With the Bank of Canada having cut rates seven times this cycle to support economic growth amid a softening labor market, Canadian investors are closely monitoring how these shifts will impact various sectors. Penny stocks, often representing smaller or newer companies, continue to offer intriguing opportunities despite their somewhat outdated label. By focusing on those with strong balance sheets and solid fundamentals, investors can uncover potential gems in the penny stock landscape that may provide both stability and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.31 | CA$60.69M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$18.67M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.275 | CA$2.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.04 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.06 | CA$665.3M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.01 | CA$20.02M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.25 | CA$364.97M | ✅ 2 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.18 | CA$203.53M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.98 | CA$186.53M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.32 | CA$3.98M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 419 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

NanoXplore (TSX:GRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NanoXplore Inc. is a graphene company that manufactures and supplies graphene powder for industrial markets in Australia, with a market cap of CA$534 million.

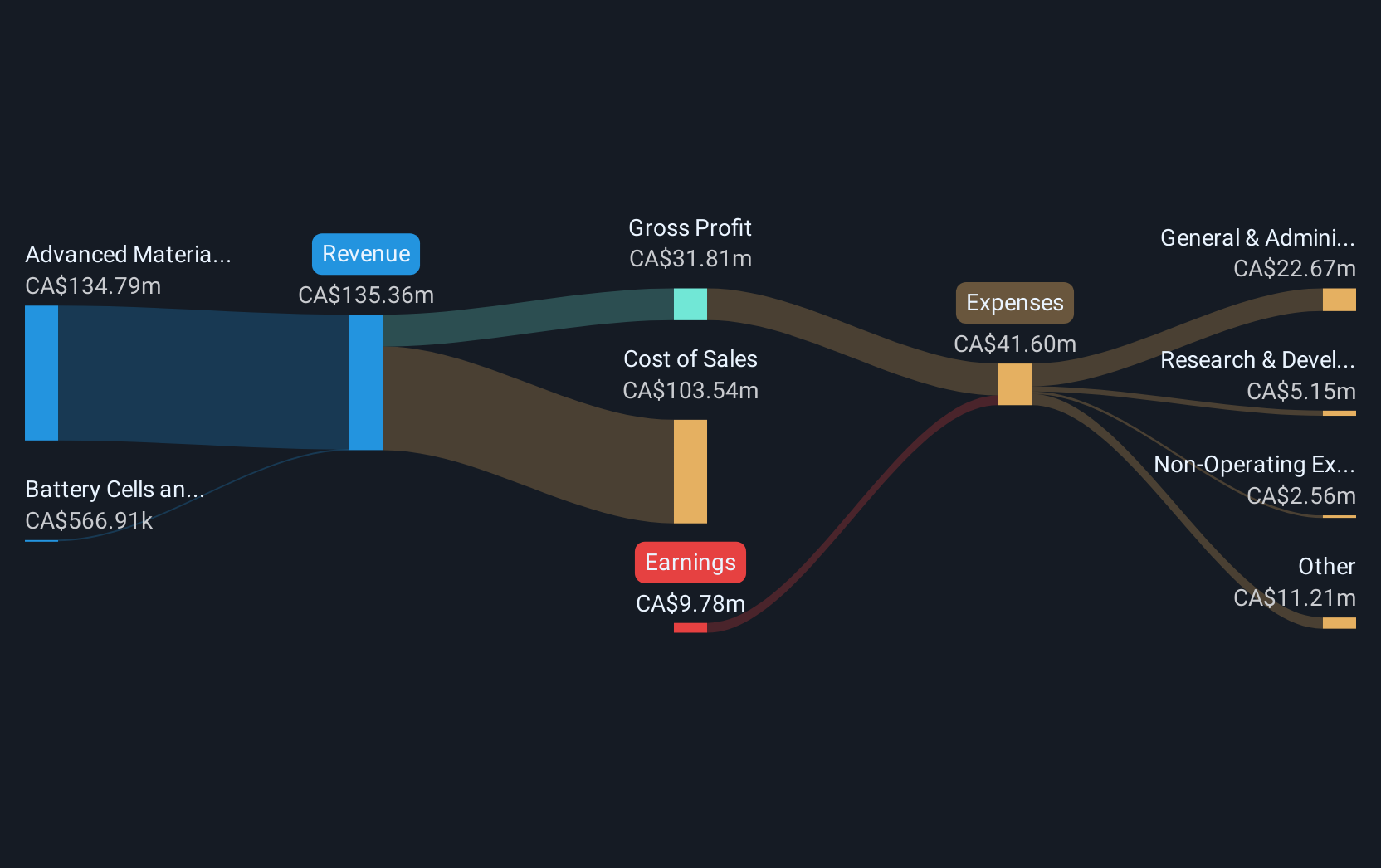

Operations: The company generates revenue from two primary segments: Battery Cells and Materials, contributing CA$0.57 million, and Advanced Materials, Plastics and Composite Products, which accounts for CA$134.79 million.

Market Cap: CA$534M

NanoXplore Inc., with a market cap of CA$534 million, operates primarily in the Advanced Materials sector, generating CA$134.79 million in revenue. Despite being unprofitable and having increased losses over five years, it has a strong cash position exceeding its total debt and short-term liabilities. The company trades significantly below its estimated fair value and has not seen meaningful shareholder dilution recently. Its management team is experienced with an average tenure of 4.8 years, while the board averages 7.4 years, adding stability to its governance structure amidst ongoing financial challenges and growth prospects forecasted at 67% annually.

- Click to explore a detailed breakdown of our findings in NanoXplore's financial health report.

- Review our growth performance report to gain insights into NanoXplore's future.

Golconda Gold (TSXV:GG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golconda Gold Ltd. is engaged in the exploration, development, and operation of gold mining properties across Canada, the United States, and South Africa with a market cap of CA$78.31 million.

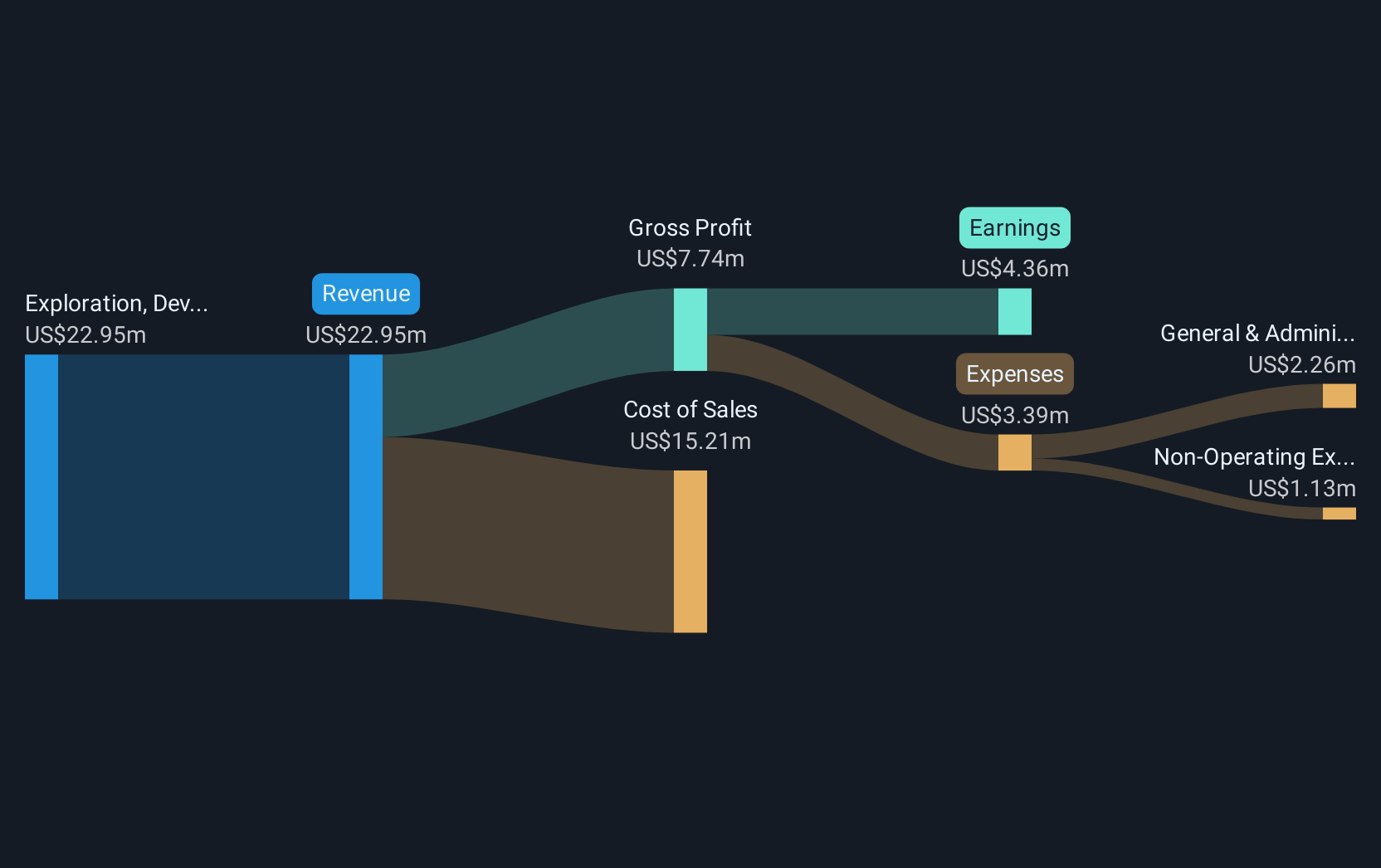

Operations: Golconda Gold Ltd. has not reported any specific revenue segments.

Market Cap: CA$78.31M

Golconda Gold Ltd., with a market cap of CA$78.31 million, has transitioned to profitability, reporting US$7.67 million in sales for Q2 2025, up from US$2.98 million the previous year. The company's net income reached US$2.36 million, reversing a prior loss, and basic earnings per share improved to US$0.03 from a loss of US$0.01 last year. Despite stable weekly volatility at 14%, Golconda's short-term assets are insufficient to cover its liabilities; however, its debt is well-managed with satisfactory coverage by operating cash flow and interest payments supported by EBIT at five times coverage levels.

- Navigate through the intricacies of Golconda Gold with our comprehensive balance sheet health report here.

- Understand Golconda Gold's track record by examining our performance history report.

Quorum Information Technologies (TSXV:QIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quorum Information Technologies Inc. is an information technology company that specializes in the automotive retail sector in Canada and the United States, with a market cap of CA$51.55 million.

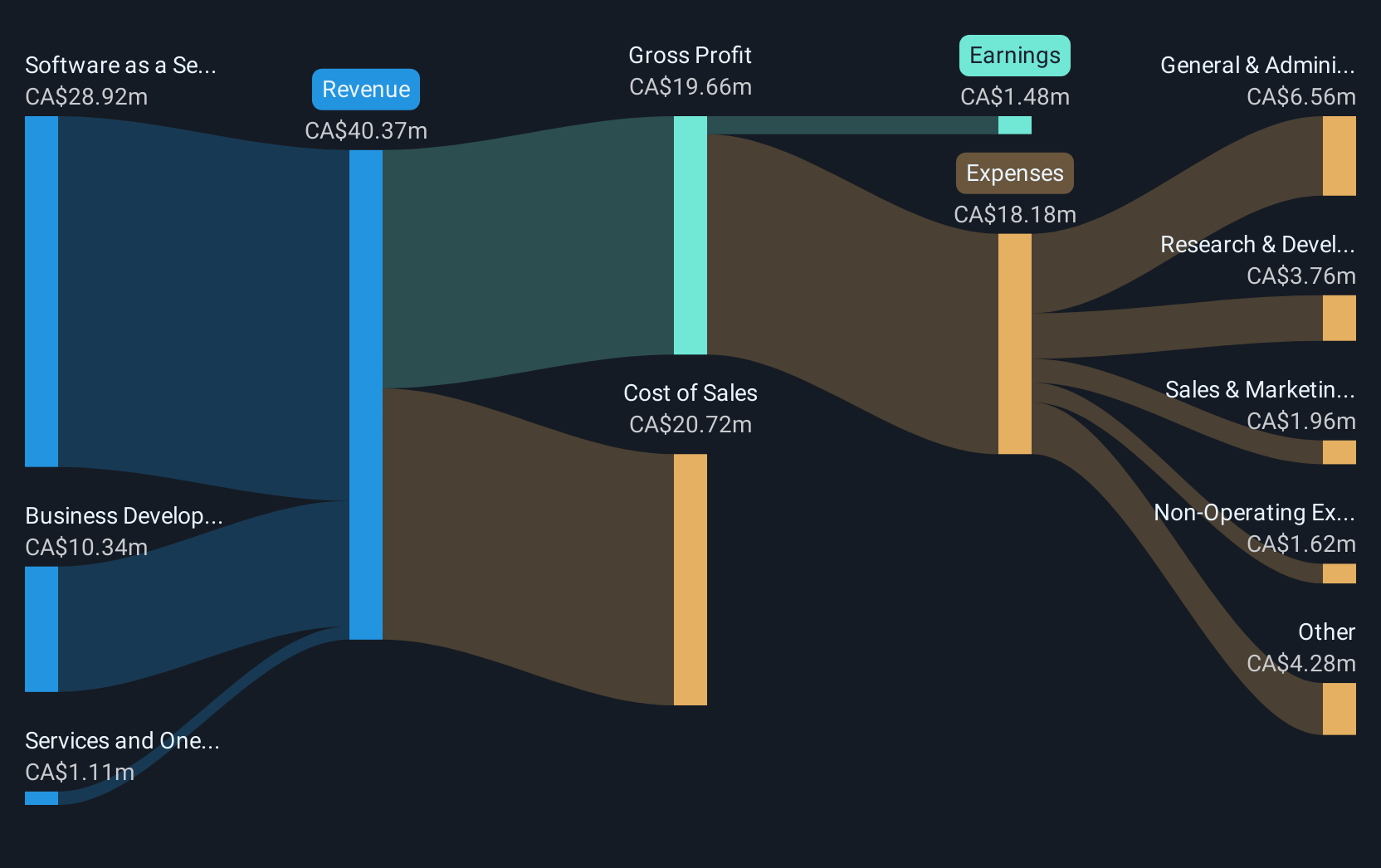

Operations: Quorum Information Technologies Inc. has not reported any specific revenue segments.

Market Cap: CA$51.55M

Quorum Information Technologies Inc., with a market cap of CA$51.55 million, has shown stable performance in the automotive retail IT sector. The company reported Q2 2025 sales of CA$10.28 million, slightly up from the previous year, while net income remained nearly unchanged at CA$0.395 million. Despite low return on equity at 4.9%, Quorum's financial health is supported by short-term assets exceeding both short and long-term liabilities, and interest payments are well covered by EBIT (3.3x). The management team is seasoned with an average tenure of 5.5 years, contributing to strategic stability amidst modest profit margins improvement to 3.7%.

- Take a closer look at Quorum Information Technologies' potential here in our financial health report.

- Assess Quorum Information Technologies' future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Get an in-depth perspective on all 419 TSX Penny Stocks by using our screener here.

- Seeking Other Investments? Uncover 13 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanoXplore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRA

NanoXplore

A graphene company, manufactures and supplies graphene powder for use in industrial markets in Australia.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives