- Taiwan

- /

- Semiconductors

- /

- TWSE:8261

Top Asian Dividend Stocks For June 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape of trade tensions and economic adjustments, Asian indices have shown resilience, with China's stock markets advancing on hopes for government stimulus despite weaker-than-expected economic indicators. In this environment, dividend stocks in Asia can offer investors a measure of stability and income potential, making them an attractive option for those seeking to balance risk with steady returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.47% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.16% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.40% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.61% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.34% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.23% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.38% | ★★★★★★ |

Click here to see the full list of 1249 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

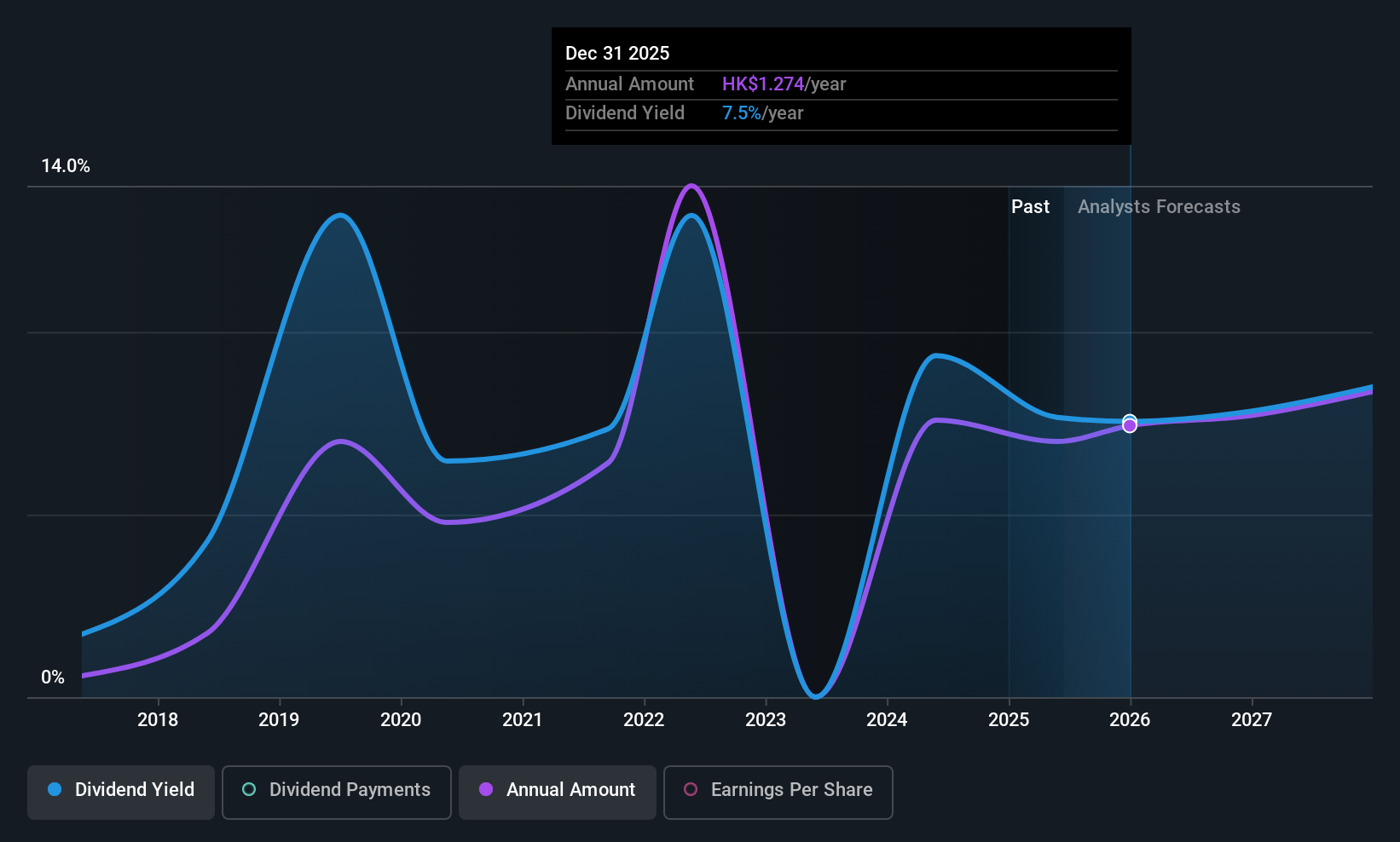

C&D International Investment Group (SEHK:1908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: C&D International Investment Group Limited is an investment holding company involved in property development, real estate industry chain investment services, and industry investment activities in the People’s Republic of China, with a market cap of HK$31.27 billion.

Operations: C&D International Investment Group Limited generates revenue primarily through its property development and management services, amounting to CN¥142.99 billion.

Dividend Yield: 7.7%

C&D International Investment Group's dividend yield is among the top 25% in Hong Kong, with a payout ratio of 47.3%, indicating coverage by earnings. However, its dividend history is less stable, having been paid for only eight years with volatility noted. The recent approval of a HK$1.20 per share dividend marks a decrease from previous levels, reflecting potential caution in cash distribution strategies amid fluctuating sales performance and significant insider selling recently observed.

- Unlock comprehensive insights into our analysis of C&D International Investment Group stock in this dividend report.

- Our valuation report unveils the possibility C&D International Investment Group's shares may be trading at a discount.

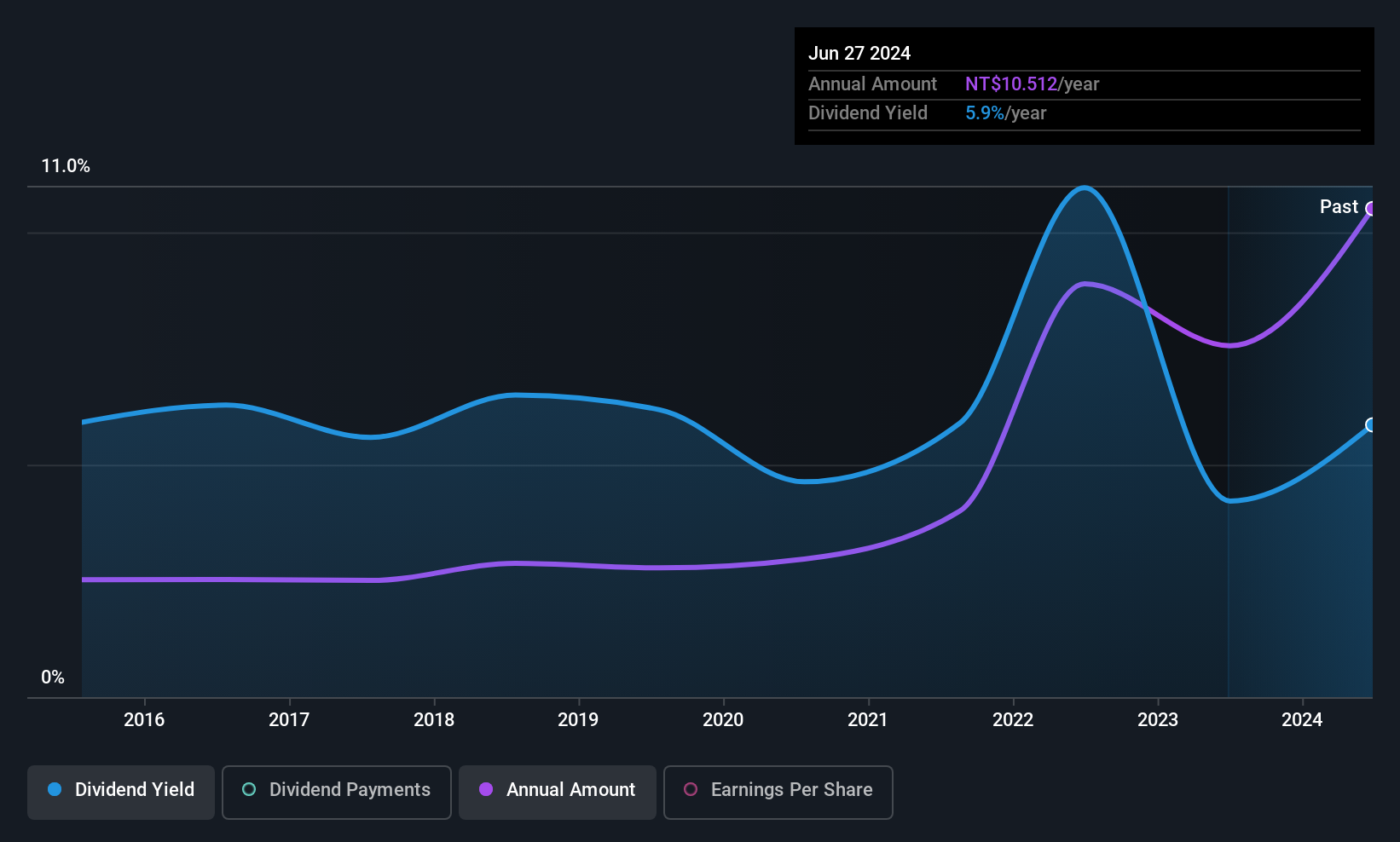

CTCI Advanced Systems (TPEX:5209)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CTCI Advanced Systems Inc. offers system integration services across hydrocarbon, power, industry, transportation, and high technology sectors in Taiwan and internationally with a market cap of NT$3.32 billion.

Operations: CTCI Advanced Systems Inc. generates revenue through sales (NT$136.34 million), system integration (NT$1 billion), and project construction (NT$4.68 billion).

Dividend Yield: 9.7%

CTCI Advanced Systems' dividend yield ranks in the top 25% of Taiwan's market, yet its high payout ratio of 101.5% suggests dividends aren't well covered by earnings. Despite a low cash payout ratio of 21.6%, indicating coverage by cash flows, dividend payments have been volatile over the past decade and unreliable in growth consistency. Recent affirmations include a TWD 322 million dividend distribution scheduled for July, despite declining sales and net income reported for Q1 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of CTCI Advanced Systems.

- Our expertly prepared valuation report CTCI Advanced Systems implies its share price may be lower than expected.

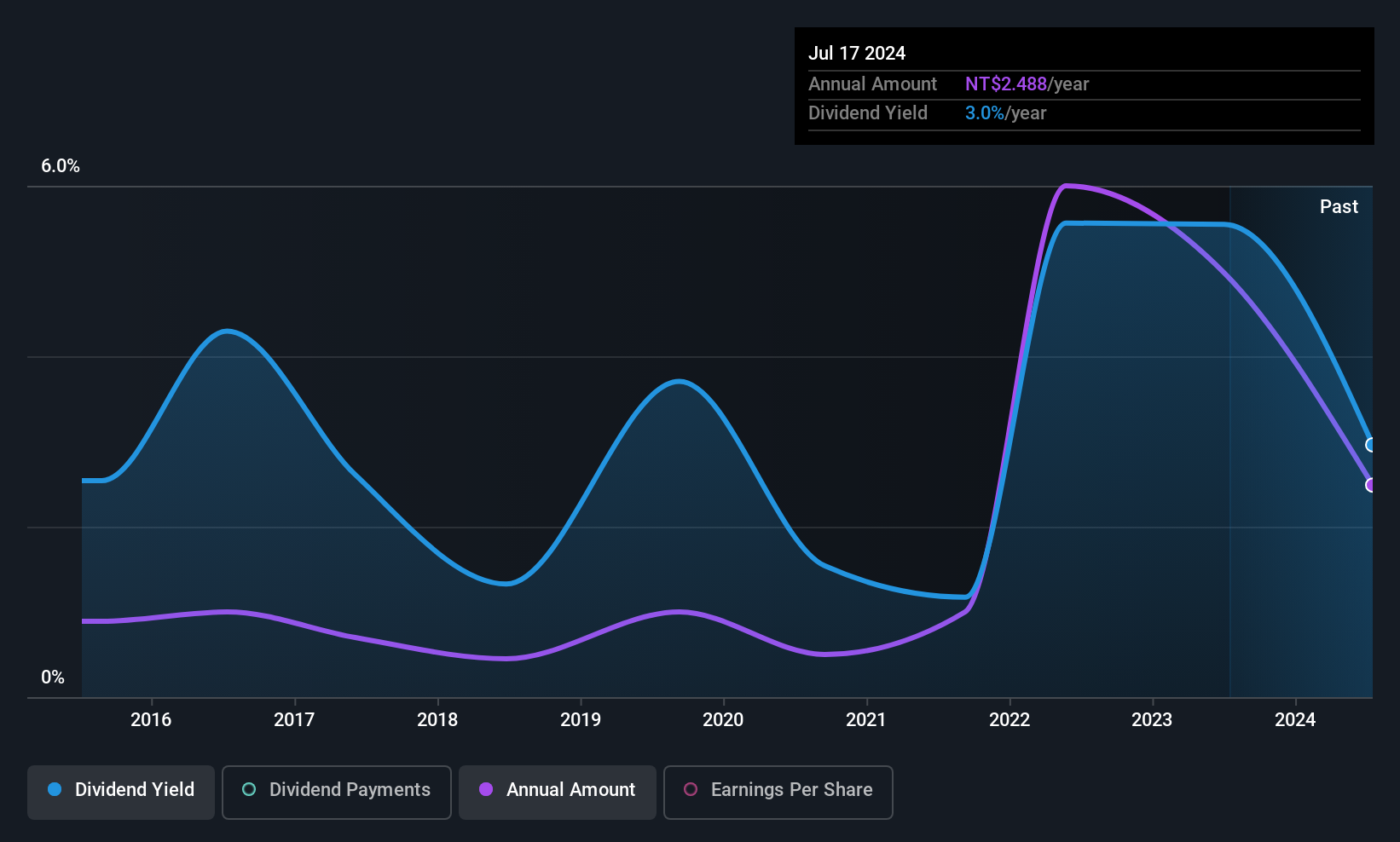

Advanced Power Electronics (TWSE:8261)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Advanced Power Electronics Co., Ltd. is a Taiwanese company that provides power discrete products and has a market capitalization of NT$10.28 billion.

Operations: Advanced Power Electronics Co., Ltd. generates revenue from its Electronic Components & Parts segment, totaling NT$3.04 billion.

Dividend Yield: 3.7%

Advanced Power Electronics' dividend yield of 3.7% is below Taiwan's top 25% dividend payers. However, a reasonable payout ratio of 58.1% and a cash payout ratio of 41.3% indicate dividends are well covered by earnings and cash flows, despite an unstable track record over the past decade. Recent Q1 results show significant growth with net income rising to TWD 171.55 million from TWD 86.35 million year-over-year, potentially supporting future payouts amidst ongoing amendments to company bylaws.

- Navigate through the intricacies of Advanced Power Electronics with our comprehensive dividend report here.

- Our valuation report unveils the possibility Advanced Power Electronics' shares may be trading at a premium.

Turning Ideas Into Actions

- Click here to access our complete index of 1249 Top Asian Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8261

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026