- Saudi Arabia

- /

- Banks

- /

- SASE:1050

Top 3 Middle Eastern Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As most Gulf markets experience an upswing, with Dubai's main index reaching its highest point in over 17 years, investors are increasingly turning their attention to dividend stocks as a means of enhancing portfolio stability and income. In the current environment of rising indices and steady oil prices, a strong dividend stock is characterized by consistent payouts and robust financial health, making it an attractive option for those looking to capitalize on the region's economic momentum.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.78% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.84% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.19% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.46% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.40% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.52% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.49% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.77% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.04% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.98% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top Middle Eastern Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

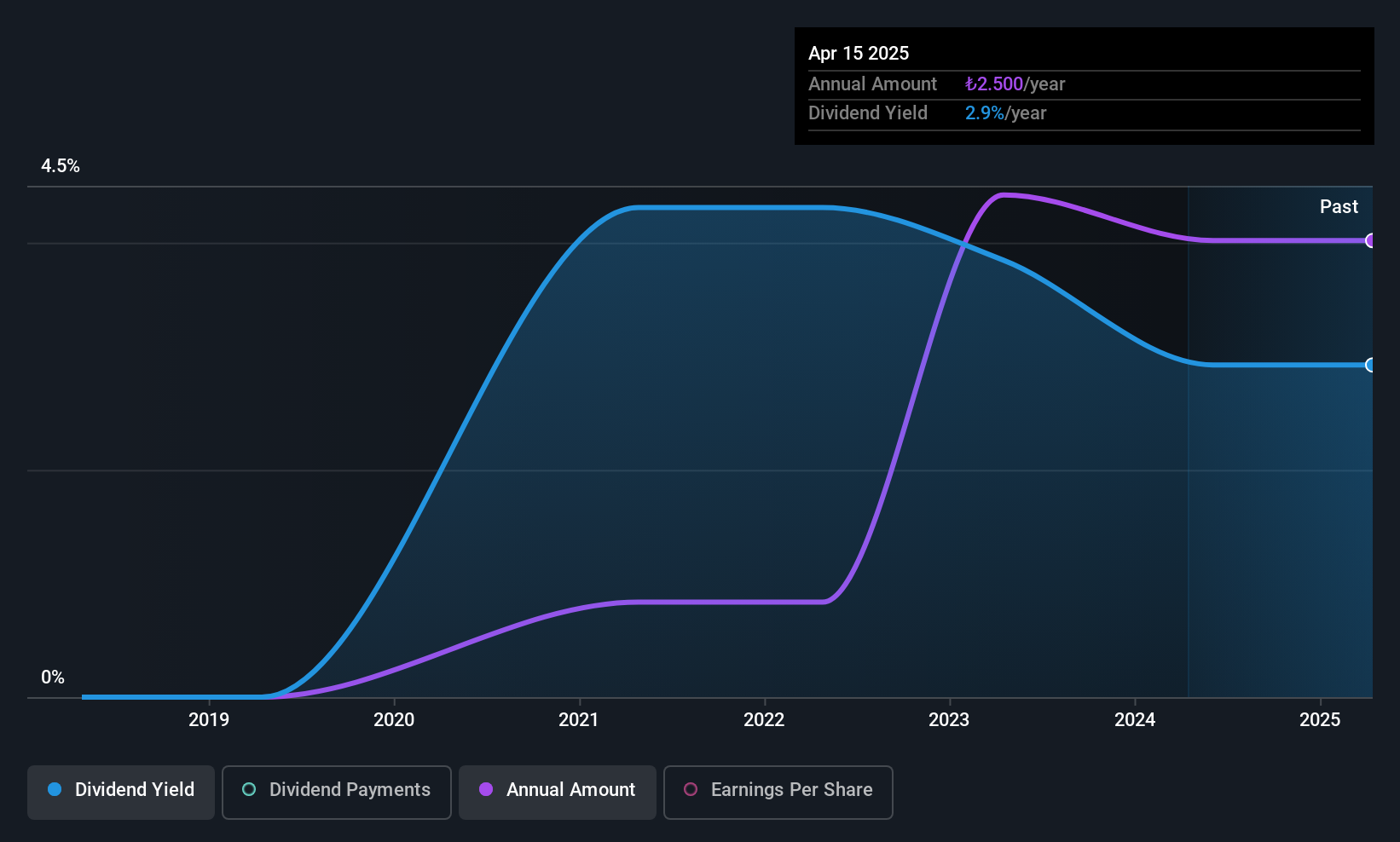

Ford Otomotiv Sanayi (IBSE:FROTO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ford Otomotiv Sanayi A.S. is involved in the manufacture, assembly, import, export, and sale of motor vehicles and spare parts mainly in Turkey with a market cap of TRY307.22 billion.

Operations: Ford Otomotiv Sanayi generates revenue from the manufacturing and sale of motor vehicles amounting to TRY584.39 billion.

Dividend Yield: 3.6%

Ford Otomotiv Sanayi presents a mixed picture for dividend investors. While its dividend yield of 3.58% ranks in the top 25% of the Turkish market, dividends have been volatile and not well covered by cash flows, with a high cash payout ratio of 130.4%. However, earnings growth is forecast at 37.55% per year, potentially supporting future payouts. Recent strategic alliances and agreements may bolster long-term competitiveness but current financials show declining sales and net income as of Q1 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Ford Otomotiv Sanayi.

- The analysis detailed in our Ford Otomotiv Sanayi valuation report hints at an deflated share price compared to its estimated value.

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri (IBSE:VAKKO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri A.S. operates in the fashion and textile industry, focusing on luxury clothing and accessories, with a market capitalization of TRY9.06 billion.

Operations: Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri A.S. generates revenue primarily from its Apparel segment, amounting to TRY14.67 billion.

Dividend Yield: 4.4%

Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri offers a compelling dividend profile with a payout ratio of 18.5%, indicating dividends are well-covered by earnings. Despite only four years of dividend history, payments have been stable and reliable, recently increasing to TRY 4 per share. The company’s dividend yield is in the top quartile of the Turkish market at 4.42%. However, profit margins have decreased from last year, which may impact future performance.

- Take a closer look at Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri's potential here in our dividend report.

- Our expertly prepared valuation report Vakko Tekstil ve Hazir Giyim Sanayi Isletmeleri implies its share price may be too high.

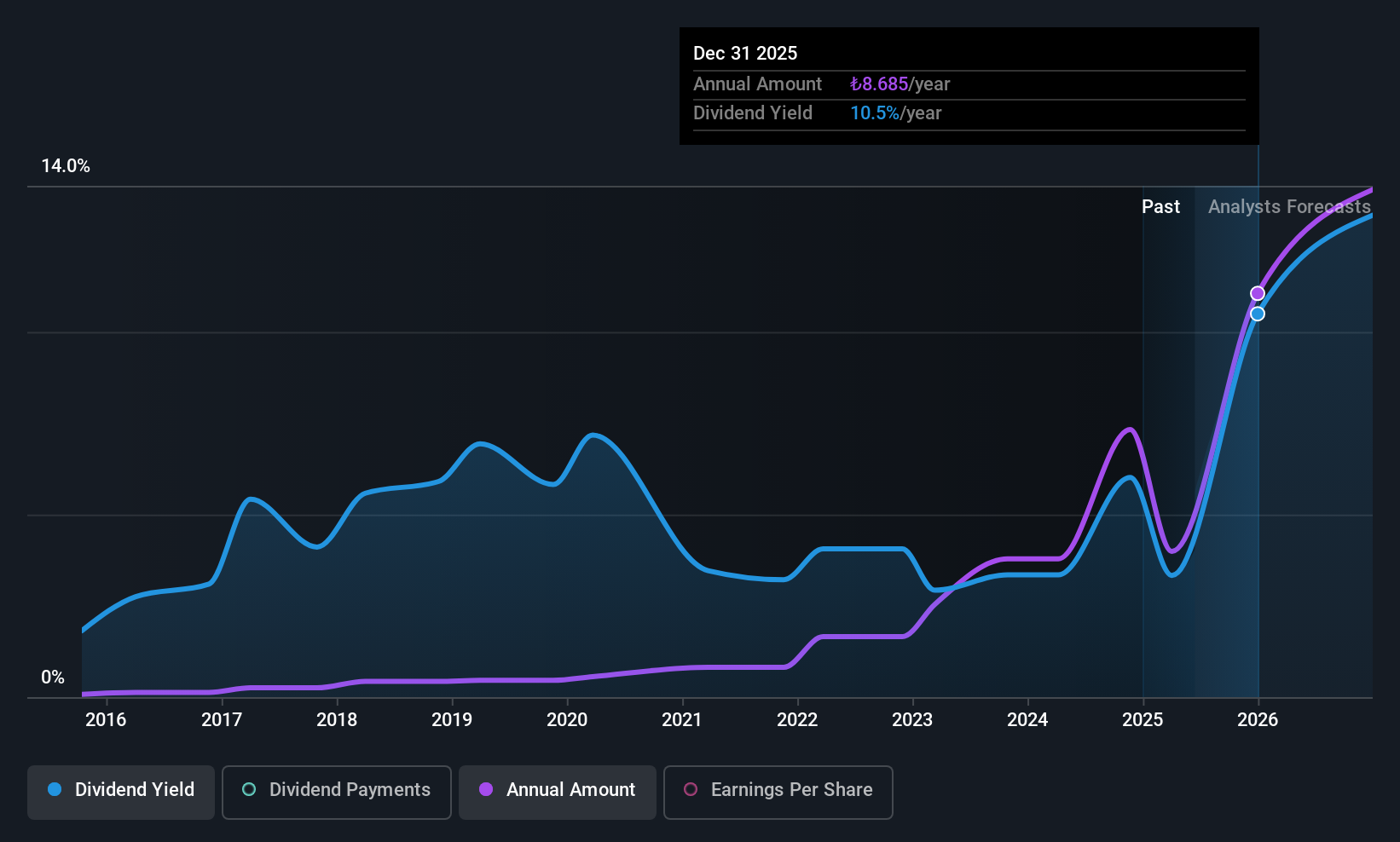

Banque Saudi Fransi (SASE:1050)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banque Saudi Fransi offers banking and financial services to individuals and businesses both in the Kingdom of Saudi Arabia and internationally, with a market cap of SAR43.31 billion.

Operations: Banque Saudi Fransi's revenue is primarily derived from its Retail Banking segment at SAR6.11 billion, followed by Corporate Banking at SAR5.59 billion, and Investment Banking & Brokerage at SAR593.84 million.

Dividend Yield: 5.7%

Banque Saudi Fransi's dividend payments have been volatile, with a recent decrease to SAR 1.50 per share for 2024, totaling SAR 2.45 billion. Despite this instability, the bank maintains a reasonable payout ratio of 55.3%, suggesting dividends are covered by earnings and forecasted to remain so at 51.7% in three years. Its dividend yield is among the top quartile in Saudi Arabia at 5.73%, supported by growing net income and interest income figures reported recently.

- Click here to discover the nuances of Banque Saudi Fransi with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Banque Saudi Fransi's current price could be inflated.

Summing It All Up

- Click this link to deep-dive into the 74 companies within our Top Middle Eastern Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banque Saudi Fransi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1050

Banque Saudi Fransi

Provides banking and financial services for individuals and businesses in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives