- Canada

- /

- Metals and Mining

- /

- TSX:EQX

TSX Stocks That May Be Up To 35% Below Estimated Intrinsic Value

Reviewed by Simply Wall St

The Canadian market has experienced significant volatility, with the TSX reaching all-time highs despite earlier declines, driven by easing trade tensions and resilient economic data. In this environment of policy uncertainty and potential tariff impacts, identifying stocks that may be trading below their intrinsic value can offer investors opportunities to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$44.79 | CA$85.65 | 47.7% |

| Timbercreek Financial (TSX:TF) | CA$7.60 | CA$11.08 | 31.4% |

| TerraVest Industries (TSX:TVK) | CA$165.96 | CA$316.12 | 47.5% |

| Magna Mining (TSXV:NICU) | CA$1.82 | CA$3.43 | 46.9% |

| Lithium Royalty (TSX:LIRC) | CA$5.30 | CA$8.80 | 39.8% |

| K92 Mining (TSX:KNT) | CA$15.20 | CA$21.42 | 29.0% |

| High Tide (TSXV:HITI) | CA$3.10 | CA$4.56 | 32.1% |

| Equinox Gold (TSX:EQX) | CA$8.07 | CA$12.42 | 35% |

| Blackline Safety (TSX:BLN) | CA$7.10 | CA$9.99 | 28.9% |

| Alphamin Resources (TSXV:AFM) | CA$0.90 | CA$1.30 | 30.8% |

Let's uncover some gems from our specialized screener.

Equinox Gold (TSX:EQX)

Overview: Equinox Gold Corp. is involved in the acquisition, exploration, development, and operation of mineral properties across the Americas with a market capitalization of CA$5.99 billion.

Operations: The company's revenue segments include RDM at $147.34 million, Aurizona at $168.39 million, Mesquite at $159.70 million, Los Filos at $449.51 million, and Castle Mountain at $48.25 million, with a segment adjustment of $723.34 million.

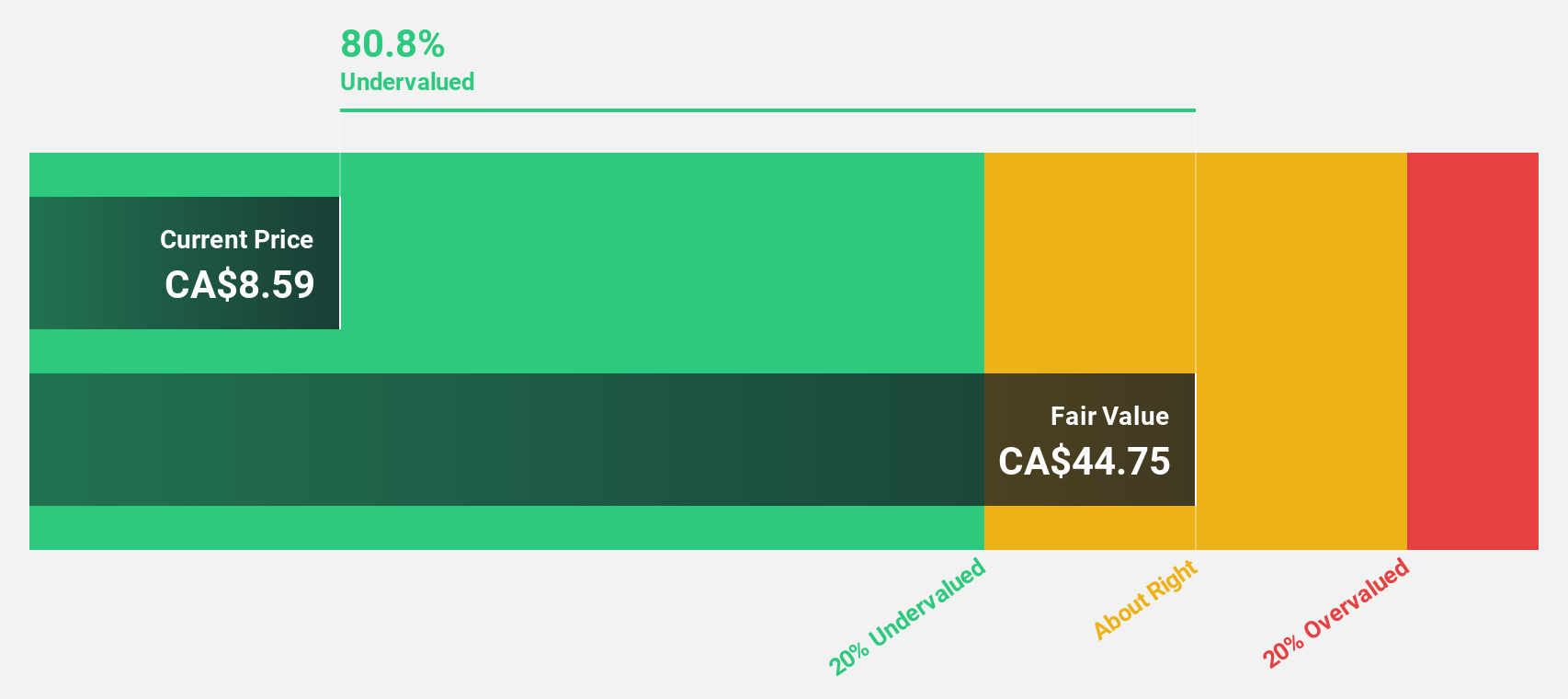

Estimated Discount To Fair Value: 35%

Equinox Gold is trading at CA$8.07, significantly undervalued compared to its estimated fair value of CA$12.42 and peers, with a forecasted revenue growth of 22.7% annually, outpacing the Canadian market's 3.9%. Despite recent shareholder dilution and a net loss in Q1 2025, earnings are expected to grow significantly over the next three years. Recent board changes and increased gold production guidance further highlight potential for future performance improvement.

- Our comprehensive growth report raises the possibility that Equinox Gold is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Equinox Gold's balance sheet health report.

Franco-Nevada (TSX:FNV)

Overview: Franco-Nevada Corporation is a royalty and stream company specializing in precious metals across various regions including the Americas, Australia, and Europe, with a market cap of CA$43.47 billion.

Operations: The company's revenue is primarily derived from precious metals at $949.70 million, supplemented by energy at $207.20 million and other mining activities contributing $57.70 million.

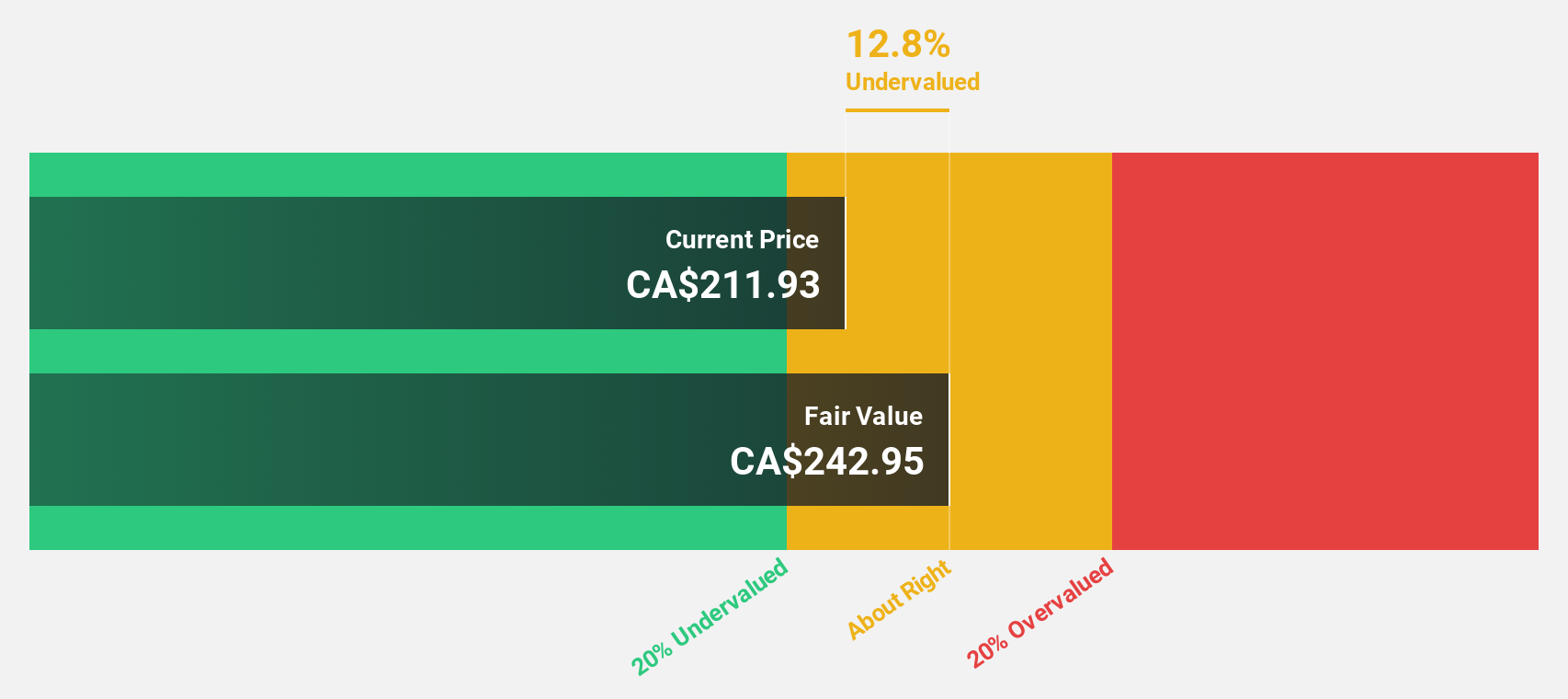

Estimated Discount To Fair Value: 11.4%

Franco-Nevada, trading at CA$226, is undervalued against its fair value estimate of CA$255.03. Its earnings are forecast to grow significantly at 23.1% annually over the next three years, surpassing the Canadian market's growth rate. The recent acquisition of a royalty package on Ontario's Côté Gold Mine for $1.05 billion enhances cash flow potential despite being dropped from the S&P/TSX 60 Shariah Index and having a lower return on equity forecast in three years (16.5%).

- In light of our recent growth report, it seems possible that Franco-Nevada's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Franco-Nevada.

Meren Energy (TSX:MER)

Overview: Meren Energy Inc., along with its subsidiaries, engages in oil and gas exploration and production across Nigeria, Namibia, South Africa, and Equatorial Guinea, with a market cap of CA$1.11 billion.

Operations: Meren Energy's revenue segments are derived from its operations in oil and gas exploration and production activities conducted across Nigeria, Namibia, South Africa, and Equatorial Guinea.

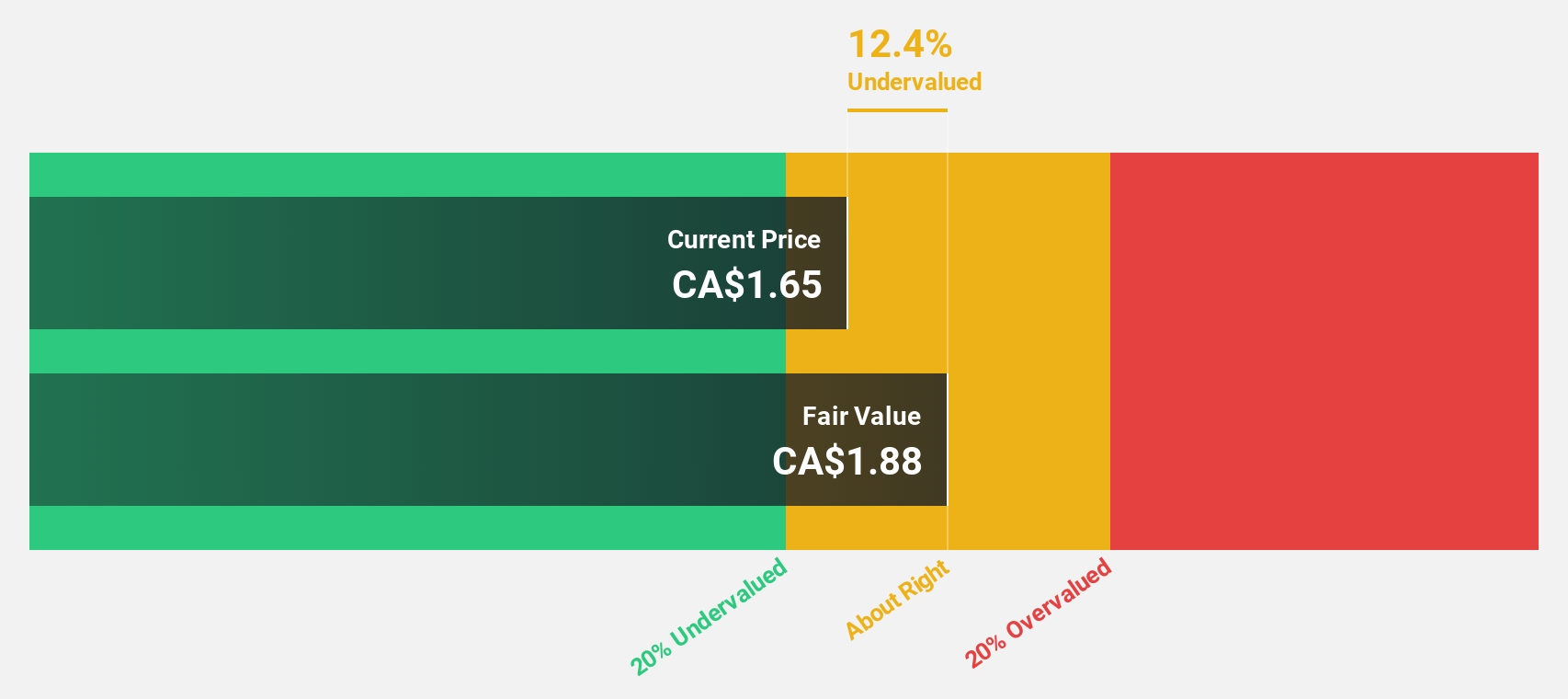

Estimated Discount To Fair Value: 12%

Meren Energy, trading at CA$1.66, is slightly undervalued compared to its fair value estimate of CA$1.89. While revenue is expected to grow at 38.5% annually, surpassing the market average, the company has experienced shareholder dilution recently and offers a high dividend yield that isn't well covered by earnings or cash flows. Recent management changes include appointing Cheryl Sandercock to the board following John Craig's departure, potentially influencing strategic direction positively given her extensive experience in energy transactions.

- According our earnings growth report, there's an indication that Meren Energy might be ready to expand.

- Get an in-depth perspective on Meren Energy's balance sheet by reading our health report here.

Next Steps

- Click here to access our complete index of 24 Undervalued TSX Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinox Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EQX

Equinox Gold

Engages in the acquisition, exploration, development, and operation of mineral properties in the Americas.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives