- Australia

- /

- Specialty Stores

- /

- ASX:NCK

Top ASX Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As the Australian market experiences a gradual decline amid global uncertainties and profit-taking by traders, investors are increasingly turning their attention to stable income sources like dividend stocks. In such volatile conditions, a good dividend stock is often characterized by its ability to provide consistent returns through regular payouts, offering some financial stability amidst market fluctuations.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 8.37% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.45% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.13% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.72% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 7.23% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.90% | ★★★★★☆ |

| IPH (ASX:IPH) | 7.31% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.44% | ★★★★★☆ |

| Bisalloy Steel Group (ASX:BIS) | 9.64% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 7.05% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Macquarie Group (ASX:MQG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macquarie Group Limited is a diversified financial services company operating across Australia, New Zealand, the Americas, Europe, the Middle East, Africa and Asia with a market cap of A$78.59 billion.

Operations: Macquarie Group Limited generates revenue through its various segments, including Corporate (A$1.10 billion), Macquarie Capital (A$2.64 billion), Macquarie Asset Management (A$4.22 billion), Banking and Financial Services (A$3.24 billion), and Commodities and Global Markets (A$6.02 billion).

Dividend Yield: 3%

Macquarie Group's dividend yield of 3.01% is below the top quartile of Australian dividend payers, with a payout ratio of 67%, indicating dividends are covered by earnings. However, its dividend history has been volatile and unreliable over the past decade. Recent developments include appointing Sean Yajnik to expand digital infrastructure advisory in the Americas and interest in acquiring a stake in TenneT Germany, which could impact future cash flows and strategic positioning.

- Click here and access our complete dividend analysis report to understand the dynamics of Macquarie Group.

- Our expertly prepared valuation report Macquarie Group implies its share price may be too high.

Nick Scali (ASX:NCK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited, with a market cap of A$1.64 billion, operates in the sourcing and retailing of household furniture and related accessories across Australia, the United Kingdom, and New Zealand.

Operations: Nick Scali Limited generates its revenue primarily from the retailing of furniture, amounting to A$492.63 million.

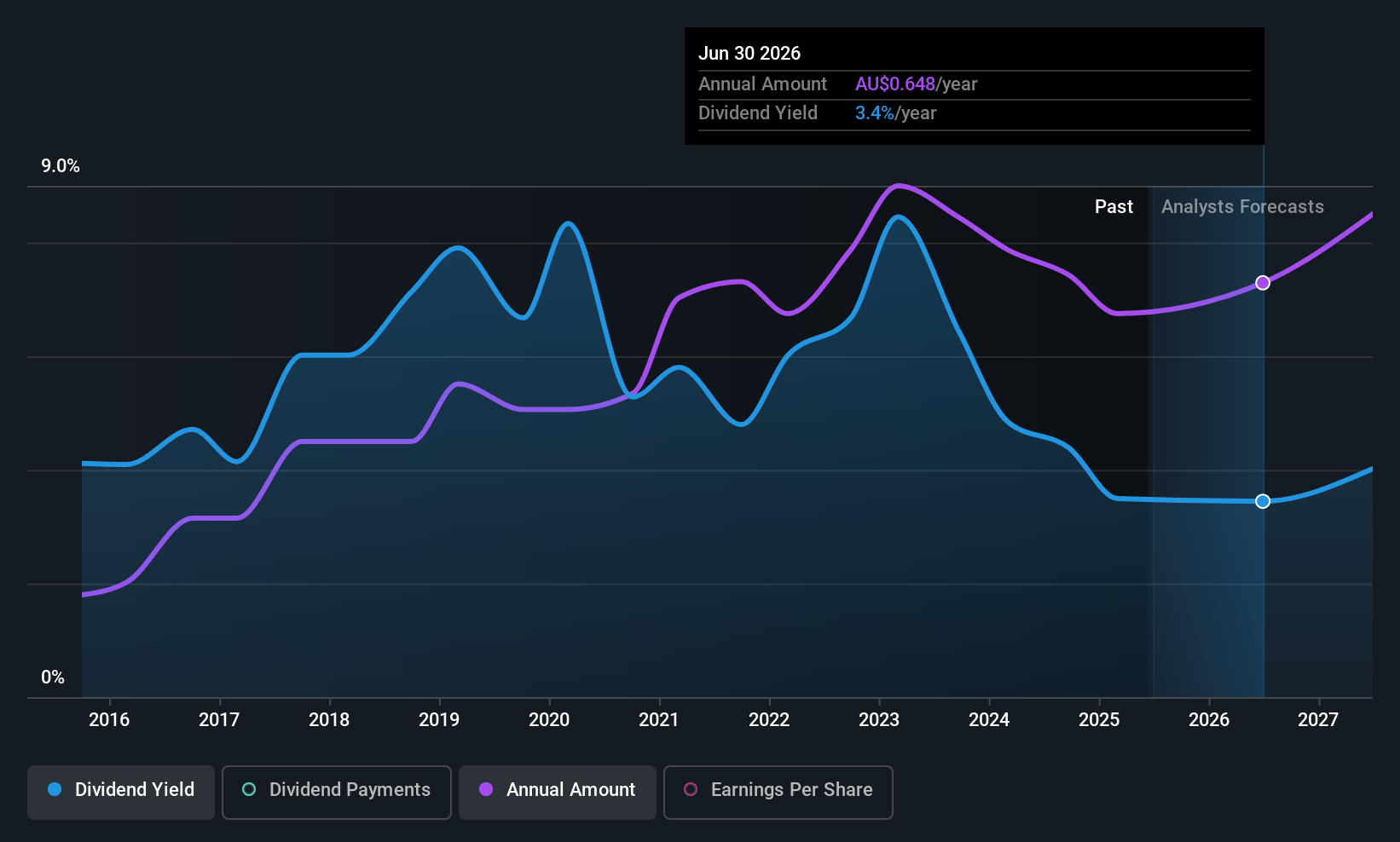

Dividend Yield: 3.1%

Nick Scali's dividend payments have been stable and growing over the past decade, with a current yield of 3.13%. While this yield is lower than the top 25% of Australian dividend payers, dividends are well-covered by earnings (payout ratio: 78.2%) and cash flows (cash payout ratio: 63.7%). The company trades at a discount to its estimated fair value. Recent executive changes include appointing Kylie Archer as CFO from July 2025, succeeding Sheila Lines who played a key role in their UK expansion.

- Get an in-depth perspective on Nick Scali's performance by reading our dividend report here.

- Our valuation report here indicates Nick Scali may be overvalued.

Sugar Terminals (NSX:SUG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sugar Terminals Limited offers storage and handling solutions for bulk sugar and other commodities in Australia, with a market cap of A$349.20 million.

Operations: Sugar Terminals Limited generates revenue of A$115.01 million from the sugar industry segment.

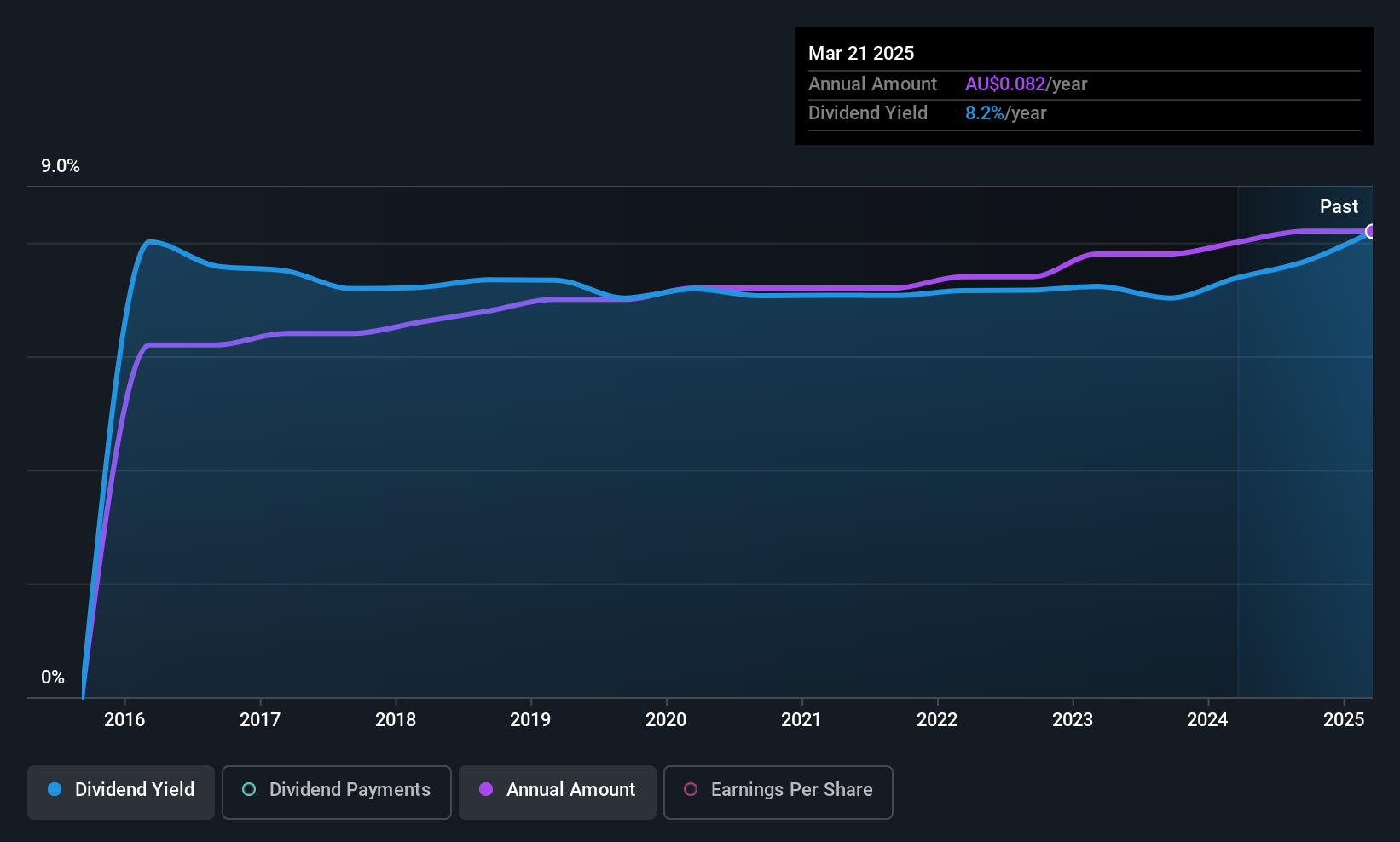

Dividend Yield: 8.5%

Sugar Terminals offers a high dividend yield of 8.45%, ranking in the top 25% of Australian dividend payers. However, its dividends are not fully covered by earnings due to a high payout ratio of 91.4%, though cash flows do cover them with an 87.6% cash payout ratio. The dividends have been stable and growing over the past decade despite shares being highly illiquid. Recent earnings show stable performance with net income at A$15.73 million for the half year ending December 2024.

- Click to explore a detailed breakdown of our findings in Sugar Terminals' dividend report.

- The analysis detailed in our Sugar Terminals valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Access the full spectrum of 28 Top ASX Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nick Scali might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NCK

Nick Scali

Engages in sourcing and retailing of household furniture and related accessories in Australia, the United Kingdom, and New Zealand.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives