- United States

- /

- Oil and Gas

- /

- NYSE:CLR

These 4 Measures Indicate That Continental Resources (NYSE:CLR) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Continental Resources, Inc. (NYSE:CLR) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Continental Resources

How Much Debt Does Continental Resources Carry?

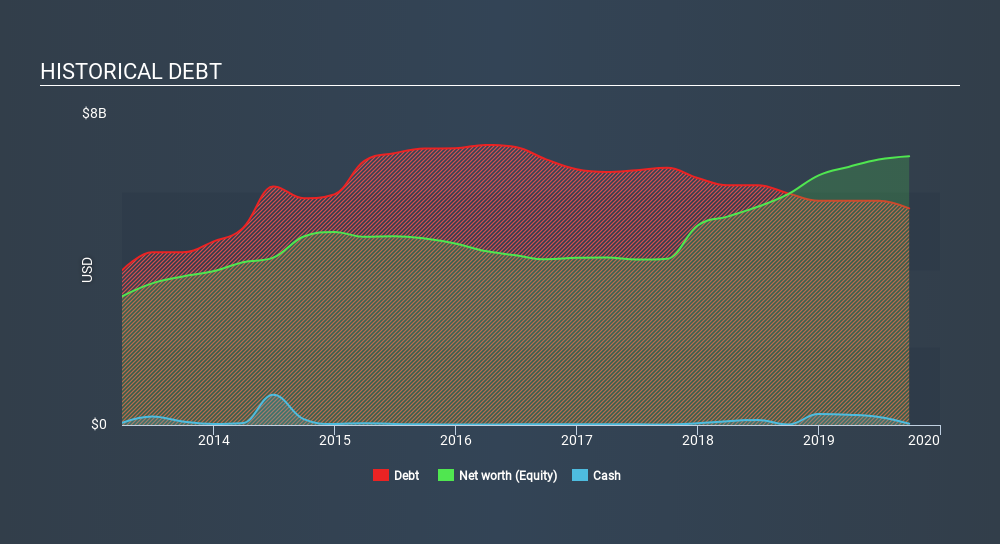

You can click the graphic below for the historical numbers, but it shows that as of September 2019 Continental Resources had US$5.57b of debt, an increase on US$6.0k, over one year. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Continental Resources's Balance Sheet?

The latest balance sheet data shows that Continental Resources had liabilities of US$1.37b due within a year, and liabilities of US$7.49b falling due after that. Offsetting these obligations, it had cash of US$35.3m as well as receivables valued at US$1.05b due within 12 months. So its liabilities total US$7.78b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its very significant market capitalization of US$12.3b, so it does suggest shareholders should keep an eye on Continental Resources's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Continental Resources has net debt worth 1.7 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.7 times the interest expense. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. The bad news is that Continental Resources saw its EBIT decline by 18% over the last year. If earnings continue to decline at that rate then handling the debt will be more difficult than taking three children under 5 to a fancy pants restaurant. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Continental Resources's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Continental Resources's free cash flow amounted to 21% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

We'd go so far as to say Continental Resources's EBIT growth rate was disappointing. Having said that, its ability handle its debt, based on its EBITDA, isn't such a worry. Overall, we think it's fair to say that Continental Resources has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Continental Resources .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:CLR

Continental Resources

Continental Resources, Inc. explores for, develops, produces, and manages crude oil, natural gas, and related products primarily in the north, south, and east regions of the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives