- United States

- /

- Industrial REITs

- /

- NYSE:REXR

The Rexford Industrial Realty (NYSE:REXR) Share Price Has Gained 181%, So Why Not Pay It Some Attention?

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on the bright side, you can make far more than 100% on a really good stock. Long term Rexford Industrial Realty, Inc. (NYSE:REXR) shareholders would be well aware of this, since the stock is up 181% in five years. The last week saw the share price soften some 1.1%.

View 4 warning signs we detected for Rexford Industrial Realty

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

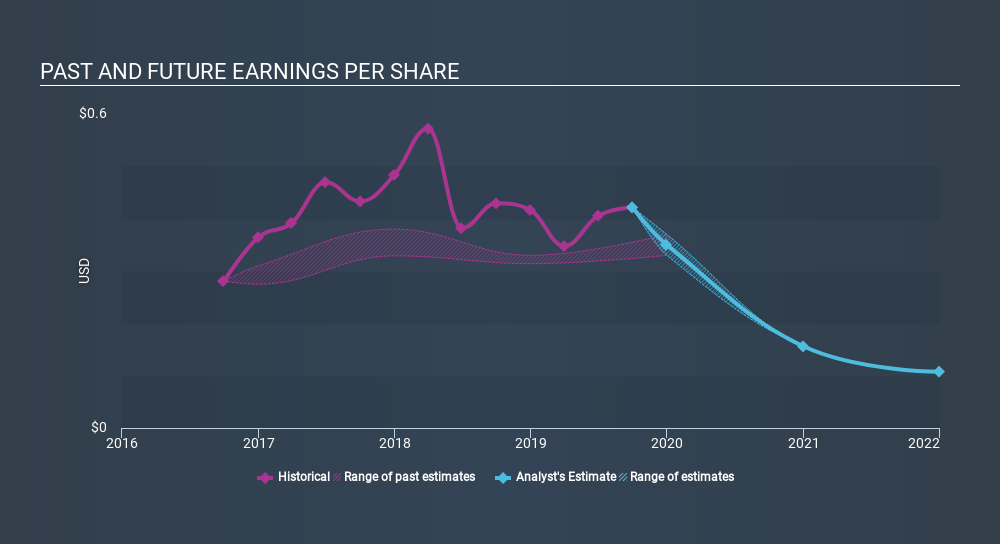

During the last half decade, Rexford Industrial Realty became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Rexford Industrial Realty share price is up 94% in the last three years. Meanwhile, EPS is up 15% per year. Notably, the EPS growth has been slower than the annualised share price gain of 25% over three years. So one can reasonably conclude the market is more enthusiastic about the stock than it was three years ago.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

While share prices often depend primarily on earnings, they can be sensitive to an investment's risk level as well. For example, we've discovered 4 warning signs for Rexford Industrial Realty (of which 1 is major) which any shareholder or potential investor should be aware of.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Rexford Industrial Realty the TSR over the last 5 years was 218%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Rexford Industrial Realty shareholders have received a total shareholder return of 53% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 26%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before spending more time on Rexford Industrial Realty it might be wise to click here to see if insiders have been buying or selling shares.

We will like Rexford Industrial Realty better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:REXR

Rexford Industrial Realty

Rexford Industrial creates value by investing in, operating and redeveloping industrial properties throughout infill Southern California, the world's fourth largest industrial market and consistently the highest-demand with lowest-supply major market in the nation.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives