense, security, and infrastructure markets across the United Kingdom, the United States, Australia, and internationally with a market cap of £2.82 billion.

Operations: The company's revenue segments include EMEA Services, generating £1.48 billion, and Global Solutions, contributing £453.90 million.

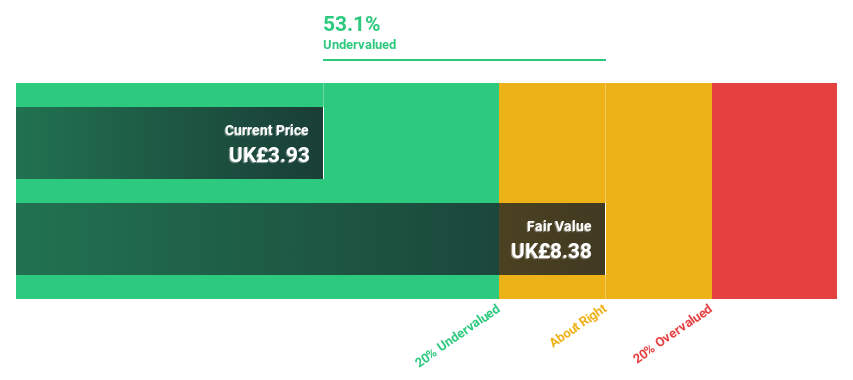

Estimated Discount To Fair Value: 13.9%

QinetiQ Group is trading at £5.18, slightly below its estimated fair value of £6.02, suggesting potential undervaluation based on cash flows. Despite a net loss of £185.7 million for the year ending March 2025, earnings are expected to grow significantly by 70.68% annually over the next three years, with profitability anticipated within this period. The company has secured a substantial £1.54 billion contract extension with the UK's Ministry of Defence, supporting future revenue growth prospects.

- The analysis detailed in our QinetiQ Group growth report hints at robust future financial performance.

- Click here to discover the nuances of QinetiQ Group with our detailed financial health report.

Vanquis Banking Group (LSE:VANQ)

Overview: Vanquis Banking Group plc provides personal credit products to the non-standard lending market in the United Kingdom and the Republic of Ireland, with a market cap of £219.70 million.

Operations: The company's revenue is primarily generated from Cards (£238.10 million), Loans (£6.30 million), Vehicle Finance (£34.20 million), and Second Charge Mortgages (£1.70 million).

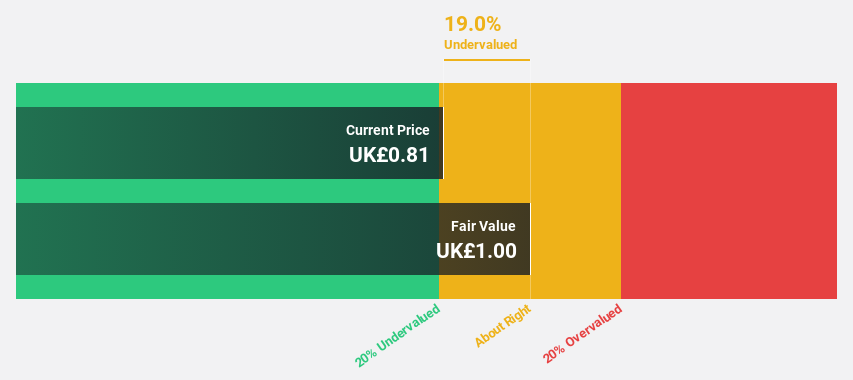

Estimated Discount To Fair Value: 14.4%

Vanquis Banking Group is trading at £0.86, below its estimated fair value of £1.01, indicating potential undervaluation based on cash flows. Despite a low forecasted Return on Equity of 13.3% in three years and operating cash flow not fully covering debt, the company is expected to become profitable within this period with earnings projected to grow by 87.43% annually, outpacing the UK market's revenue growth rate of 3.6%.

- According our earnings growth report, there's an indication that Vanquis Banking Group might be ready to expand.

- Click to explore a detailed breakdown of our findings in Vanquis Banking Group's balance sheet health report.

Next Steps

- Click through to start exploring the rest of the 52 Undervalued UK Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QinetiQ Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:QQ.

QinetiQ Group

Operates as a science and engineering company in the defense, security, and infrastructure markets in the United Kingdom, the United States, Australia, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives