- United States

- /

- Communications

- /

- NasdaqGM:OCC

The Optical Cable (NASDAQ:OCC) Share Price Is Down 22% So Some Shareholders Are Getting Worried

Ideally, your overall portfolio should beat the market average. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Optical Cable Corporation (NASDAQ:OCC) shareholders for doubting their decision to hold, with the stock down 22% over a half decade.

See our latest analysis for Optical Cable

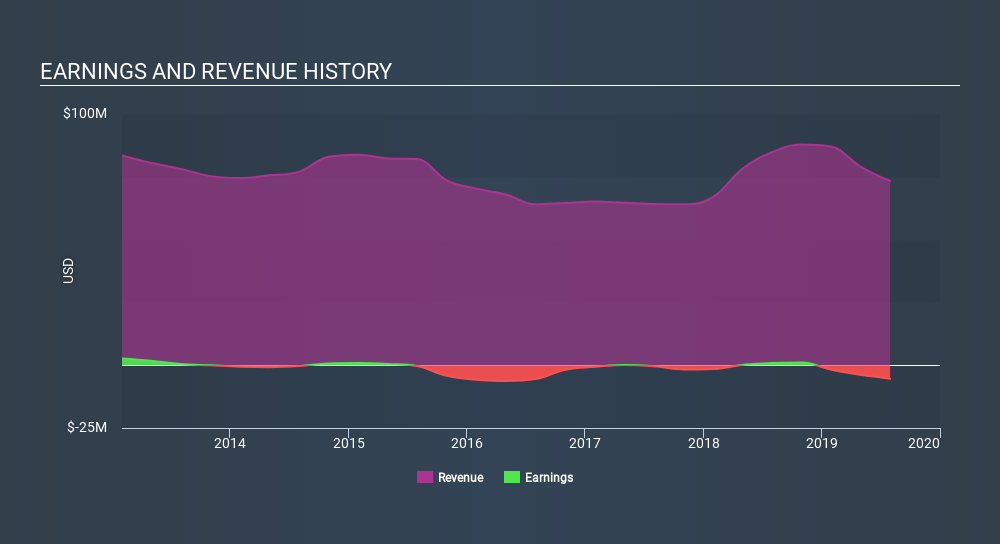

Given that Optical Cable didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over five years, Optical Cable grew its revenue at 0.05% per year. That's not a very high growth rate considering it doesn't make profits. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 4.9% (annualized) in the same time frame. Investors should consider how bad the losses are, and whether the company can make it to profitability with ease. It could be worth putting it on your watchlist and revisiting when it makes its maiden profit.

The graphic below depicts how revenue has changed over time.

If you are thinking of buying or selling Optical Cable stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Optical Cable shareholders are down 17% for the year, but the market itself is up 21%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4.5% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You could get a better understanding of Optical Cable's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGM:OCC

Optical Cable

Manufactures and sells fiber optic and copper data communications cabling and connectivity solutions primarily for the enterprise market in the United States and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives