- United States

- /

- Transportation

- /

- NYSE:UBER

Uber Technologies (NYSE:UBER) And Wayve Announce L4 Autonomous Vehicle Trials In London

Reviewed by Simply Wall St

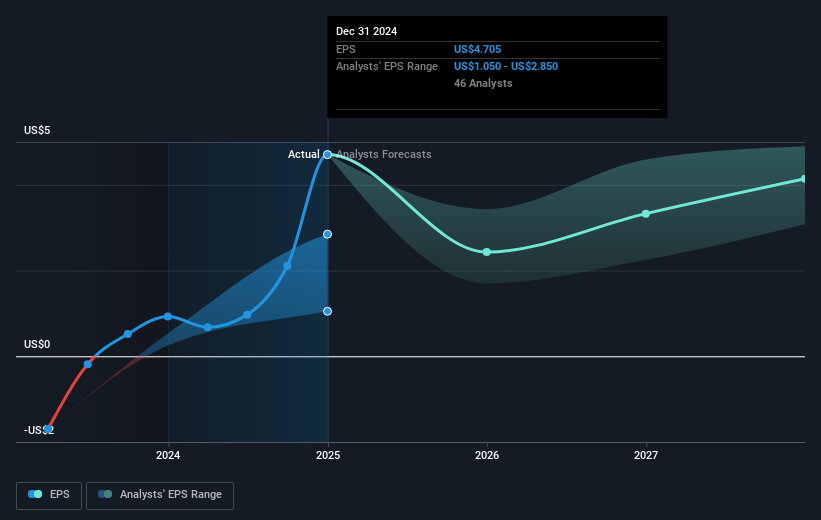

Uber Technologies (NYSE:UBER) announced a significant collaboration with Wayve to trial autonomous vehicles in London, marking its intent to expand in autonomous mobility. This development could have been a key driver in Uber's 23% price increase last quarter, reflecting investor optimism. Notably, Uber's impressive Q1 2025 results also underscored its growth trajectory, showcasing increased sales and a return to profitability. Meanwhile, the broader market appreciated 12% over the last year amid optimistic corporate earnings and tariff-related discussions, likely providing a supportive backdrop for Uber's stock performance.

Uber’s collaboration with Wayve to explore autonomous vehicles in London marks a significant development that can potentially enhance its competitive positioning. As the company ventures into autonomous mobility, this initiative may positively impact its revenue and earnings forecasts by generating new growth avenues. However, the ambitious move into less dense markets could present profitability challenges, given the anticipated competition and pricing pressures. Analysts have expressed mixed views on the long-term benefits of these initiatives, hinging on Uber's ability to effectively capture market share and improve operational efficiency in these new areas.

Over the past three years, Uber’s total return, including share price appreciation and dividends, surged to a very large 303.89%, underscoring robust long-term share performance. In the past year alone, Uber outperformed the US Transportation industry and broader market, which returned 6.9% and 12.4% respectively. This comparison highlights Uber's stronger performance trajectory in recent times, even as challenges remain in other areas. The latest shift in share prices, which aligns closely with the current analyst price target of US$88.42, indicates that recent market actions reflect moderate investor confidence relative to the projected valuation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives