- Greece

- /

- Personal Products

- /

- ATSE:PAP

The Papoutsanis (ATH:PAP) Share Price Has Soared 443%, Delighting Many Shareholders

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. Not every pick can be a winner, but when you pick the right stock, you can win big. Take, for example, the Papoutsanis S.A. (ATH:PAP) share price, which skyrocketed 443% over three years. In the last week shares have slid back 2.4%.

View our latest analysis for Papoutsanis

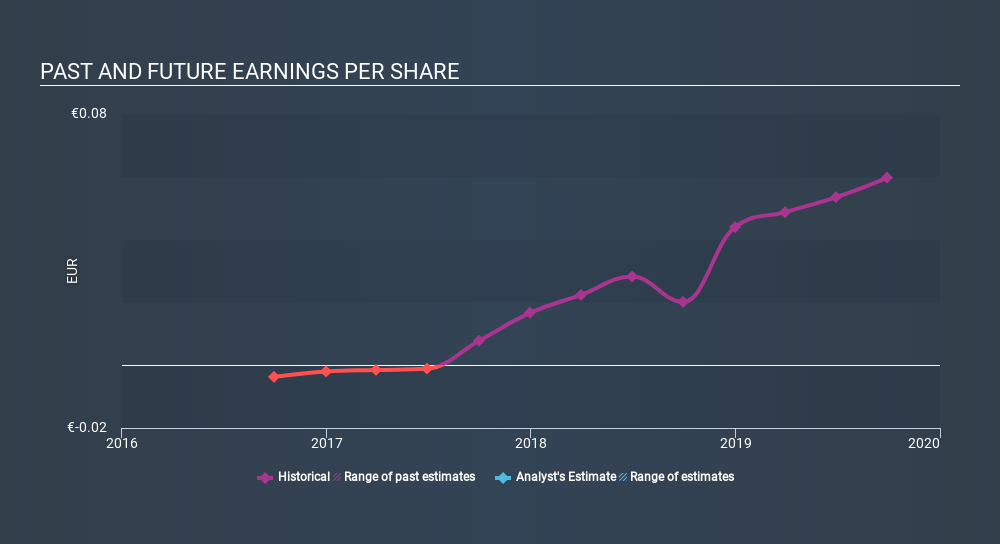

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, Papoutsanis moved from a loss to profitability. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into Papoutsanis's key metrics by checking this interactive graph of Papoutsanis's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Papoutsanis's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Papoutsanis hasn't been paying dividends, but its TSR of 457% exceeds its share price return of 443%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Papoutsanis provided a TSR of 42% over the year. That's fairly close to the broader market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 20%. It is possible that management foresight will bring growth well into the future, even if the share price slows down. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Papoutsanis you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ATSE:PAP

Papoutsanis

Engages in the production and sale of soaps and liquid cosmetics in Greece.

Solid track record and good value.

Market Insights

Community Narratives