As the Canadian market navigates a landscape marked by elevated inflation and a softening labor market, investors are keenly observing upcoming economic indicators that could influence central bank decisions. Amidst this backdrop of potential volatility, dividend stocks on the TSX offer a compelling opportunity for those seeking stable income streams; they can provide resilience in uncertain times due to their regular payouts and potential for capital appreciation.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.40% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.08% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.08% | ★★★★★☆ |

| Rogers Sugar (TSX:RSI) | 5.64% | ★★★★☆☆ |

| Power Corporation of Canada (TSX:POW) | 4.23% | ★★★★★☆ |

| North West (TSX:NWC) | 3.12% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.23% | ★★★★★☆ |

| Magna International (TSX:MG) | 4.23% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.58% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.73% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our Top TSX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

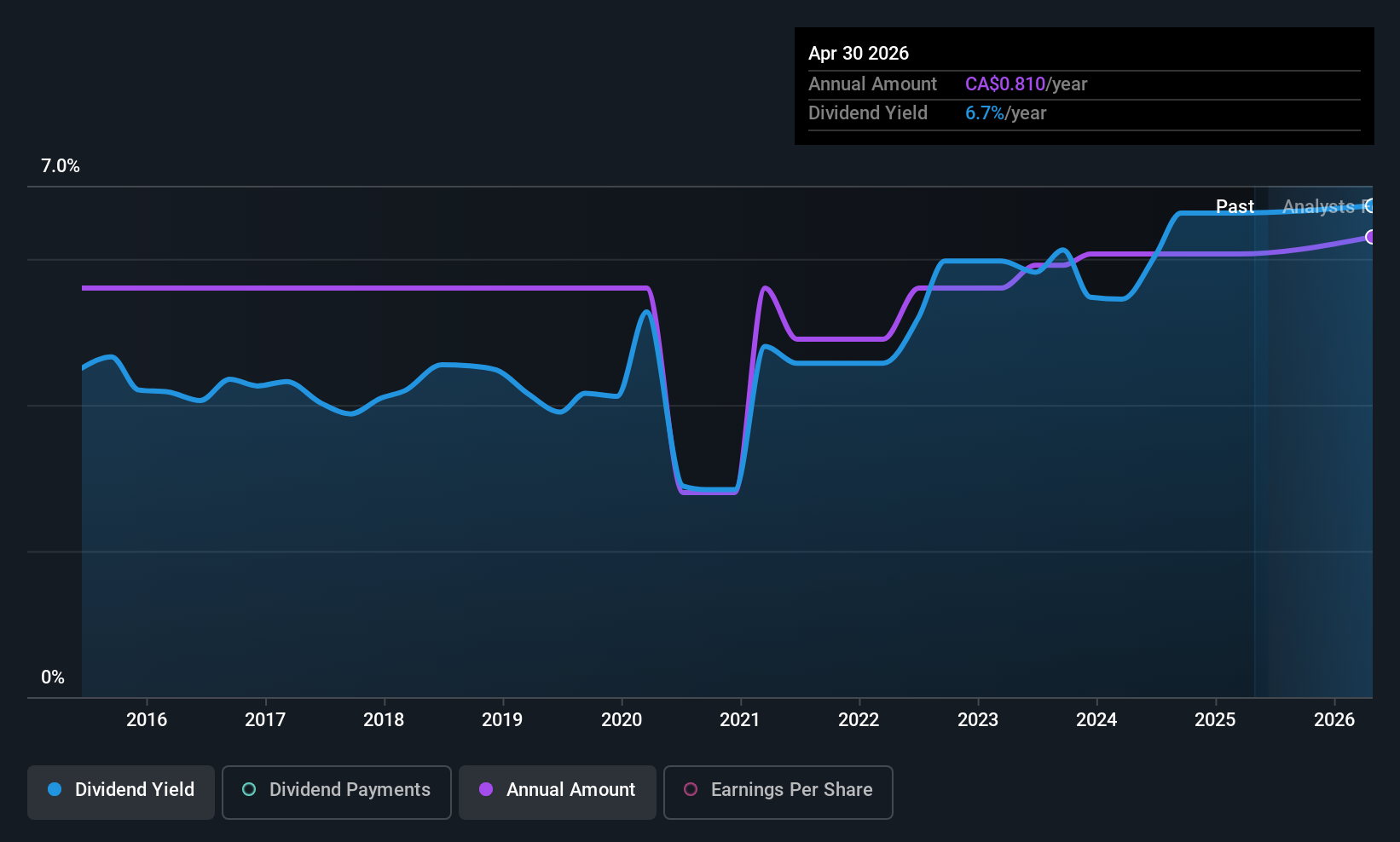

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$918.77 million.

Operations: Evertz Technologies Limited generates revenue primarily from its Television Broadcast Equipment Market segment, which accounts for CA$501.62 million.

Dividend Yield: 6.6%

Evertz Technologies offers a high dividend yield of 6.57%, placing it in the top 25% of Canadian dividend payers. However, its dividends are not well-covered by earnings, with a payout ratio of 101.7%. Recent financials show declining net income and sales year-over-year, which may impact future payouts. The company declared a regular quarterly dividend of C$0.20 per share for July 2025 and completed a share buyback worth C$2.02 million earlier this year.

- Delve into the full analysis dividend report here for a deeper understanding of Evertz Technologies.

- The valuation report we've compiled suggests that Evertz Technologies' current price could be quite moderate.

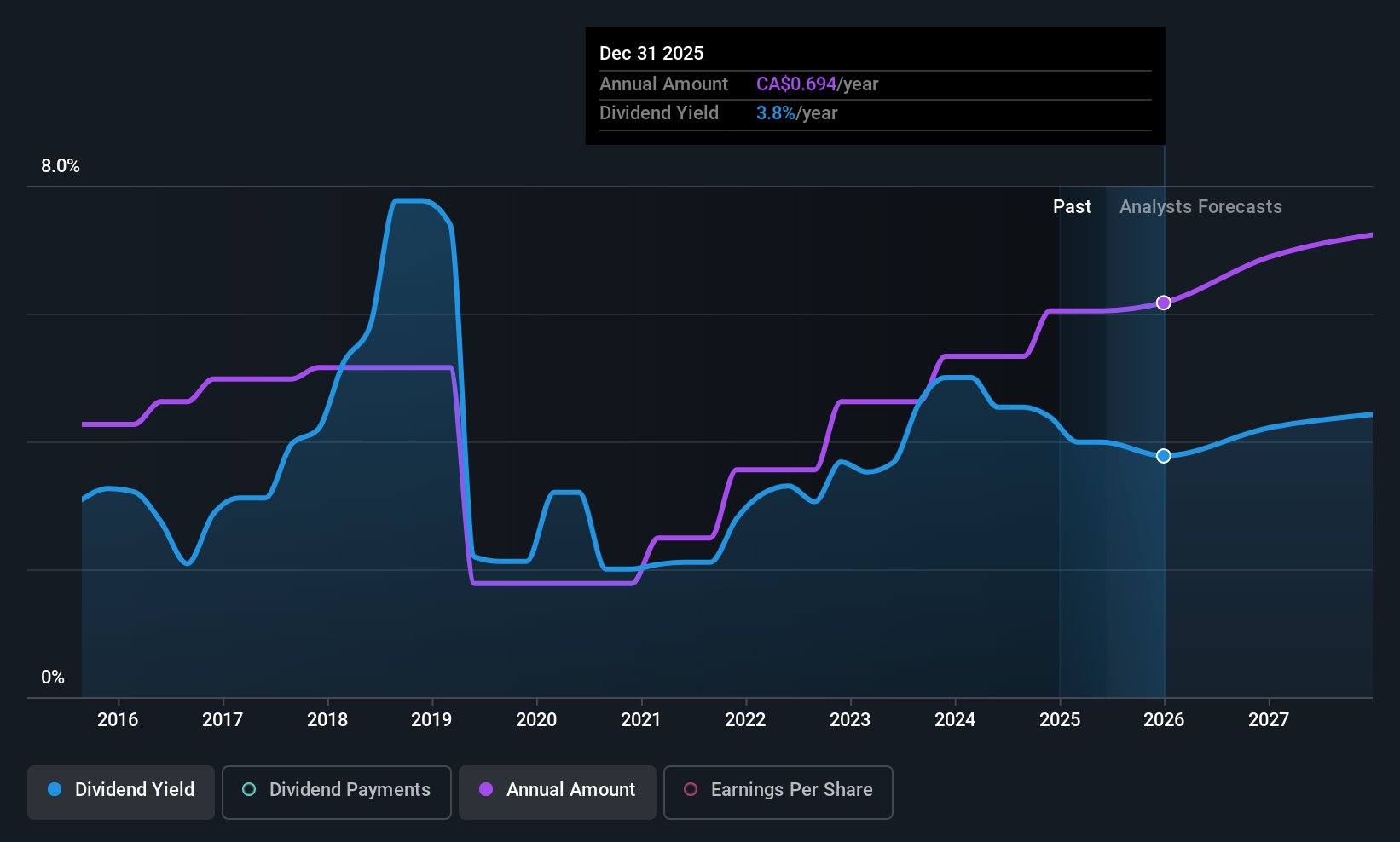

High Liner Foods (TSX:HLF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated processes and markets prepared and packaged frozen seafood products in North America, with a market cap of CA$462.44 million.

Operations: High Liner Foods Incorporated generates revenue of $971.97 million through its operations in manufacturing and marketing prepared and packaged frozen seafood products.

Dividend Yield: 4.3%

High Liner Foods provides a dividend yield of 4.25%, though it falls short of the top Canadian payers. Its dividends are well-covered by earnings, with a payout ratio of 28.9%, but have been unstable over the past decade. Recent financials indicate declining net income despite increased sales, potentially affecting future stability. The company affirmed a quarterly dividend of C$0.17 per share and completed significant share repurchases worth C$20.3 million under its buyback program.

- Navigate through the intricacies of High Liner Foods with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, High Liner Foods' share price might be too pessimistic.

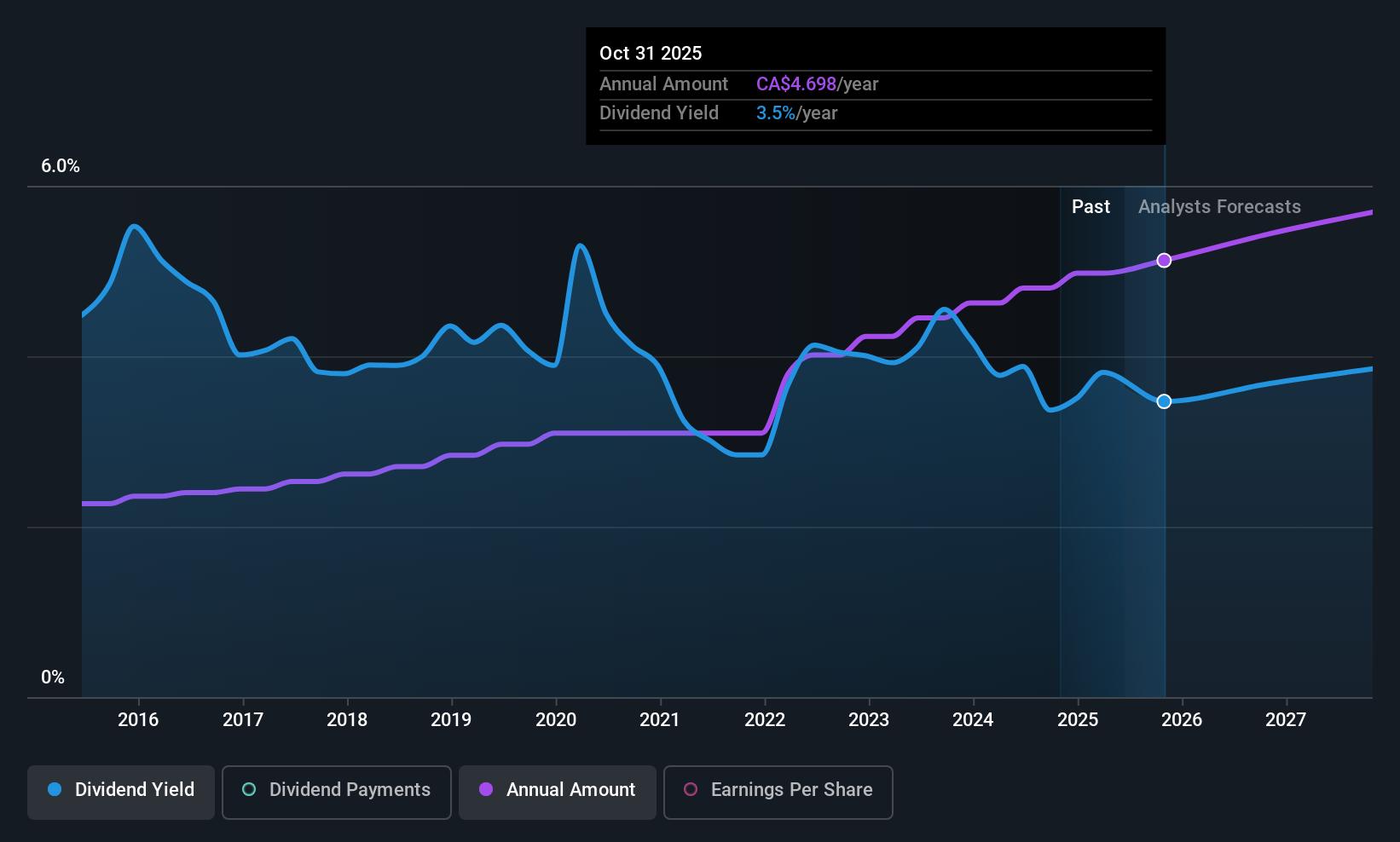

National Bank of Canada (TSX:NA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers a range of financial services to individuals, businesses, institutional clients, and governments both domestically and internationally, with a market cap of CA$57.21 billion.

Operations: National Bank of Canada's revenue is primarily derived from its Personal and Commercial segment at CA$4.44 billion, Financial Markets excluding USSF&I at CA$3.67 billion, Wealth Management at CA$3.10 billion, and U.S. Specialty Finance and International (USSF&I) at CA$1.36 billion.

Dividend Yield: 3.2%

National Bank of Canada offers a stable dividend yield of 3.23%, though below the top Canadian payers, supported by a low payout ratio of 44.5%. Dividends have been reliable and growing over the past decade. The bank recently announced a share repurchase program for up to 8 million shares, indicating confidence in its financial position, despite recent earnings showing slight declines in EPS compared to last year.

- Dive into the specifics of National Bank of Canada here with our thorough dividend report.

- According our valuation report, there's an indication that National Bank of Canada's share price might be on the expensive side.

Key Takeaways

- Discover the full array of 22 Top TSX Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives