- Taiwan

- /

- Semiconductors

- /

- TWSE:6239

Top Global Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cooling labor markets, trade tensions, and fluctuating economic indicators, investors are increasingly seeking stability in their portfolios. In this environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive consideration for those looking to balance risk with steady returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.45% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.20% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.61% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.20% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.36% | ★★★★★★ |

| Daicel (TSE:4202) | 5.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.33% | ★★★★★★ |

Click here to see the full list of 1556 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

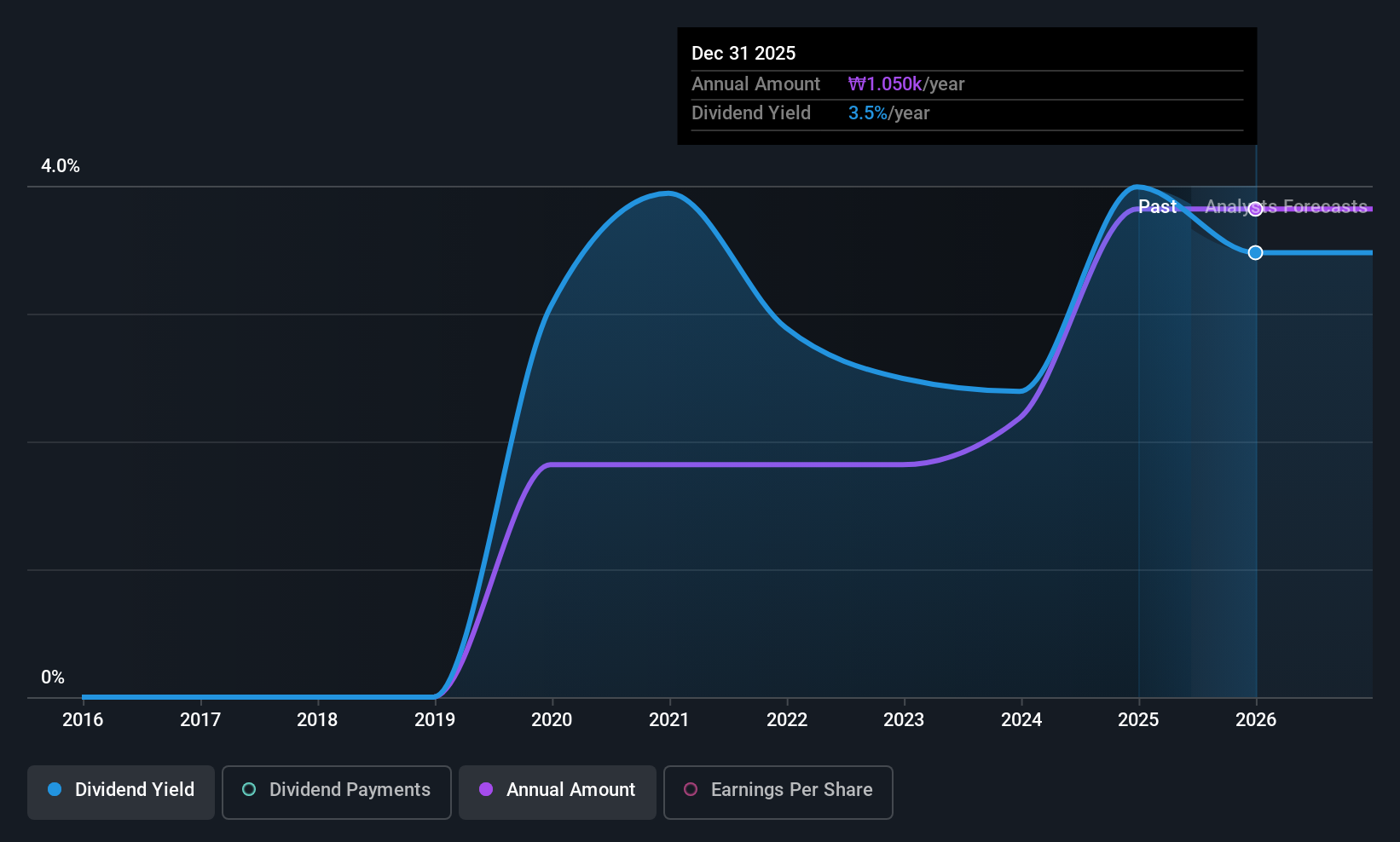

Hy-Lok (KOSDAQ:A013030)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Hy-Lok Corporation operates in the fluid and control system industry globally, with a market cap of ₩364.35 billion.

Operations: Hy-Lok Corporation generates revenue of ₩189.77 billion from manufacturing and selling fittings for mechanical equipment, flange valves, unions, and nipples in the fluid and control system industry worldwide.

Dividend Yield: 3.7%

Hy-Lok's dividend payments have been stable and reliable, growing with minimal volatility over its six-year history. While the dividend yield is slightly below the top 25% of payers in Korea, it remains well-covered by both earnings and cash flows, with payout ratios at 31.8% and 41.3%, respectively. The company recently completed a share buyback tranche for KRW 4.85 billion, enhancing shareholder value amidst its undervaluation relative to fair value estimates.

- Delve into the full analysis dividend report here for a deeper understanding of Hy-Lok.

- The valuation report we've compiled suggests that Hy-Lok's current price could be quite moderate.

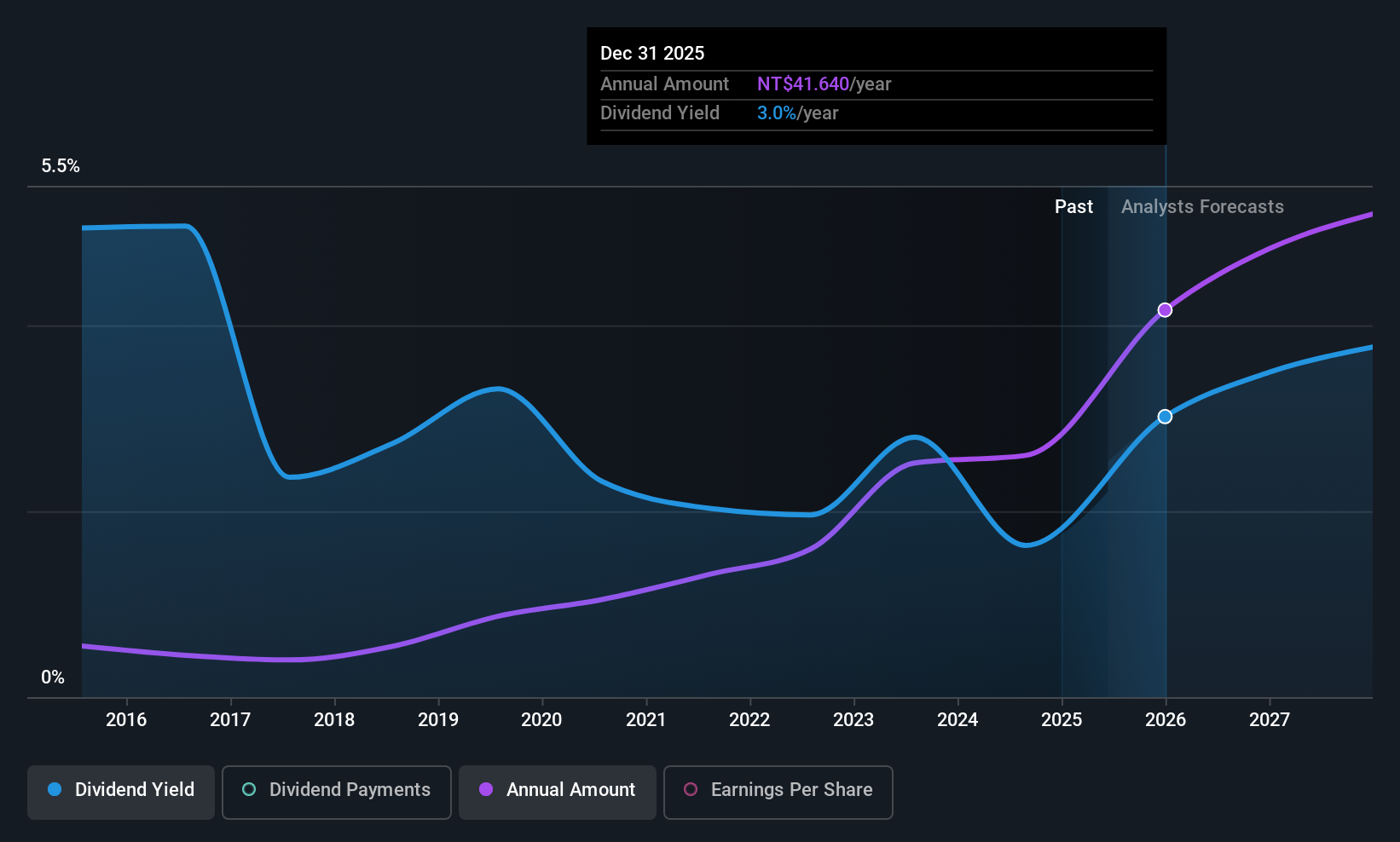

Lotes (TWSE:3533)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lotes Co., Ltd. designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally, with a market cap of NT$151.74 billion.

Operations: Lotes Co., Ltd. generates its revenue primarily from the Electronic Components & Parts segment, amounting to NT$31.51 billion.

Dividend Yield: 3%

Lotes' dividend payments have been volatile over the past decade, though recent earnings growth of 46.3% and a payout ratio of 49.2% suggest dividends are currently well-covered by earnings. The cash payout ratio stands at 72.1%, indicating coverage by cash flows as well. Trading at nearly half its estimated fair value, Lotes is conducting a share buyback program valued up to TWD 28.65 billion to transfer shares to employees, potentially enhancing shareholder value amidst undervaluation concerns.

- Unlock comprehensive insights into our analysis of Lotes stock in this dividend report.

- In light of our recent valuation report, it seems possible that Lotes is trading behind its estimated value.

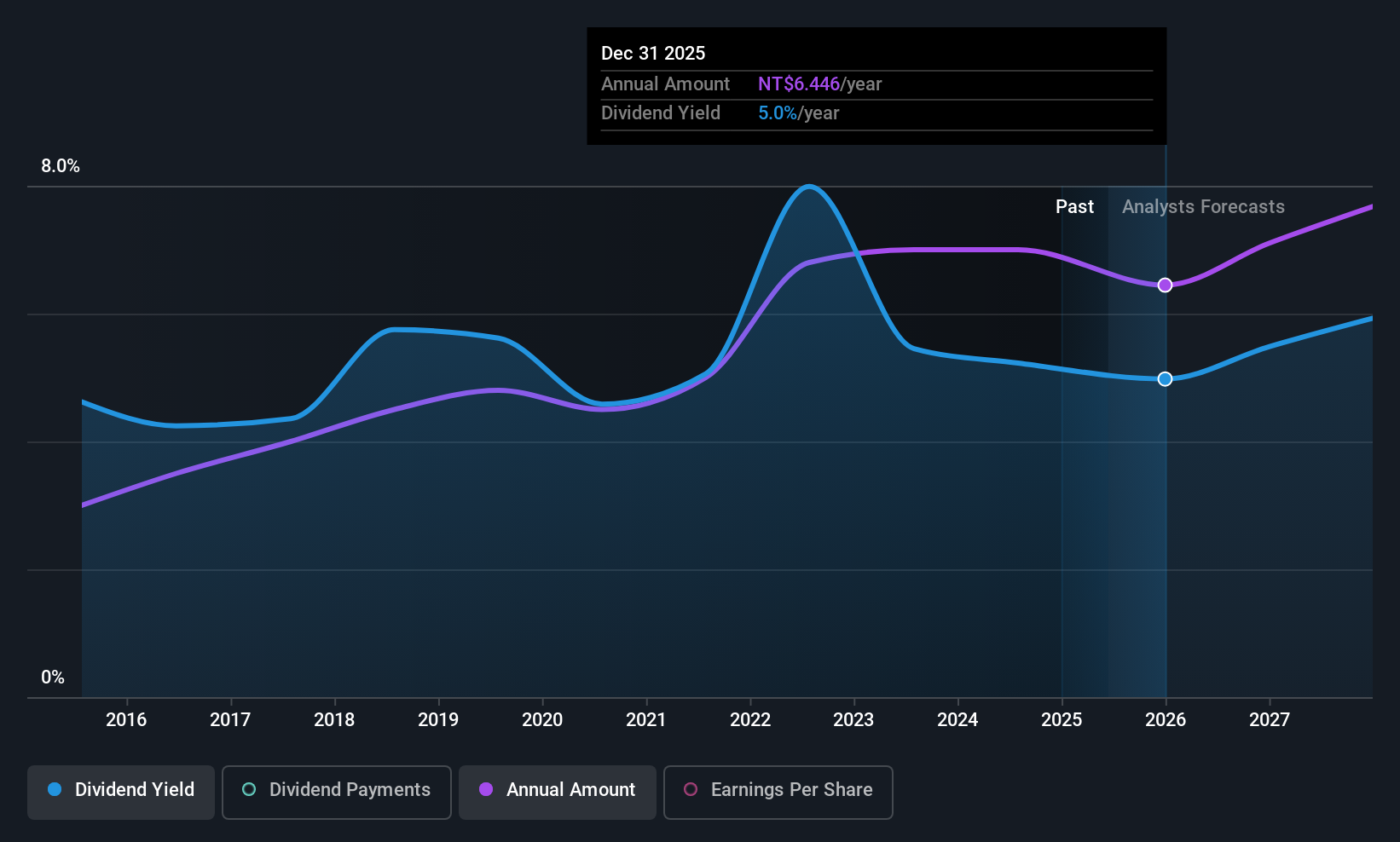

Powertech Technology (TWSE:6239)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Powertech Technology Inc. operates in the integrated circuit industry by researching, designing, developing, assembling, manufacturing, packaging, testing, and selling IC products across multiple regions including Taiwan and internationally; it has a market cap of approximately NT$92.53 billion.

Operations: Powertech Technology Inc.'s revenue primarily comes from its Semiconductors segment, which generated NT$70.48 billion.

Dividend Yield: 5.6%

Powertech Technology offers a high dividend yield of 5.6%, placing it among the top 25% of dividend payers in Taiwan. The dividends are well-covered by both earnings and cash flows, with payout ratios at 84% and 73.5%, respectively, indicating sustainability. Despite a recent decline in quarterly sales and net income compared to the previous year, Powertech's dividends have been stable and reliable over the past decade, supported by its attractive valuation with a P/E ratio below market average.

- Take a closer look at Powertech Technology's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Powertech Technology shares in the market.

Where To Now?

- Reveal the 1556 hidden gems among our Top Global Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6239

Powertech Technology

Researches, designs, develops, assembles, manufactures, packages, tests, and sells various integrated circuit (IC) products in Taiwan, Japan, Singapore, the United States, Europe, China, Hong Kong, Macao, and internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives