Those Who Purchased DBV Technologies (EPA:DBV) Shares Three Years Ago Have A 68% Loss To Show For It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While it may not be enough for some shareholders, we think it is good to see the DBV Technologies S.A. (EPA:DBV) share price up 19% in a single quarter. But that is small recompense for the exasperating returns over three years. Indeed, the share price is down a tragic 68% in the last three years. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

View our latest analysis for DBV Technologies

DBV Technologies isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

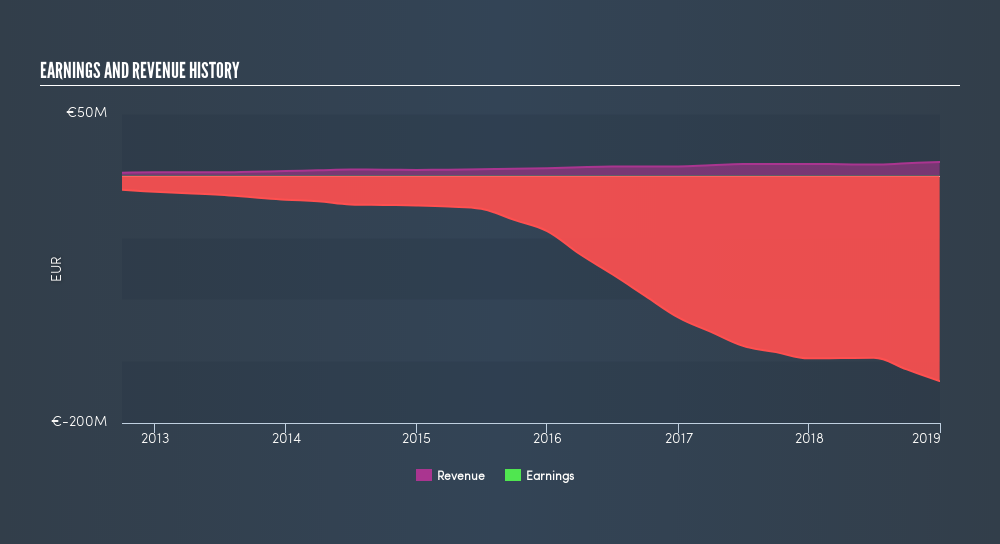

Over three years, DBV Technologies grew revenue at 16% per year. That's a pretty good rate of top-line growth. That contrasts with the weak share price, which has fallen 32% compounded, over three years. The market must have had really high expectations to be disappointed with this progress. So this is one stock that might be worth investigating further, or even adding to your watchlist.

DBV Technologies is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Investors in DBV Technologies had a tough year, with a total loss of 43%, against a market gain of about 7.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:DBV

DBV Technologies

A clinical-stage biopharmaceutical company, engages in the research and development of epicutaneous immunotherapy products in France.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion