- Italy

- /

- Other Utilities

- /

- BIT:HER

These 4 Measures Indicate That Hera (BIT:HER) Is Using Debt Extensively

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Hera S.p.A. (BIT:HER) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Hera

What Is Hera's Debt?

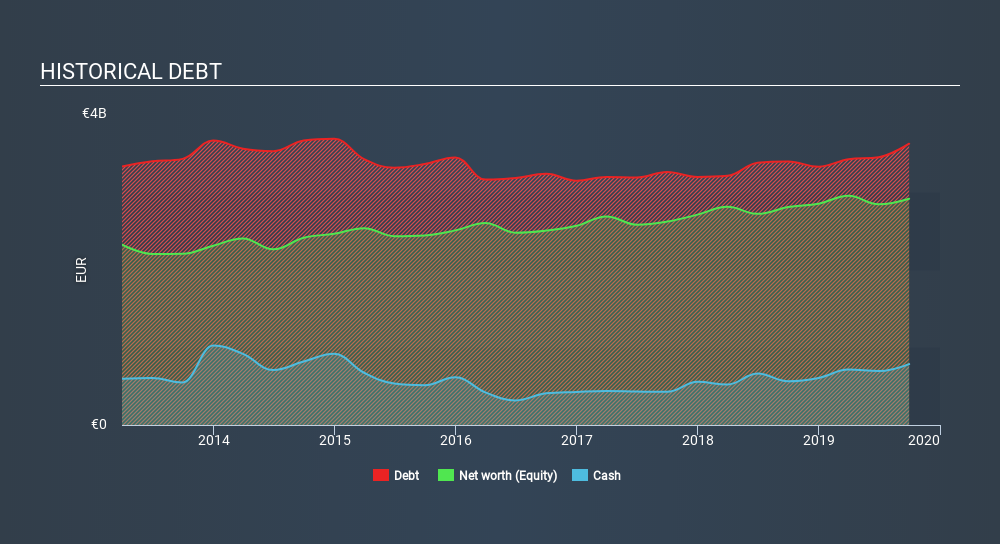

The image below, which you can click on for greater detail, shows that at September 2019 Hera had debt of €3.62b, up from €3.39b in one year. However, it also had €783.8m in cash, and so its net debt is €2.83b.

How Strong Is Hera's Balance Sheet?

According to the last reported balance sheet, Hera had liabilities of €2.95b due within 12 months, and liabilities of €3.70b due beyond 12 months. On the other hand, it had cash of €783.8m and €1.81b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €4.05b.

This deficit is considerable relative to its market capitalization of €6.16b, so it does suggest shareholders should keep an eye on Hera's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Hera's debt is 3.0 times its EBITDA, and its EBIT cover its interest expense 6.9 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Hera grew its EBIT by 7.7% in the last year. Whilst that hardly knocks our socks off it is a positive when it comes to debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Hera can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Hera recorded free cash flow of 46% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

While Hera's net debt to EBITDA makes us cautious about it, its track record of staying on top of its total liabilities is no better. But its not so bad at covering its interest expense with its EBIT. It's also worth noting that Hera is in the Integrated Utilities industry, which is often considered to be quite defensive. Looking at all the angles mentioned above, it does seem to us that Hera is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Take risks, for example - Hera has 1 warning sign we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:HER

Hera

A multi-utility company, engages in the waste management, water services, and energy businesses in Italy.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Iluka (ASX:ILU) an interesting future

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Trending Discussion