- United States

- /

- Real Estate

- /

- NYSEAM:GBR

The New Concept Energy (NYSEMKT:GBR) Share Price Is Down 36% So Some Shareholders Are Getting Worried

Many investors define successful investing as beating the market average over the long term. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term New Concept Energy, Inc. (NYSEMKT:GBR) shareholders, since the share price is down 36% in the last three years, falling well short of the market return of around 47%. The falls have accelerated recently, with the share price down 25% in the last three months.

Check out our latest analysis for New Concept Energy

We don't think New Concept Energy's revenue of US$609,000 is enough to establish significant demand. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that New Concept Energy will discover or develop fossil fuel before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

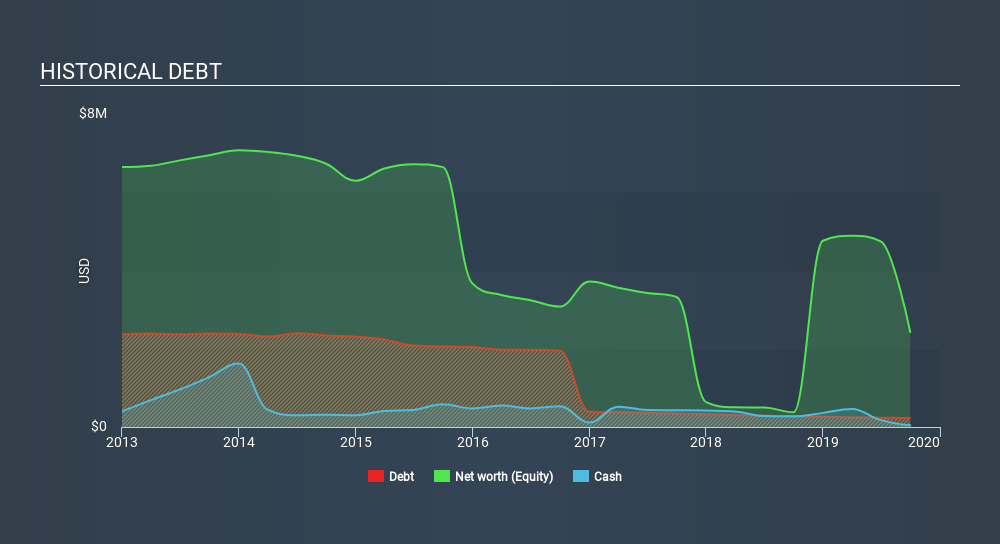

New Concept Energy had liabilities exceeding cash by US$3.5m when it last reported in September 2019, according to our data. That makes it extremely high risk, in our view. But with the share price diving 14% per year, over 3 years , it's probably fair to say that some shareholders no longer believe the company will succeed. You can click on the image below to see (in greater detail) how New Concept Energy's cash levels have changed over time. You can click on the image below to see (in greater detail) how New Concept Energy's cash levels have changed over time.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit, forcing investors to rely on other measures. For example, we've discovered 7 warning signs for New Concept Energy (of which 5 are major) which any shareholder or potential investor should be aware of.

A Different Perspective

New Concept Energy shareholders are down 19% for the year, but the market itself is up 25%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 2.1% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You could get a better understanding of New Concept Energy's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like New Concept Energy better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSEAM:GBR

Flawless balance sheet slight.

Market Insights

Community Narratives