As the Canadian market navigates a landscape marked by trade developments, central bank meetings, and fiscal debates, investors are keeping a close eye on potential volatility. Amidst these broader economic discussions, penny stocks remain an intriguing area for investment. Although the term may seem outdated, these stocks often represent smaller or newer companies that can offer growth opportunities at lower price points. By focusing on those with strong financials and clear growth potential, investors can uncover hidden gems in this segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.65 | CA$594.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.37 | CA$722.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.52 | CA$190.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.69 | CA$459.06M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.75 | CA$14.86M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.39 | CA$101.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.47 | CA$141.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.82 | CA$143.13M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.79 | CA$173.06M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 874 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

EcoSynthetix (TSX:ECO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EcoSynthetix Inc. is a renewable chemicals company that develops and commercializes bio-based technologies as alternatives to synthetic, petrochemical-based chemicals across various global markets, with a market cap of CA$234.90 million.

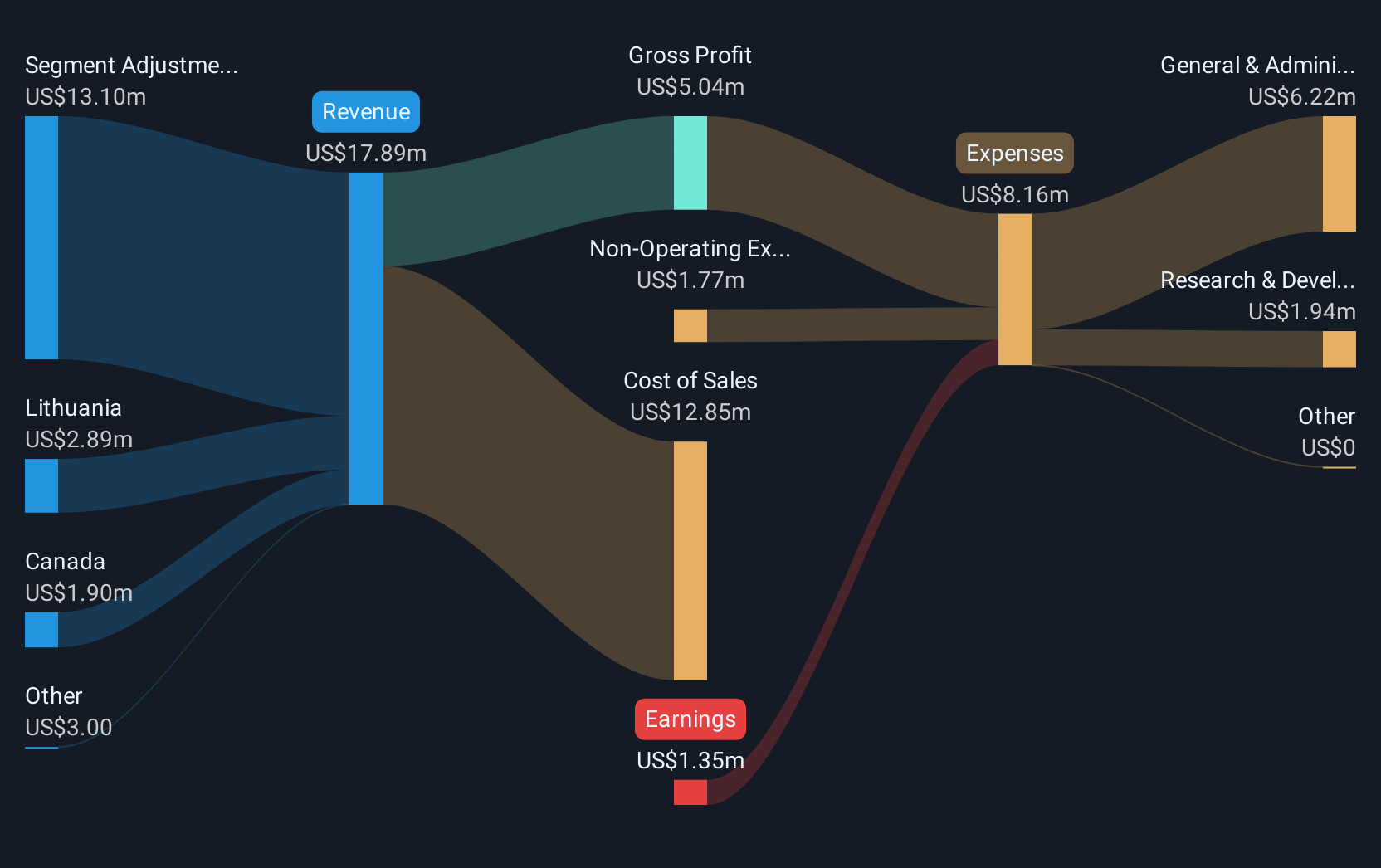

Operations: The company's revenue primarily comes from its Biopolymer Nanosphere Technology Platform, generating $17.89 million.

Market Cap: CA$234.9M

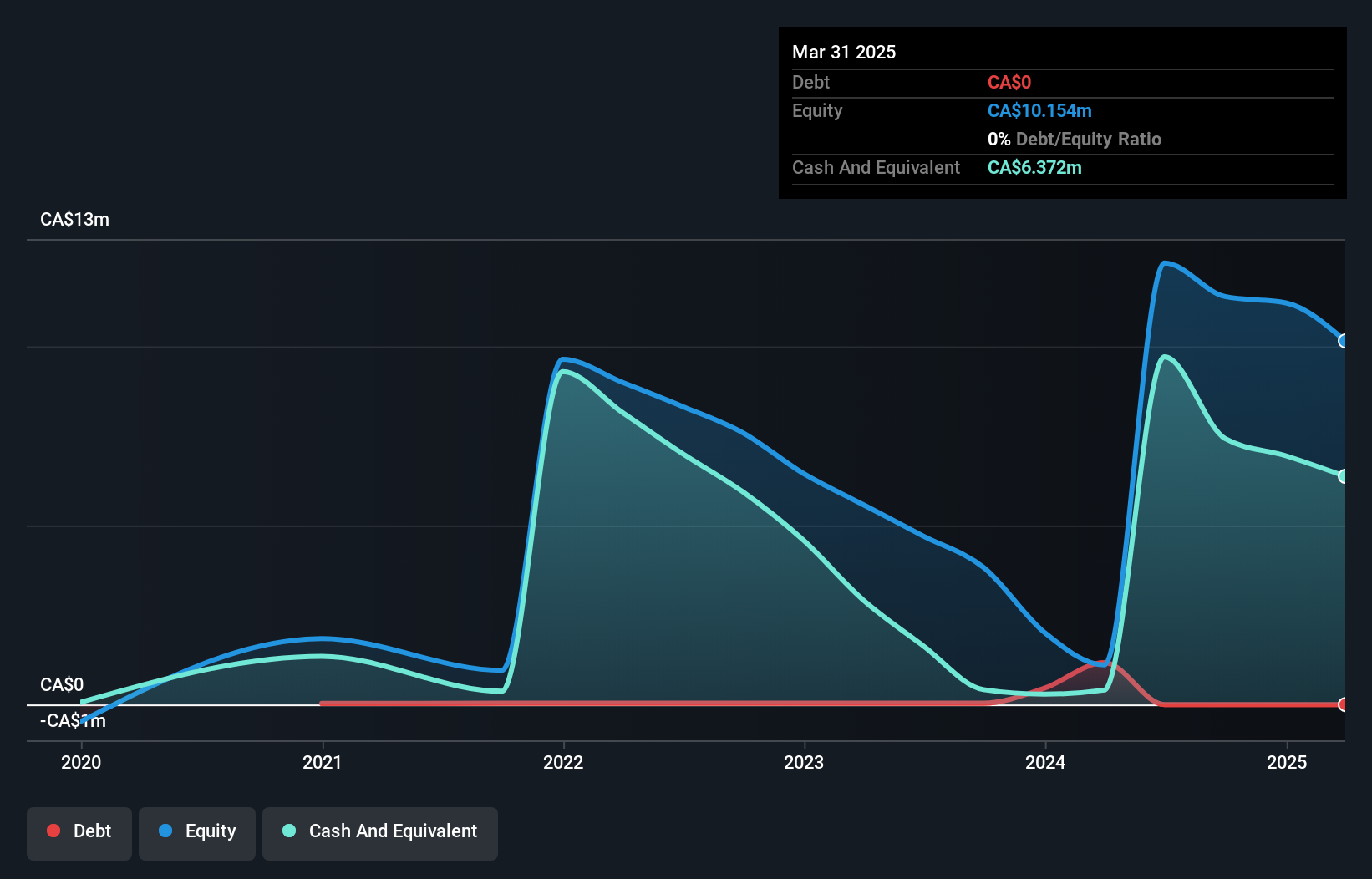

EcoSynthetix Inc., with a market cap of CA$234.90 million, is navigating the penny stock landscape with its focus on bio-based technologies. The company reported US$4.04 million in revenue for Q1 2025, although it remains unprofitable with a net loss of US$0.61 million. Despite this, EcoSynthetix has no debt and maintains a strong cash position, providing over three years of runway based on current free cash flow trends. Recent strategic moves include a share buyback program to repurchase up to 7% of its shares by May 2026, reflecting confidence in its long-term prospects amidst leadership changes at the board level.

- Dive into the specifics of EcoSynthetix here with our thorough balance sheet health report.

- Examine EcoSynthetix's past performance report to understand how it has performed in prior years.

01 Communique Laboratory (TSXV:ONE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 01 Communique Laboratory Inc. offers cybersecurity and remote access solutions across the United States, Asia-Pacific, and Canada, with a market cap of CA$36.72 million.

Operations: The company generates revenue of CA$0.40 million from the development and marketing of its communications software.

Market Cap: CA$36.72M

01 Communique Laboratory Inc., with a market cap of CA$36.72 million, operates in the cybersecurity and remote access sector but remains pre-revenue with CA$0.40 million in sales. The company is unprofitable, reporting a net loss of CA$0.14 million for Q1 2025, with losses increasing by 2% annually over five years. Despite this, it boasts a strong cash position sufficient for over three years without debt concerns and has not diluted shareholders recently. However, its share price remains highly volatile compared to other Canadian stocks despite improved weekly volatility over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of 01 Communique Laboratory.

- Learn about 01 Communique Laboratory's historical performance here.

SPARQ Systems (TSXV:SPRQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SPARQ Systems Inc. designs, manufactures, and sells single-phase microinverters for residential and commercial solar electric applications, with a market cap of CA$92.38 million.

Operations: SPARQ Systems Inc. has not reported any specific revenue segments.

Market Cap: CA$92.38M

SPARQ Systems Inc., with a market cap of CA$92.38 million, operates in the solar energy sector and recently commenced commercial production of microinverters in India, signaling potential operational progress. Despite sales reaching CA$1.65 million for 2024, the company is still pre-revenue and unprofitable, with net losses widening to CA$5.65 million annually. Concerns about its ability to continue as a going concern were raised by auditors due to financial uncertainties. However, SPARQ maintains sufficient cash reserves for over a year without debt issues and has not significantly diluted shareholders recently despite being dropped from an index.

- Take a closer look at SPARQ Systems' potential here in our financial health report.

- Explore historical data to track SPARQ Systems' performance over time in our past results report.

Next Steps

- Dive into all 874 of the TSX Penny Stocks we have identified here.

- Curious About Other Options? The latest GPUs need a type of rare earth metal called Neodymium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if 01 Communique Laboratory might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ONE

01 Communique Laboratory

Provides cyber security and remote access solutions in the United States, Asia-Pacific, and Canada.

Flawless balance sheet slight.

Market Insights

Community Narratives