- Canada

- /

- Communications

- /

- TSX:QTRH

TSX Penny Stocks To Consider In July 2025

Reviewed by Simply Wall St

The Canadian stock market has been on a steady climb, buoyed by trade optimism and solid corporate earnings, with the TSX reaching new highs amidst a period of low volatility. As investors navigate this upward trend, the allure of penny stocks—often representing smaller or newer companies—remains significant due to their potential for growth at accessible price points. While traditionally seen as riskier investments, focusing on penny stocks with strong balance sheets and solid fundamentals can uncover valuable opportunities in today's market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.63 | CA$160.77M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.74 | CA$498.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.90 | CA$18.04M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.84 | CA$189.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.40 | CA$683.92M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.96 | CA$172.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$186.17M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.26 | CA$9.02M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 452 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Quarterhill (TSX:QTRH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quarterhill Inc. operates in the intelligent transportation systems sector both in Canada and internationally, with a market cap of CA$153.09 million.

Operations: The company generates revenue of $152.30 million from its intelligent transportation systems segment.

Market Cap: CA$153.09M

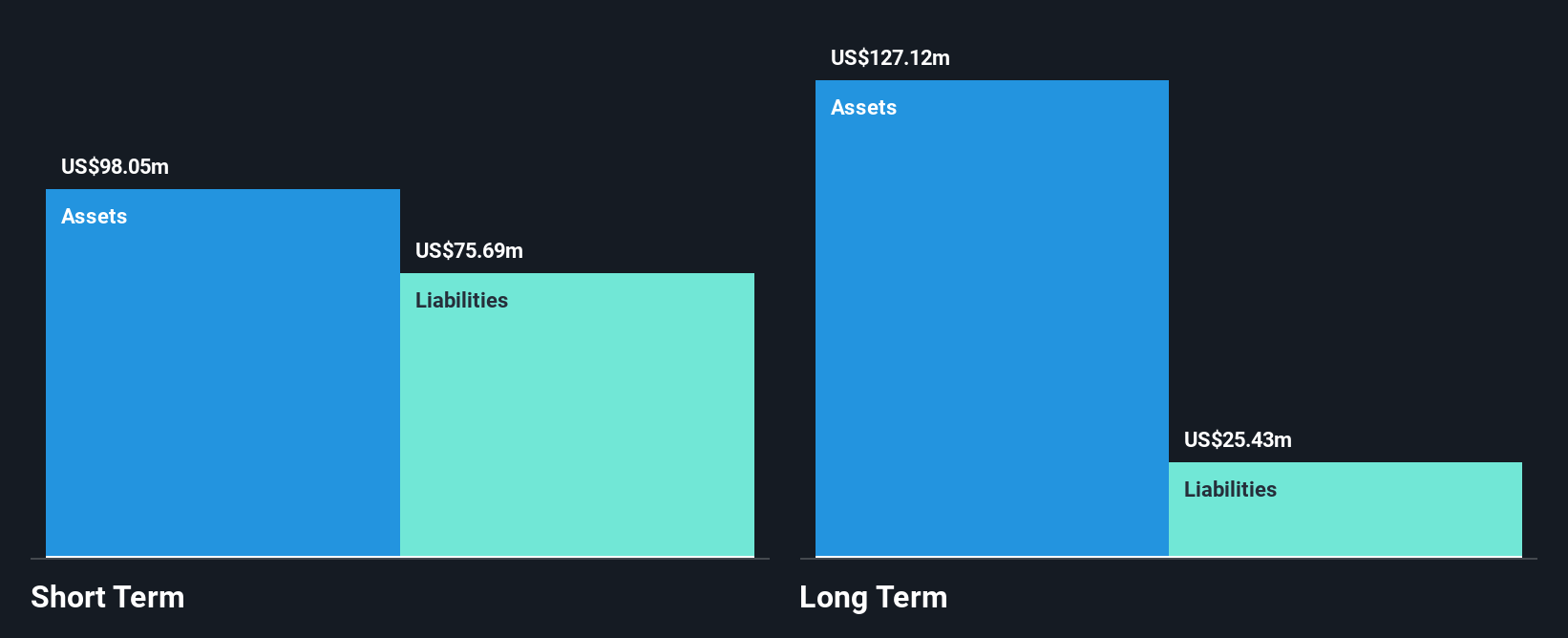

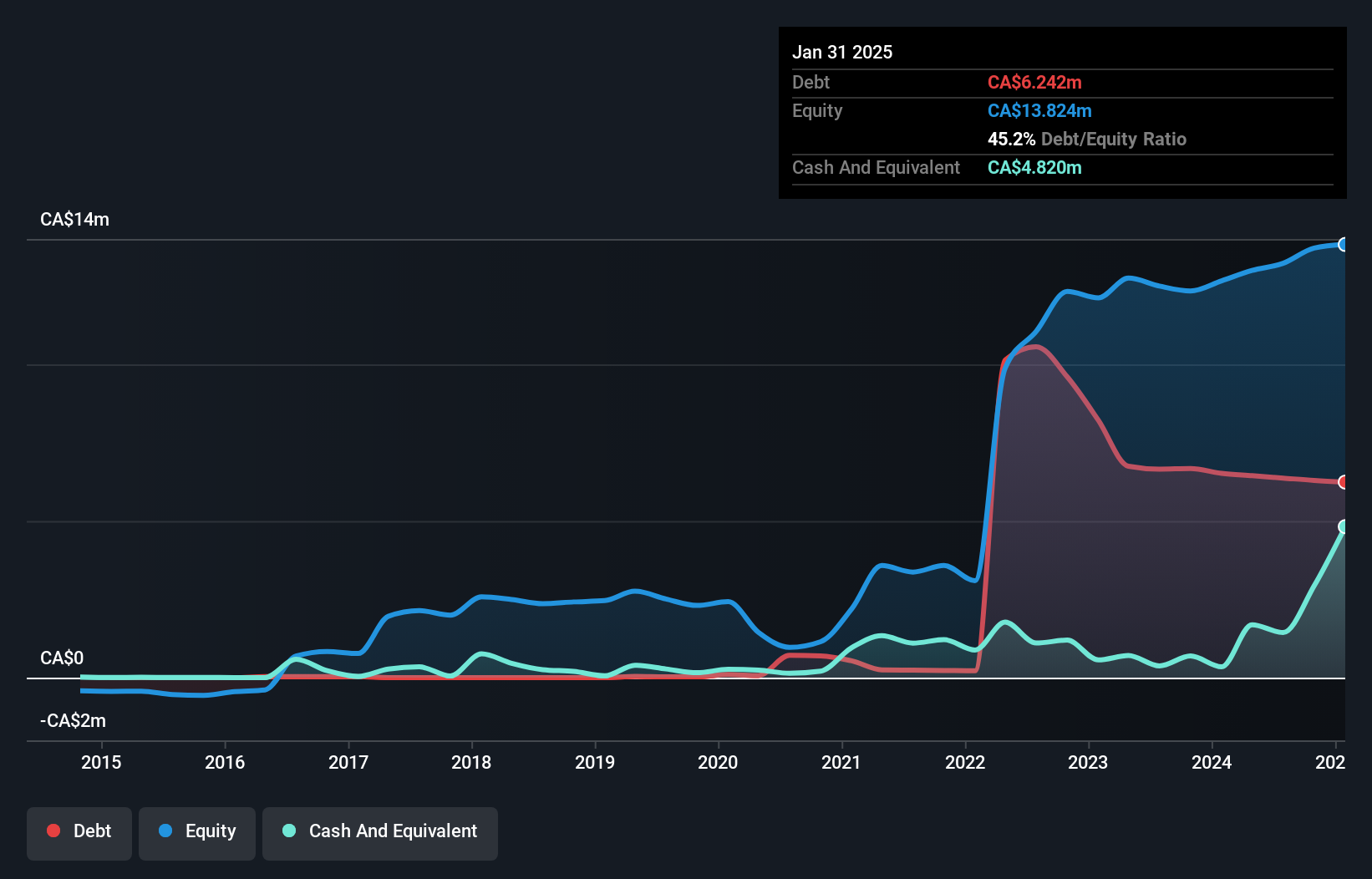

Quarterhill Inc. operates with a market cap of CA$153.09 million, generating revenue primarily from its intelligent transportation systems segment. Recent strategic downsizing aims to cut costs and align resources, potentially saving US$12 million annually. Despite being unprofitable and experiencing increased losses over the past five years, Quarterhill's short-term assets exceed both short- and long-term liabilities, suggesting financial stability in the near term. The company's management team is relatively new, which may present challenges but also opportunities for fresh strategies. Revenue growth is forecasted at 7.16% per year; however, profitability remains elusive in the foreseeable future.

- Click here and access our complete financial health analysis report to understand the dynamics of Quarterhill.

- Gain insights into Quarterhill's future direction by reviewing our growth report.

Green Impact Partners (TSXV:GIP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Green Impact Partners Inc. offers water, waste, and solids treatment and recycling services across Canada and North America, with a market cap of CA$74.96 million.

Operations: The company generates revenue of CA$147.55 million from its Water & Solids Recycling & Energy Product Optimization segment.

Market Cap: CA$74.96M

Green Impact Partners, with a market cap of CA$74.96 million, is currently unprofitable and not expected to achieve profitability in the near term. The company's net debt to equity ratio of 30.7% is deemed satisfactory, while its short-term assets fall short of covering liabilities. Recent events include a drop from the S&P/TSX Venture Composite Index and board changes introducing experienced professionals like Ahmed Kassongo and Alex Langer. GIP faces high share price volatility but has managed to secure additional financing for working capital needs through a loan from its CEO, suggesting ongoing financial maneuvering amidst operational challenges.

- Click to explore a detailed breakdown of our findings in Green Impact Partners' financial health report.

- Assess Green Impact Partners' future earnings estimates with our detailed growth reports.

Progressive Planet Solutions (TSXV:PLAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Progressive Planet Solutions Inc., along with its subsidiaries, focuses on acquiring and exploring mineral properties in Canada and the United States, with a market cap of CA$25.79 million.

Operations: The company generates revenue of CA$19.36 million from the acquisition and exploration of mineral properties in Canada and the United States.

Market Cap: CA$25.79M

Progressive Planet Solutions, with a market cap of CA$25.79 million, has recently become profitable and its short-term assets exceed its short-term liabilities. The company signed a deal to license a lightweight cat litter recipe and secured an exclusive five-year supply agreement for geothermal grout. It also procured mineral rights to the Ferguson Creek Pozzolan Property, enhancing its asset base. Despite increased debt levels over five years, debt is well-covered by operating cash flow and interest payments are manageable. Recent financial maneuvers include reducing long-term debt from $6.1 million to under $5.7 million without pre-payment penalties.

- Navigate through the intricacies of Progressive Planet Solutions with our comprehensive balance sheet health report here.

- Explore historical data to track Progressive Planet Solutions' performance over time in our past results report.

Next Steps

- Unlock our comprehensive list of 452 TSX Penny Stocks by clicking here.

- Contemplating Other Strategies? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quarterhill might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QTRH

Quarterhill

Operates in the intelligent transportation systems business in Canada and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives